[ad_1]

USD Technical Outlook

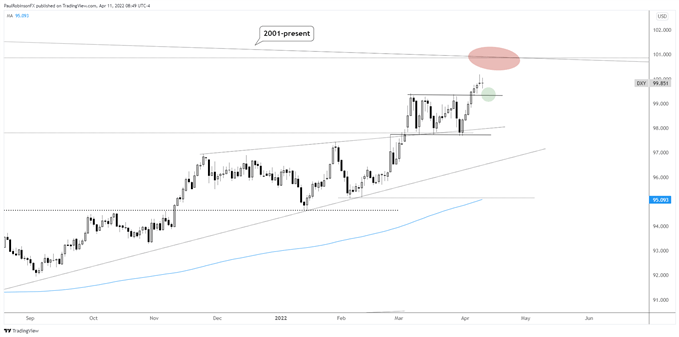

- US Dollar Index (DXY) broke out of range

- Has major long-term trend-line just ahead

- Test of top of range may provide support

US Dollar Technical Analysis: Nearing Very Long-term Resistance

The US Dollar Index (DXY) finally broke out of a trading range it had been creating for almost a month. The resolution to the top-side was anticipated given the direction of the overall trend. Not far ahead lies a very important trend-line dating back over two decades.

The 2001 to current trend-line runs down from 2001 over the top of the March 2020 spike-high. Given the massive catalyst behind the 2020 high it boosts the trend-lines importance even if it only has the bare minimum connecting points to be considered a trend-line.

One scenario that could play out before arriving at the long-term threshold, is a test of the top of the range as support. Old resistance is viewed as a potential source of support. A dip back to the 99.41 area could provide an entry spot for would-be longs.

As long as the top of the range holds on a daily closing basis, then the outlook will remain bullish. A reversal through the top of the range, though, could lead to a swift decline as the market is caught wrong-footed.

A rise up to the trend-line could bring some big volatility. If this is indeed the case, and if a big turnabout occurs, then it could shift the focus lower for the dollar. A bridge we will cross should we get there. For now, focusing on a potential range retest and how that plays out.

US Dollar Index (DXY) Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link