[ad_1]

For tips and expert insights on how to trade EUR/USD, download the euro’s trading guide!

Recommended by Diego Colman

How to Trade EUR/USD

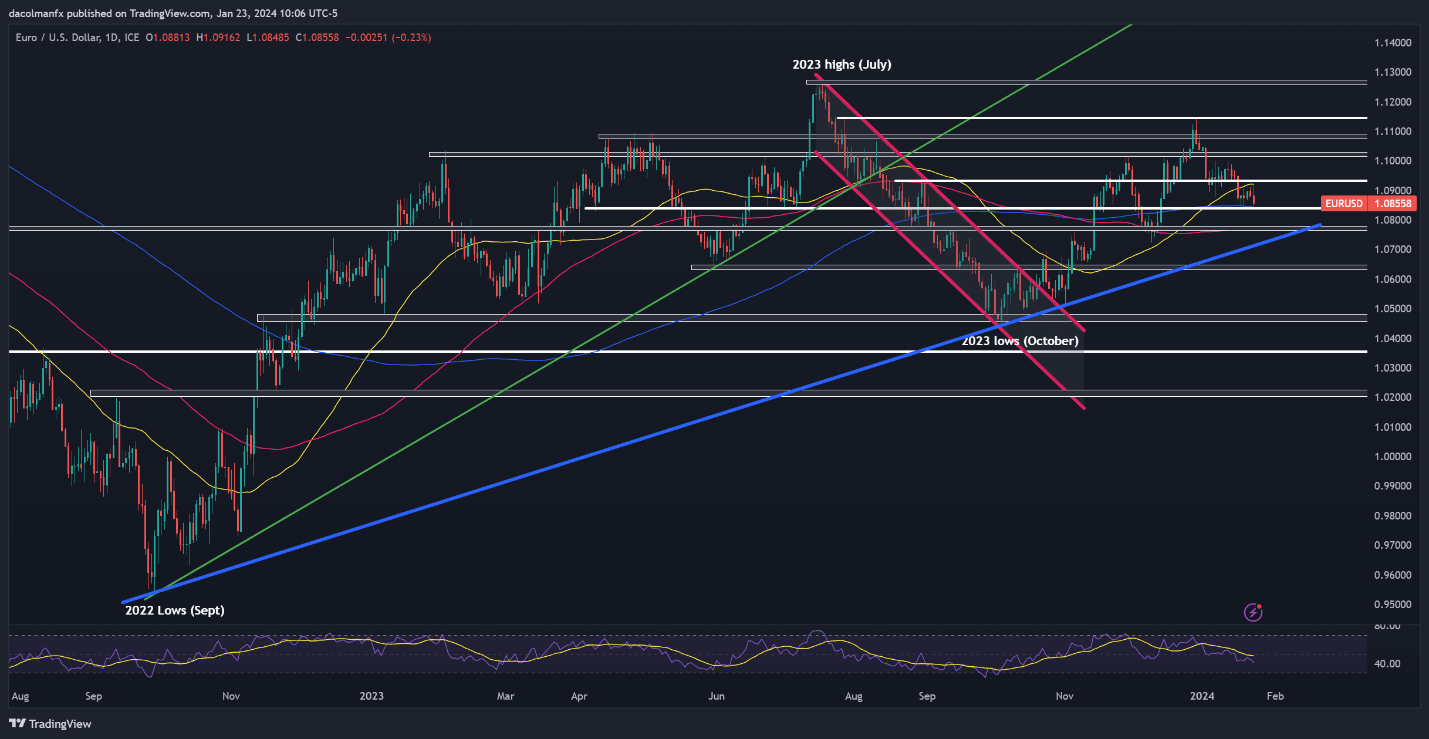

EUR/USD TECHNICAL ANALYSIS

EUR/USD has been moving lower this week, but has so far managed to hold above its 200-day simple moving average near 1.0840. For sentiment around the euro to improve, the bulls have to protect this floor at all costs; failure to do so could result in a pullback towards 1.0770. On further weakness, all eyes will be on trendline support at 1.0710.

In the event of a bullish reversal ahead of the ECB decision, technical resistance extends from 1.0920 to 1.0935. If history is any guide, buyers will face difficulties in clearing this barrier; however, a successful breakout has the potential to usher in rally towards 1.1020. On continued upward momentum, attention will turn to 1.1080.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

For a complete overview of the Japanese yen’s technical and fundamental outlook, download our complimentary Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free JPY Forecast

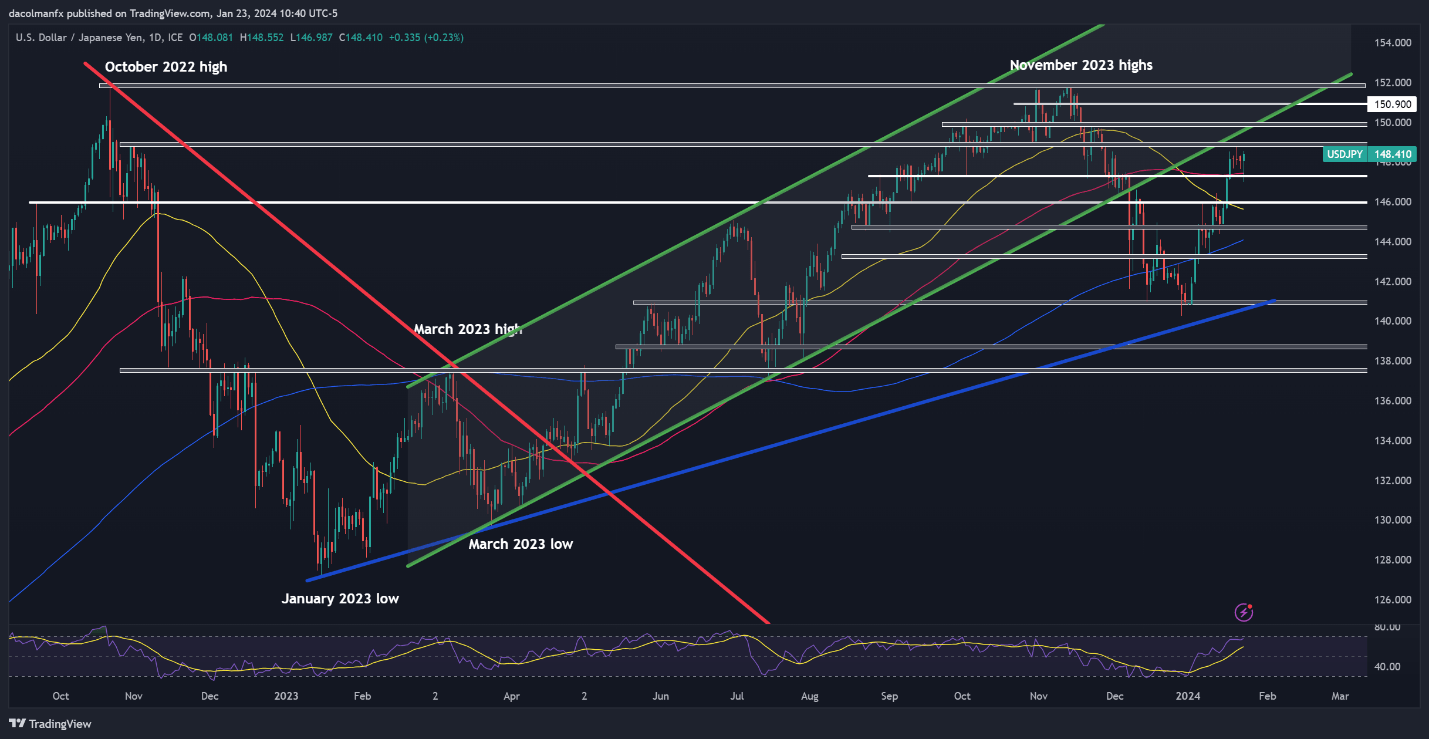

USD/JPY TECHNICAL ANALYSIS

While the Bank of Japan’s monetary policy announcement sparked some yen’s volatility, it was ultimately a nothingburger, with the institution maintaining its ultra-loose policy settings – a decision that could pave the way for further weakness in the Japanese currency.

Looking at USD/JPY, prices seem to be ready to start the next leg higher after a short period of market consolidation, as shown on the daily chart below, where the pair can be seen approaching a key ceiling near 149.00. If buyers manage to push the exchange rate above this ceiling, a retest of the 150.00 level could be just around the corner.

On the flip side, if USD/JPY reverses off technical resistance, initial support is located near 147.40, near the 100-day simple moving average. Prices are likely to stabilize in this area before resuming their bullish path; however, a decisive breakdown could pave the way for a retracement toward the 146.00 handle.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Interested in learning how retail positioning can shape the short-term trajectory of USD/CAD? Our sentiment guide has all the answers. Download your free guide now!

| Change in | Longs | Shorts | OI |

| Daily | 2% | 9% | 5% |

| Weekly | 20% | 0% | 10% |

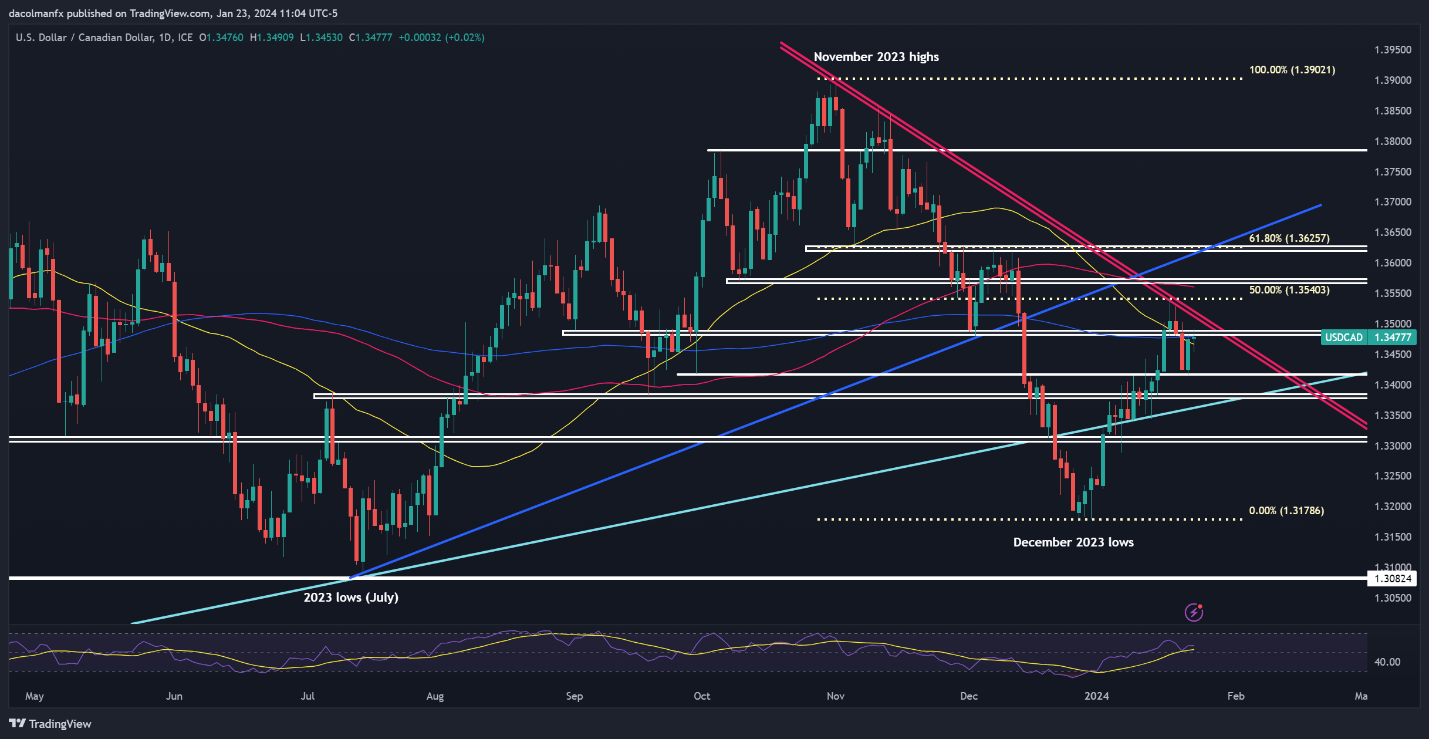

USD/CAD TECHNICAL ANALYSIS

After a sharp pullback late last week, USD/CAD has regained ground over the past two days, overcoming significant hurdles in the process, including the 200-day and 50-day simple moving averages. Should gains accelerate in the coming days, trendline resistance appears at 1.3500. Looking higher, the crosshairs will be on 1.3540, the 50% retracement of the November/December downturn.

In contrast, should USD/CAD’s upward momentum falter and prices turn lower, primary support below the key moving averages highlighted before looms at 1.3415, followed by 1.3380. Although the pair may bottom out in this region during a pullback, a decisive breakdown could create the right conditions for a drop toward the 1.3300 handle.

USD/CAD TECHNICAL CHART

[ad_2]

Source link