[ad_1]

US Dollar Outlook:

- The US Dollar’s post-CPI meltdown is one for the books: the worst daily performance of 2022; and USD/JPY rates are pacing for their worst weekly loss since the start of the pandemic.

- US Treasury yields, US real yields, and Fed rate hike odds have collapsed in a dramatic fashion.

- The IG Client Sentiment Index suggests that USD/JPY rates have a bearish bias in the near-term.

Recommended by Christopher Vecchio, CFA

Get Your Free USD Forecast

US Dollar Gets Wrecked

The surprising October US inflation report, coming in far below consensus forecasts, has provided a reprieve for risk assets. Rates markets have dramatically repriced expectations for the Federal Reserve rate hike path, with the main Fed rate expected to reach 4.875% by May 2023, down from its peak of 5.135% set after the November Fed meeting. US Treasury yields are down across the curve, with parts of the belly off by some -20-bps to -30-bps. US real yields are cratering as well.

While these have been positive developments for gold prices and US stocks, the latter of which is having its best performance since April 2020, the net-result has been a US Dollar (via the DXY Index) that has been absolutely wrecked, on pace for its worst daily performance of 2022.

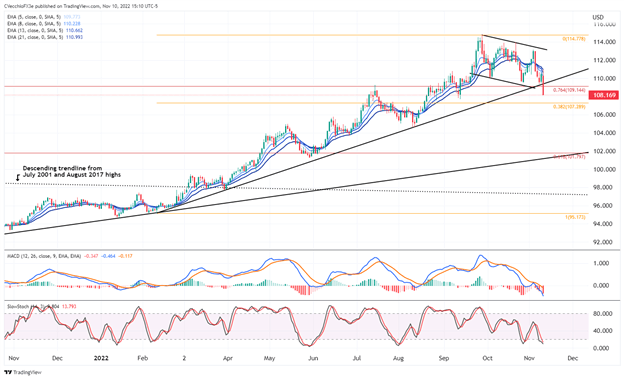

DXY PRICE INDEX TECHNICAL ANALYSIS: DailyTimeframe (November 2021 to November 2022) (CHART 1)

The DXY Index is losing bull flag support, and in turn, losing the uptrend from the February, August, and early-November swing lows. This may be indicative of a near-term top. Momentum has deteriorated rapidly, with the greenback gauge below its daily 5-, 8-, 13-, and 21-EMA envelope, which is now in bearish sequential. Daily MACD has continued its descent while below its signal line, and daily Slow Stochastics are back in oversold territory. Further losses into the area between the 38.2% Fibonacci retracement of the February 2022 low/September 2022 high at 107.29 and the September low at 107.68 may transpire before near-term technical support is reached.

Recommended by Christopher Vecchio, CFA

How to Trade USD/JPY

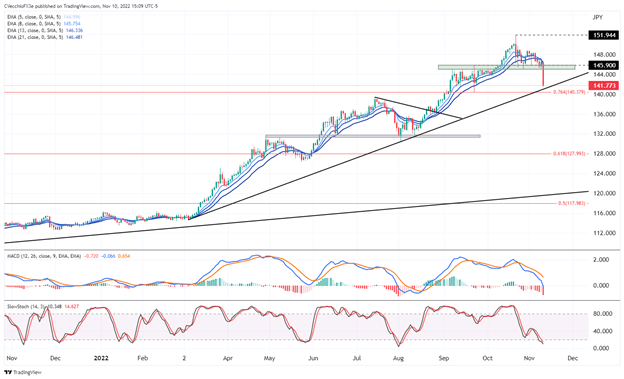

USD/JPY RATE TECHNICAL ANALYSIS: DAILY TIMEFRAME (November 2021 to November 2022) (CHART 2)

USD/JPY rates have been clobbered as US Treasury yields have collapsed, pacing for one of its worst losses of the past decade and the worst weekly performance since the start of the pandemic in 2020. The pre-intervention high set on September 22 at 145.90 is no longer supporter, having been busted with relative ease. The area around 140.35/141.10 now comes into focus: the September 22 low; the 76.4% Fibonacci retracement of the 1990 high/2011 low range; and the rising trendline from the February and August 2022 lows.

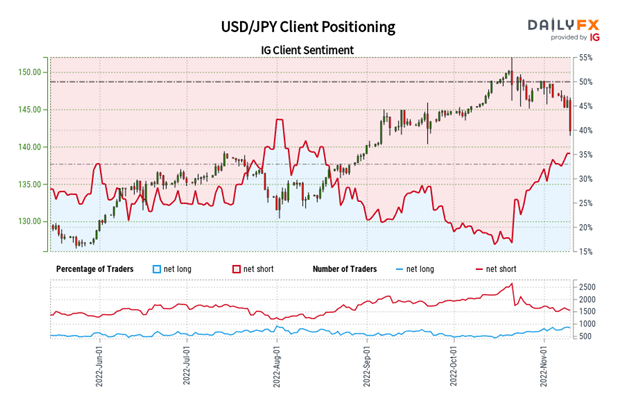

IG Client Sentiment Index: USD/JPY RATE Forecast (November 10, 2022) (Chart 3)

USD/JPY: Retail trader data shows 44.46% of traders are net-long with the ratio of traders short to long at 1.25 to 1. The number of traders net-long is 13.09% higher than yesterday and 15.13% higher from last week, while the number of traders net-short is 21.29% lower than yesterday and 27.44% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Source link