[ad_1]

UK’s Brent Crude Oil has been playing along with WTI to the downside since March 2022’s high. This is where price peaked this year at 133. Brent Oil has its worse week and month since it’s September drop as it has dropped by 15% so far in November. This weakness is supported by negative sentiment as demand is still an issue and as the Covid situation is worsening in China.

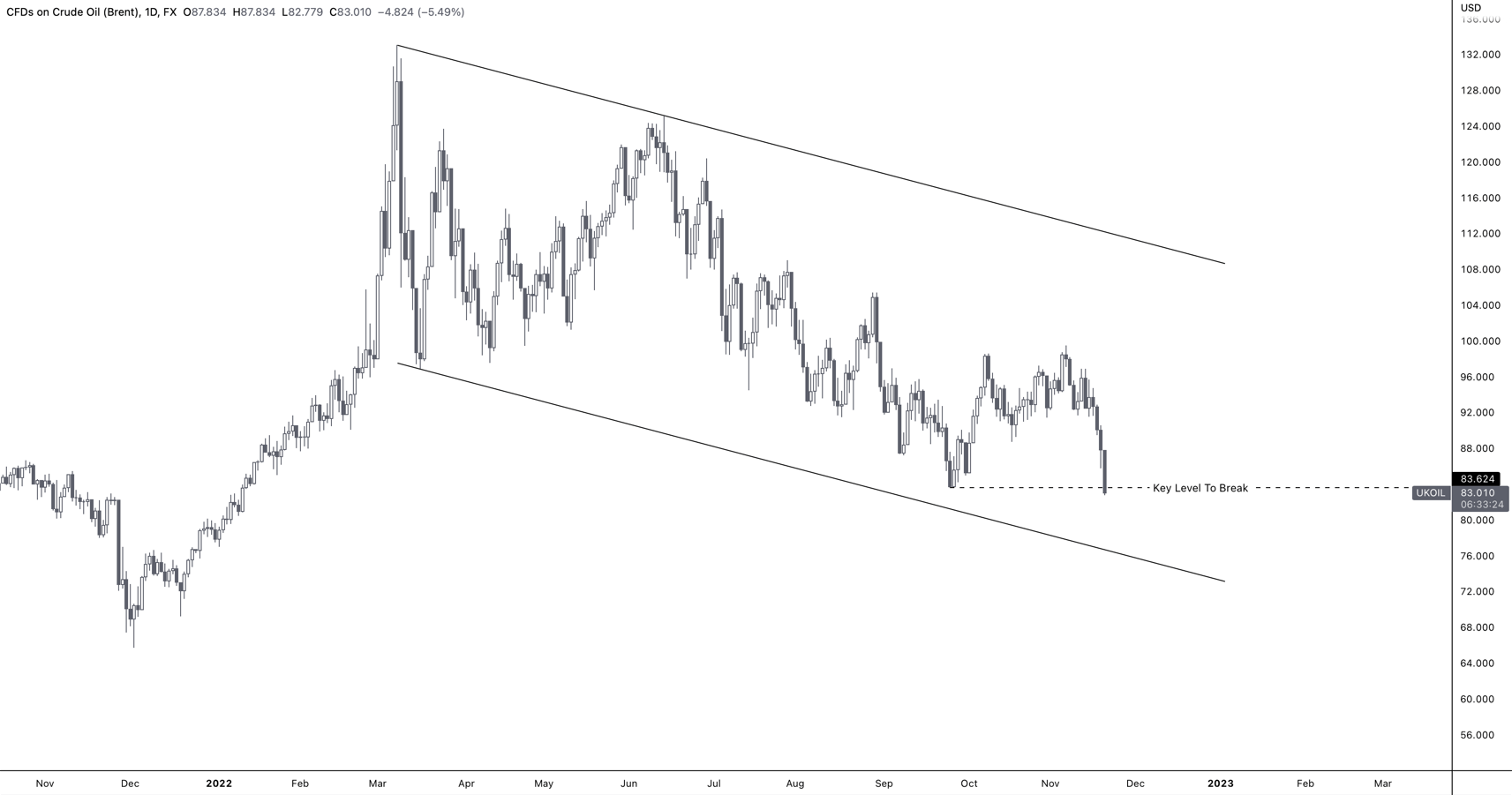

UK Brent Crude Oil – Daily Timeframe – November 21st 2022

Chart prepared on TradingView by Zorrays Junaid

The key level at 83.770 has broken through which formed a that is required to break to confirm a continuation to the downside which would push price into the lower bound of the descending channel. The question remains whether price will respect that lower bound or not.

In terms of momentum, the 14-day RSI remains within a bearish territory. MACD’s Moving Averages have crossed over and falling into MACD’s bearish territory.

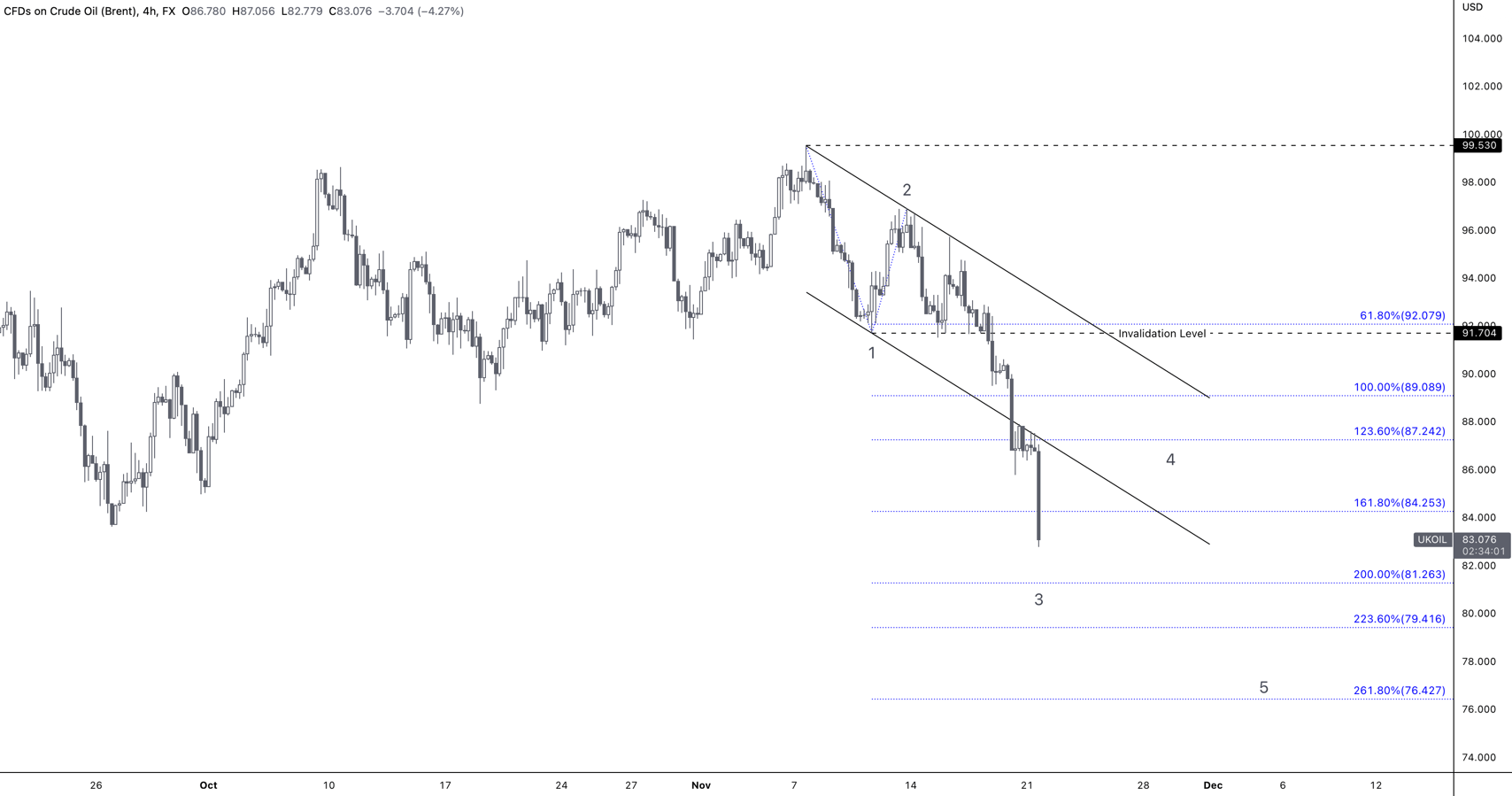

UK Brent Crude Oil – 4 Hour Timeframe – November 21st 2022

Chart prepared on TradingView by Zorrays Junaid

Zooming in a bit more, I can see that the price is Brent Crude Oil is forming a 5-wave impulse wave to the downside since the highs of November 7th 2022 at 99.530, therefore, further move down is still on the cards to complete the bearish sequence. Wave 3 seems to be currently in play and has reached its most common Fibonacci target at 1.618% extension of wave 1.

There would be no surprise if a short-term correction into wave 4 can happen at anytime with an invalidation level sitting at 91.704. Should wave 4 go into wave 1’s territory, this current 5 wave impulse wave would no longer be valid.

— Written by Zorrays Junaid, Contributor, DailyFX.com

[ad_2]

Source link