[ad_1]

S&P 500, SPX, NASDAQ 100, NDX – Price Action:

- US indices steady after widely-expected Fed rate hike.

- Earnings, China stimulus, and resilient global growth are supportive.

- Extreme optimism, overbought conditions, overcrowded positioning, and seasonality are potential headwinds.

- What is the outlook for the Dow, the S&P 500 index, and the Nasdaq 100 index?

Recommended by Manish Jaradi

Get Your Free Equities Forecast

US equity indices were largely flat, hovering around year-to-date highs after the US Federal Reserve hiked interest rates by the widely expected quarter percentage point.

While the post-meeting statement kept the bias for “additional policy firming”, at the press conference, Fed Chair Powell seemed to have leaned toward the dovish side. “I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted,” said Powell. “And I would also say it’s possible that we would choose to hold steady and we’re going to be making careful assessments, as I said, meeting by meeting.” The data-dependent/ patient approach going into the next meeting has boosted the market’s perception that US interest rates are peaking, supporting risk appetite at the margin.

With the earnings season off to a good start, global growth being resilient, and additional China stimulus remaining a possibility, markets have reasons to cheer. Having said that, extreme optimism, overbought conditions, overcrowded positioning, and seasonality headwinds are potential risks. For more discussion on this, see “S&P 500, Nasdaq 100 Forecast: Overly Optimistic Sentiment Poses a Minor Setback Risk,” published July 23.

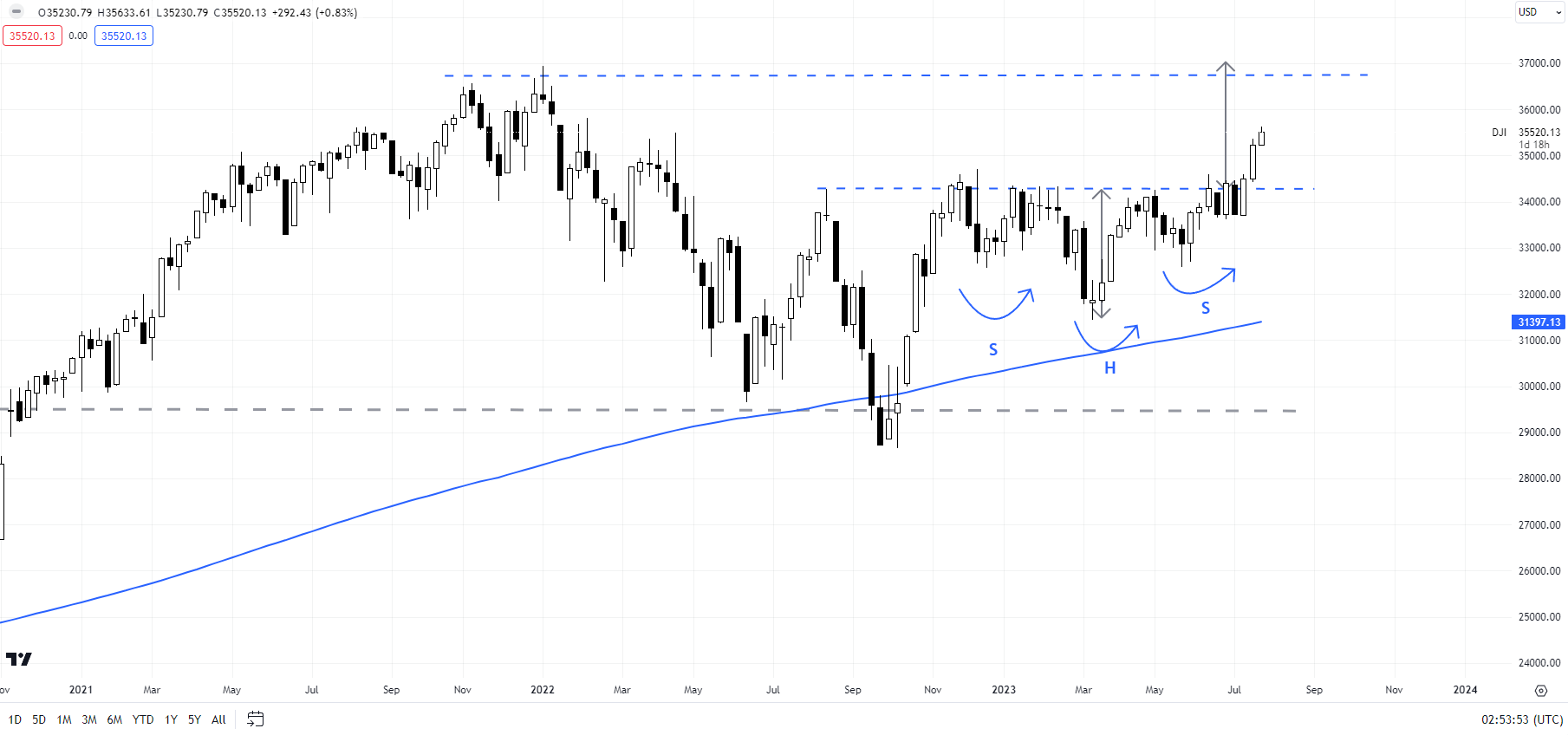

Dow Jones Industrial Average Weekly Chart

Chart Created Using TradingView

Dow Jones Industrial Average: Scope for further gains

The Dow Jones Industrial Average’s recent break above a horizontal trendline from August at about 34280 has triggered a reverse head & shoulders pattern, first highlighted in “Dow, S&P 500, Nasdaq Technical Outlook: No Sign of a Reversal,” published July 9. The left shoulder is at the December low, the head is at the March low, and the right shoulder is at the May low. The bullish break has opened the way toward the 2022 high of around 37000.

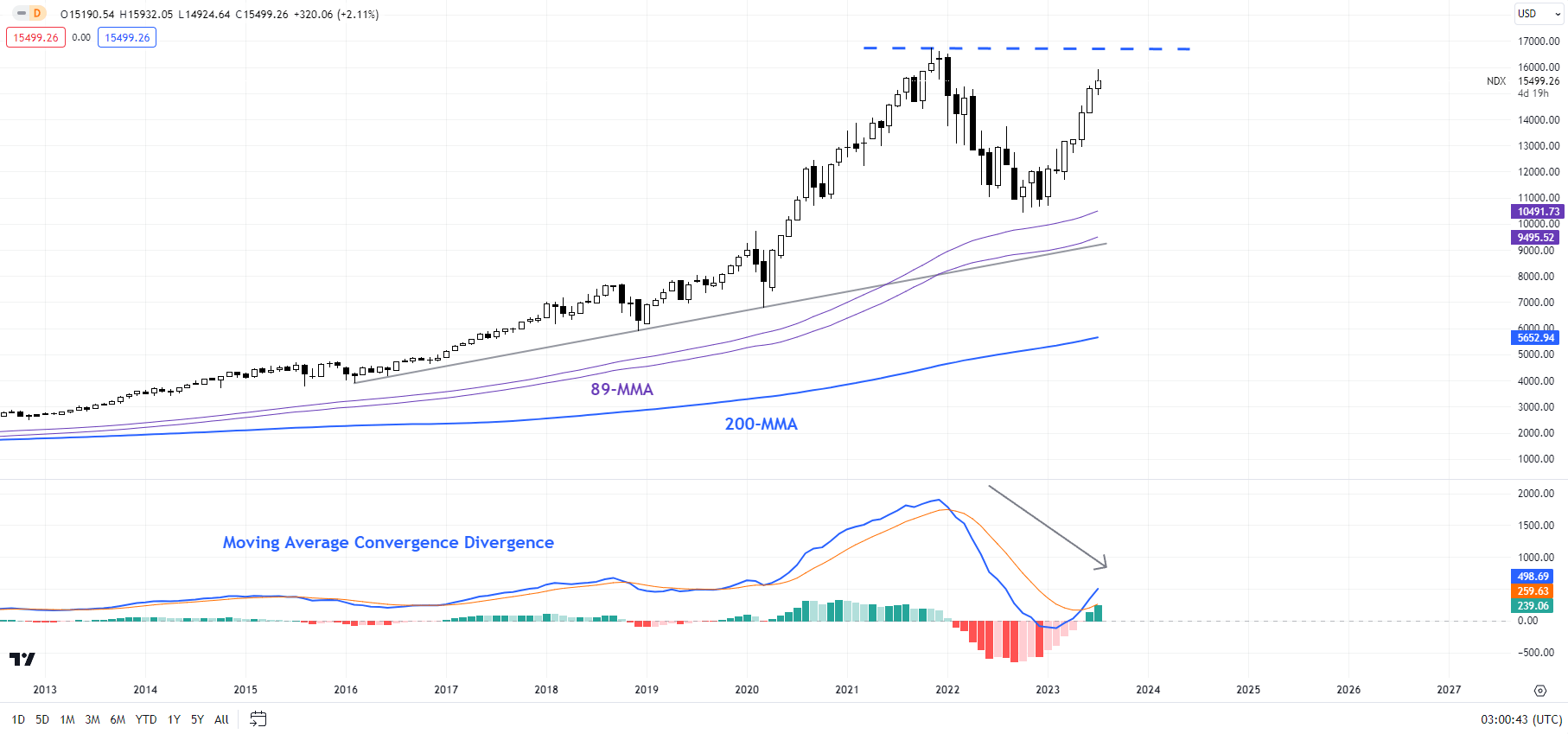

NASDAQ 100 Monthly Chart

Chart Created Using TradingView

Nasdaq 100: Overbought, but no sign of reversal

The Nasdaq 100 index is looking quite overbought, while diversity continues to remain low. For more on diversity, see “S&P 500, Nasdaq 100 Forecast: Overly Optimistic Sentiment Poses a Minor Setback Risk,” published July 23. Furthermore, the momentum on higher timeframe charts has failed to reflect the strength on shorter timeframe charts. For instance, on the monthly chart, the index is close to its 2021 peak, but the Moving Average Convergence Divergence indicator has hardly picked up.

To be sure, this doesn’t necessarily mean the index is bearish, not at least until there is a price confirmation. It probably means, from a risk: reward perspective, it may be prudent to turn cautious. Immediate support is at the mid-June high of 15285, around the 30-day moving average. Subsequent support is at the end-June low of 14690 – a break below this support would be needed for the immediate bullish pressure to ease.

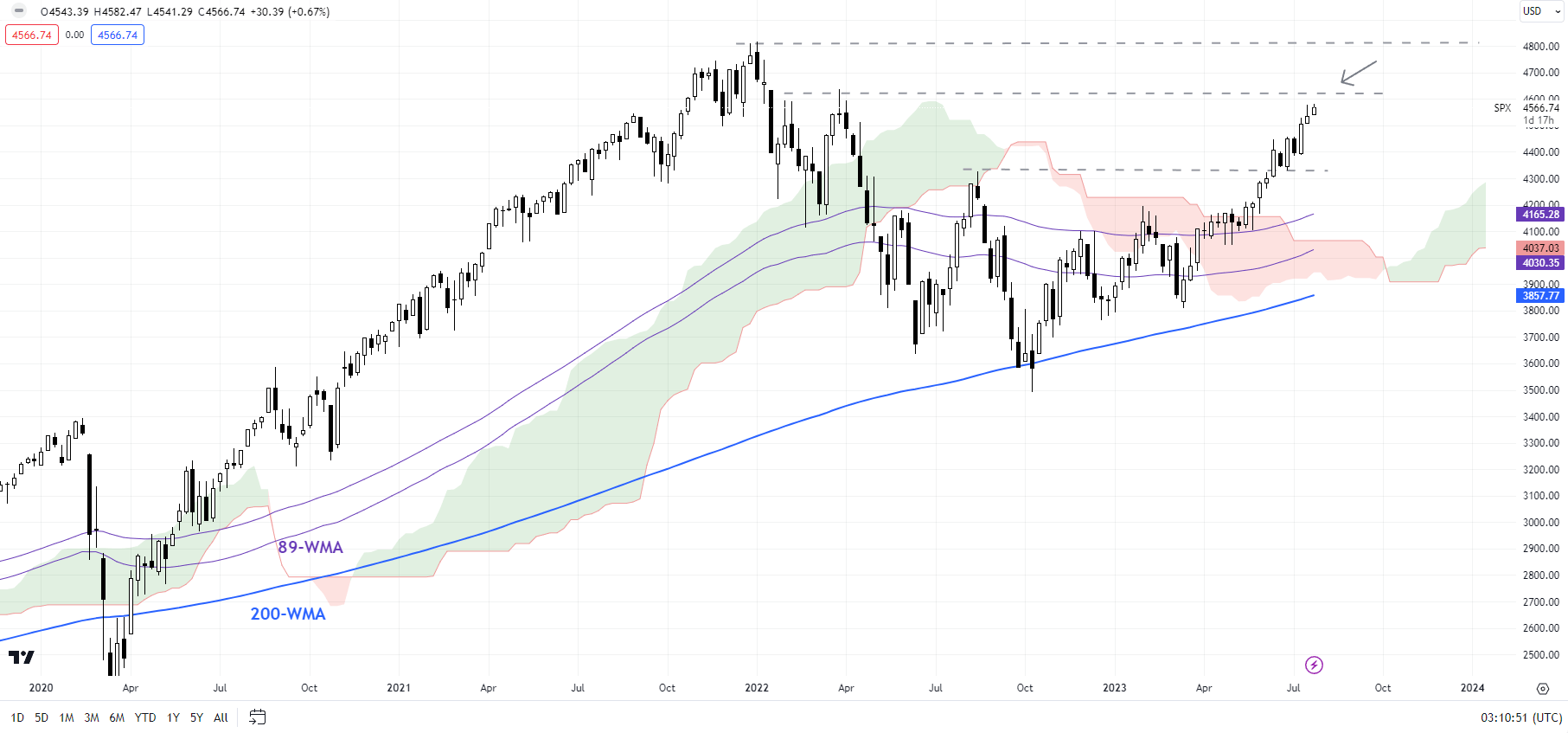

S&P 500 Weekly Chart

Chart Created Using TradingView

S&P 500: Uptrend intact as it nears a key hurdle

From a trend perspective, like the Nasdaq 100 index, there is no sign of a reversal of the uptrend on the S&P 500 index charts. Having said that, tentative signs of fatigue are emerging as the S&P 500 index nears the April 2022 high of 4637, slightly below the 2022 record high of 4819.

Still, unless the index breaks below immediate support at the mid-June high of 4450, the path of least resistance remains sideways to up in the near term – a point confirmed by still-solid momentum on the weekly charts. Only a break below 4450 would indicate that the bullish pressure had temporarily faded. For the broader bullish outlook to reverse, the index would need to fall below the 89-day moving average (now at about 4250).

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

Source link