[ad_1]

US Dollar (DXY) Price and Chart Analysis

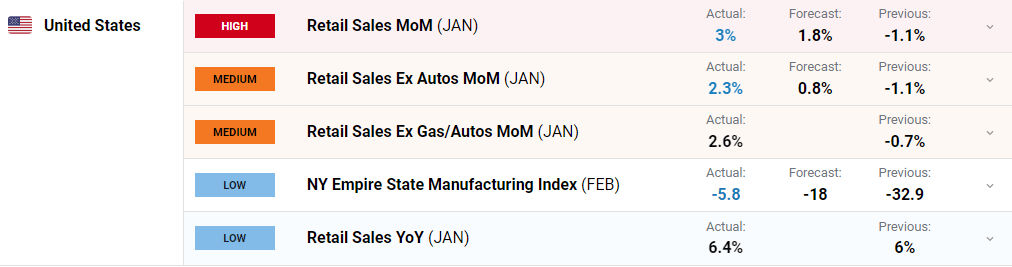

- Retail sales pick up in January, NY Empire State Manuf Index also beats to the upside.

- The US dollar continues to push higher.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Advanced US retail sales picked up further in January, beating market expectations, and fuelling a further rise in the US dollar. According to the latest report from the US Census Bureau,

‘Advance estimates of U.S. retail and food services sales for January 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $697.0 billion, up 3.0 percent (±0.5 percent) from the previous month, and up 6.4 percent (±0.7 percent) above January 2022.’

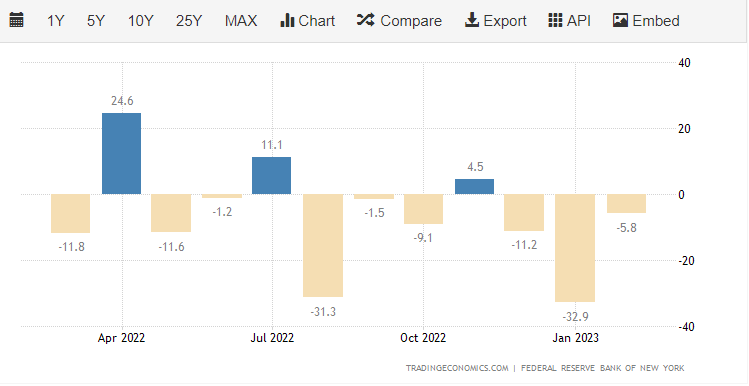

The New York Empire State Manufacturing Index also beat estimates and climbed 27.1 points from a month earlier.

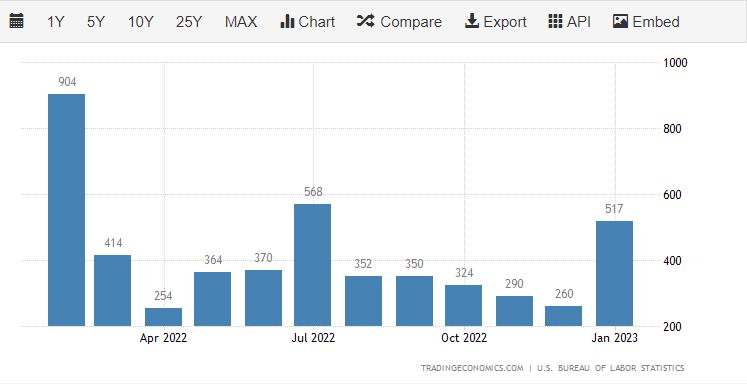

The Federal Reserve will look at these figures and see them as supportive of the central bank’s ongoing war against inflation. The latest inflation report showed that price pressures remain sticky in the US, and at uncomfortably high levels, while the January US Jobs Report blew through expectations with 517k jobs created, beating forecasts of 185k jobs with ease. A stronger jobs market, better retail sales, and improving manufacturing conditions show the US economy continuing to pick up and will allow the Fed more wiggle room to keep rates higher for longer if they deem it necessary.

Recommended by Nick Cawley

Building Confidence in Trading

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

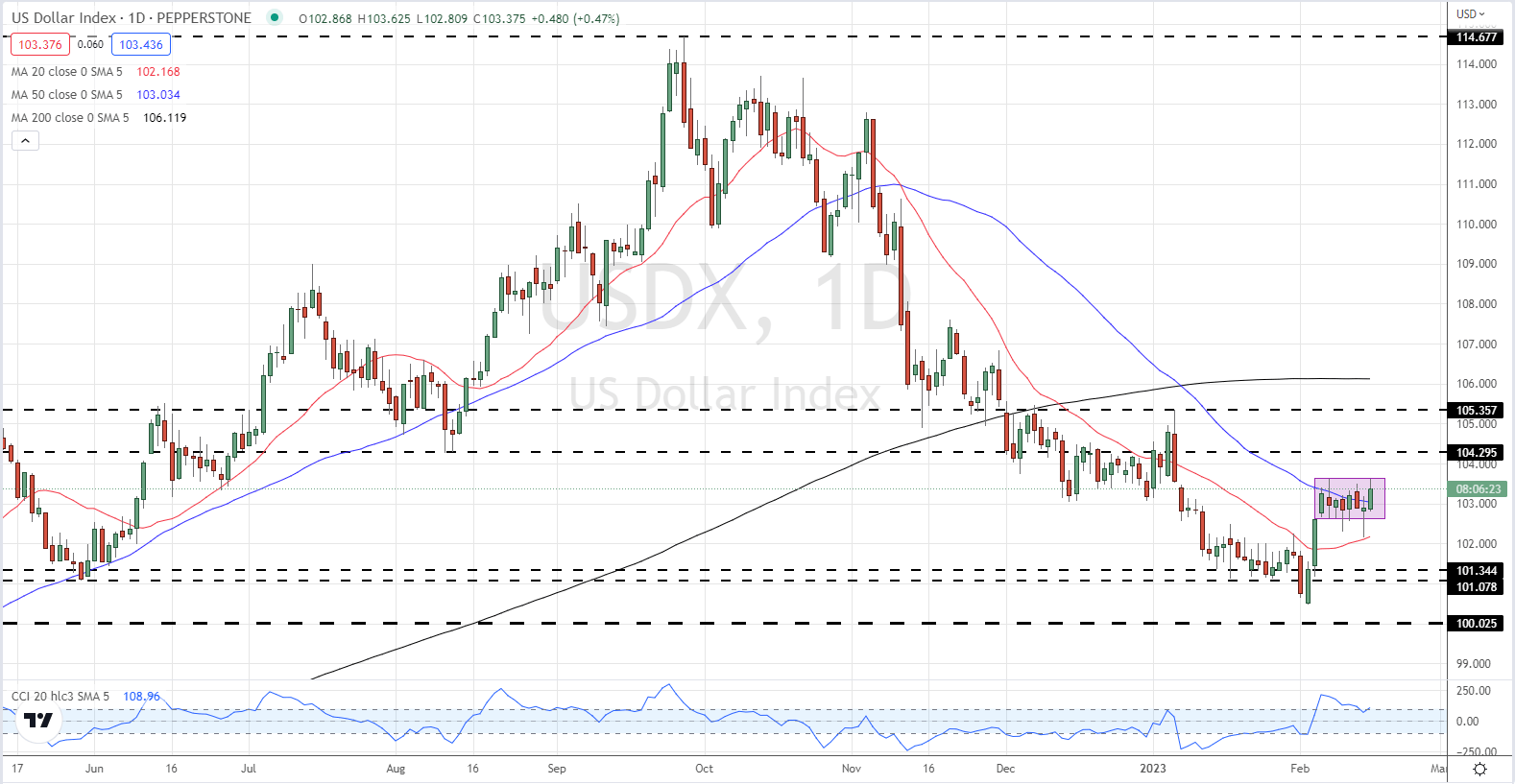

The US dollar (DXY) has been all day, boosted by higher short-term US Treasury yields, and has just tagged a fresh five-week high. The daily chart shows a potentially bullish setup with a confirmed break above 103.60 opening the way to 104.30 and 105.36.

US Dollar (DXY) February 15, 2023

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link