[ad_1]

US Dollar, DXY Index, USD/JPY, USD/CHF, Crude Oil, Gold – Talking Points

- The US Dollar strengthened again on Monday, boosted by better yields

- China saw an increase in Covid-19 cases and parts of several cities are locked down

Recommended by Daniel McCarthy

Get Your Free USD Forecast

The US Dollar firmed again on Monday after Friday’s gains with Treasury yields bumping higher across the curve. The 1-year note is again approaching the 21-year high of 4.84% that was seen earlier this month.

Surging Covid-19 cases in China saw broad risk-off trading to start the week.

The Japanese Yen and Swiss Franc faired ‘least-worse’ against the greenback so far today, reflecting their perceived haven status.

Late Friday, the Commodity Futures Trading Commission (CFTC) Commitment of Traders (COT) report showed that speculators had turned to nett short US Dollars for the first time since July 2021.

Chinese stocks fell on the worries about further lockdowns with three Covid-19 deaths over the weekend in Beijing. Chongqing, Guangzhou and Shijiazhuang, all major Chinese metropolises, are facing increased restrictions.

Hong Kong’s Hang Seng Index (HSI) was down over 3% at one stage before making somewhat of a recovery. Mainland China’s CSI 300 index is also down, but to a lesser extent.

Australia and Japan’s indices are fairly flat despite a slightly positive lead from Wall Street’s close on Friday.

Crude oil is lower to start the week with a stronger US Dollar and global growth concerns weighing. The WTI futures contract is under US$ 80 bbl while the Brent contract is below US$ 87 bbl.

Gold is also under pressure, sliding under US$ 1,750 today.

After German PPI, the US will get the Chicago Fed National activity index data. There will be a number of speakers crossing the wires from the Bank of England, ECB, Bundesbank and the Fed.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

Introduction to Forex News Trading

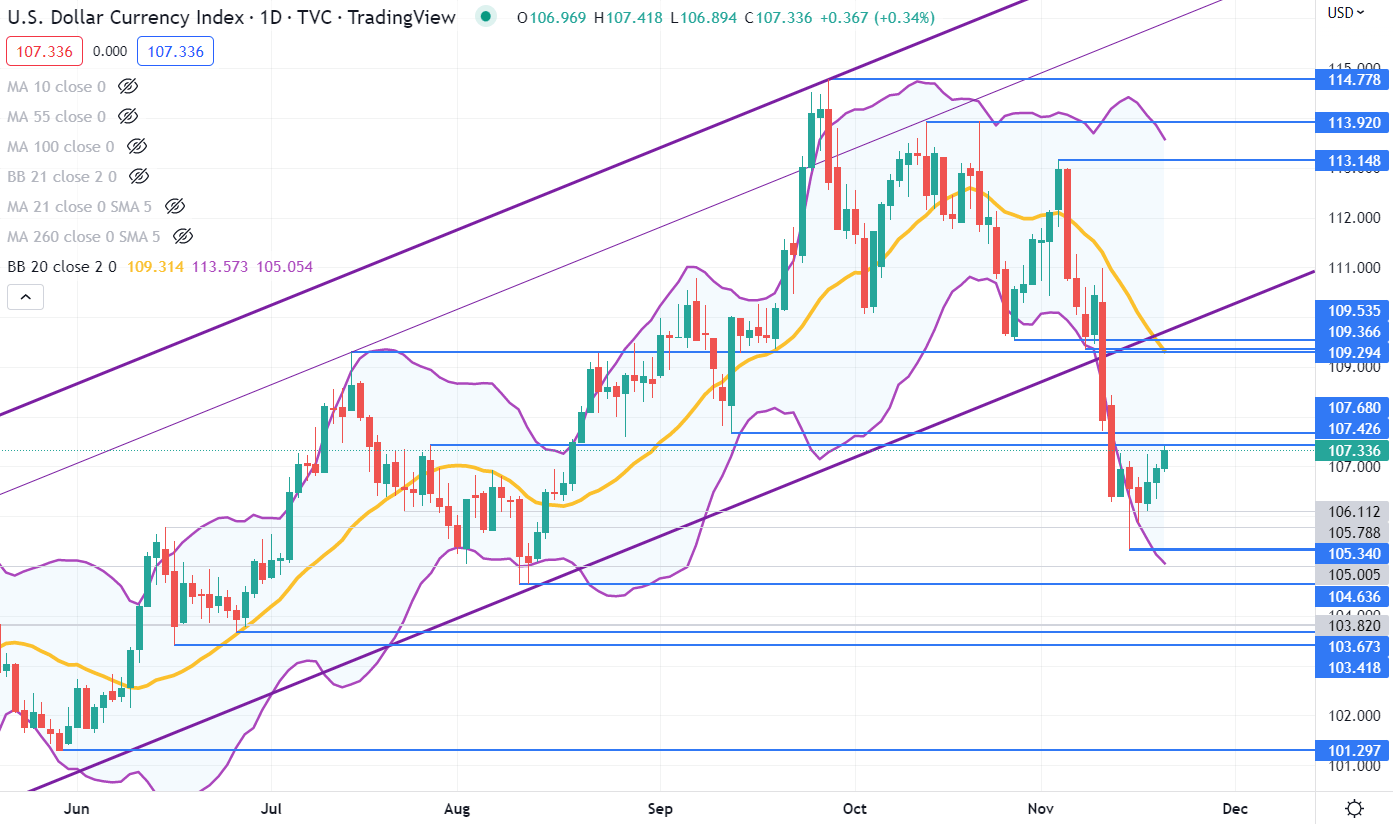

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY index is a US Dollar index that is weighted against EUR (57.6%), JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%) and CHF (3.6%).

After closing back inside the lower band of the 21-day simple moving average (SMA) based Bollinger Band last week, the US Dollar has started to rally.

It is nudging up against possible breakpoint resistance 107.43, Above there, further resistance might be at 107.68, 109.30, 109.37 and 109.54.

Support could be at the prior lows of 105.34, 104.64, 103.67 or 101.30.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]

Source link