[ad_1]

US DOLLAR OUTLOOK:

- The U.S. dollar rebounds following hawkish comments from the FOMC chairman at a central banking forum in Sintra

- Powell says that more tightening is coming and that strong majority of Fed officials support two additional rate hikes this year

- This article looks at key DXY’s technical levels to watch in the coming days and weeks

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: ECB Forum on Central Banking Roundup: Fed, ECB, BoE and BoJ Heads Weigh in

The U.S. dollar, as measured by the DXY index, rebounded on Wednesday after a subdued performance earlier in the week, supported by hawkish comments by the Federal Reserve chairman at a forum in Sintra, Portugal. In early afternoon trading, the greenback gauge was up about 0.5% to 103.00 and was on track to notch its best close since June 13.

At a central banking panel hosted by the ECB, FOMC chief Powell said that the current policy setting may not be restrictive enough and that more tightening is on the horizon, noting that a broad majority of Fed officials support two additional rate hikes this year.

Powell’s warning did not end there. He also admitted that he doesn’t expect core inflation to get to 2.0% until 2025. Although he did not say so explicitly, his rhetoric signals rates could stay high for an extended period of time as part of ongoing efforts to restore price stability. This could mean no cuts in 2024.

Related: USD/JPY, EUR/JPY Head Higher as Yen Intervention Talk Fails to Arrest Slide

Despite Powell’s hawkish message, many traders remain doubtful about plans for further hikes, arguing that the U.S. economy will not be able to tolerate a tighter policy stance. For more clarity on the outlook, it is imperative to keep an eye on key macroeconomic reports in the coming days and weeks, such as jobless claims, PCE deflator, non-farm payrolls, CPI, etc.

If incoming data continues to surprise to the upside, skepticism about the Fed’s roadmap could fade, leading interest rate expectations to drift in a more hawkish direction, in line with the central bank guidance. This could bolster the U.S. dollar heading into the third quarter.

Recommended by Diego Colman

Traits of Successful Traders

US DOLLAR TECHNICAL ANALYSIS

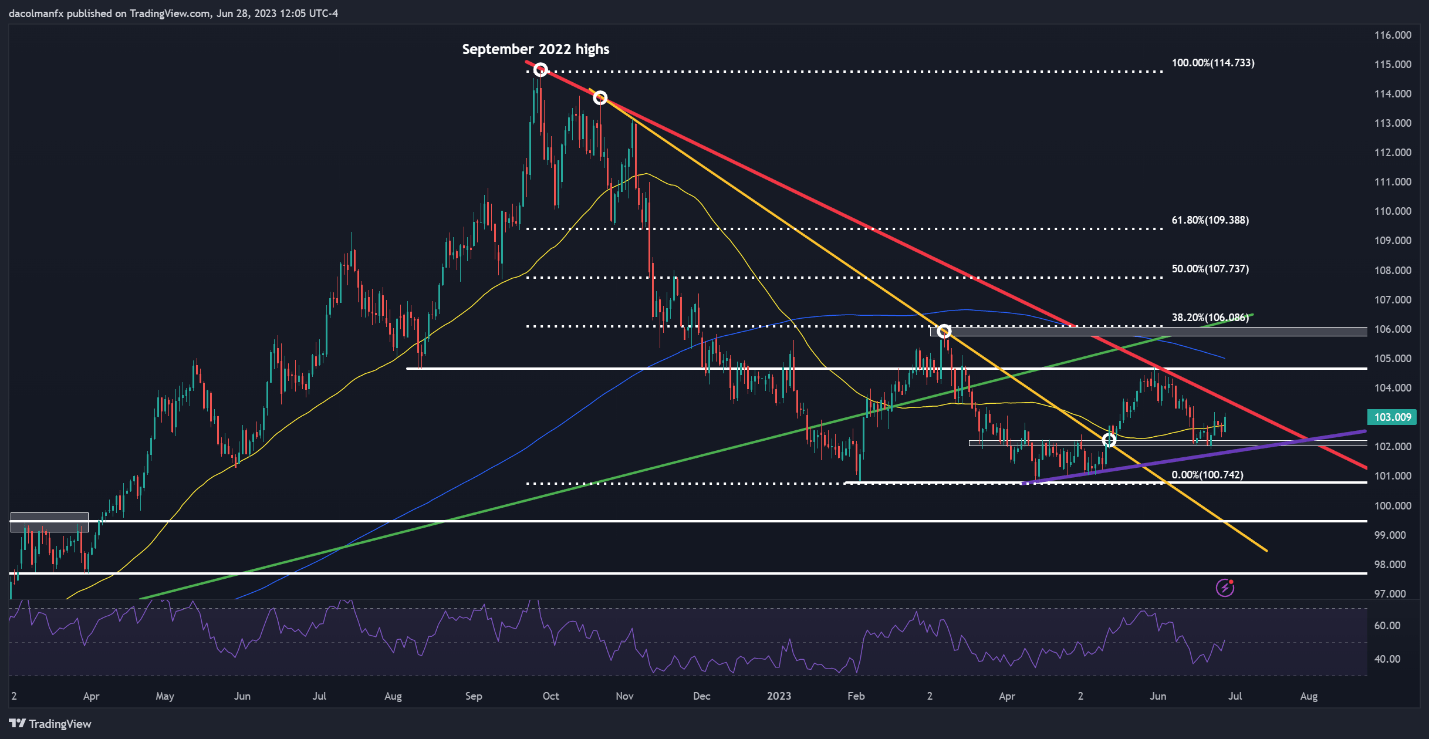

After its recent rebound, the US dollar (DXY) is steadily approaching medium-term trendline resistance at 103.50. While bulls may have a hard time pushing prices above this technical barrier, a breakout could lure new buyers into the market, setting the stage for a move toward 104.70, near the May swing highs.

On the other hand, if sellers regain control of the market and trigger a pullback, initial support stretches from 102.20 to 101.81, followed by 100.80, around the 2023 lows. On further weakness, we could see a drop towards 99.50.

US DOLLAR (DXY) TECHNICAL ANALYSIS

[ad_2]

Source link