[ad_1]

US Dollar, (EUR/USD, GBP/USD, USD/JPY) Analysis

EUR/USD Slides Ahead of Crucial EU Growth Data While USD Receives a Bid

EUR/USD slid moments after the Wall Street Journal reported that Iranian allies brace for response after a deadly drone strike killed three Americans at a US outpost in Jordan. The attack is the latest in the evolving conflict in the Middle East and now that US soldiers have been affected, has the potential to escalate tensions to another level.

The potential for widening conflict has seen the dollar receive a bid on Monday in what appears to be related to the safe-haven properties associated with the world’s reserve currency. However, another safe haven asset, gold is yet to respond in a similar fashion, meaning the move may simply be a function of market positioning ahead of the two-day FOMC meeting which gets under way tomorrow.

Furthermore, German and EU GDP for the fourth quarter could very well confirm a technical recession as the economic outlook in Europe continues to deteriorate. Just this morning the ECB’s Centeno mentioned the April meeting as a possibility for the first rate cut, motivating that it is not necessary to wait for wage growth data that becomes available in May. Not helping the matter is the case of a fast declining 2-year Bund yield (German government bond) which is dragging the Euro lower.

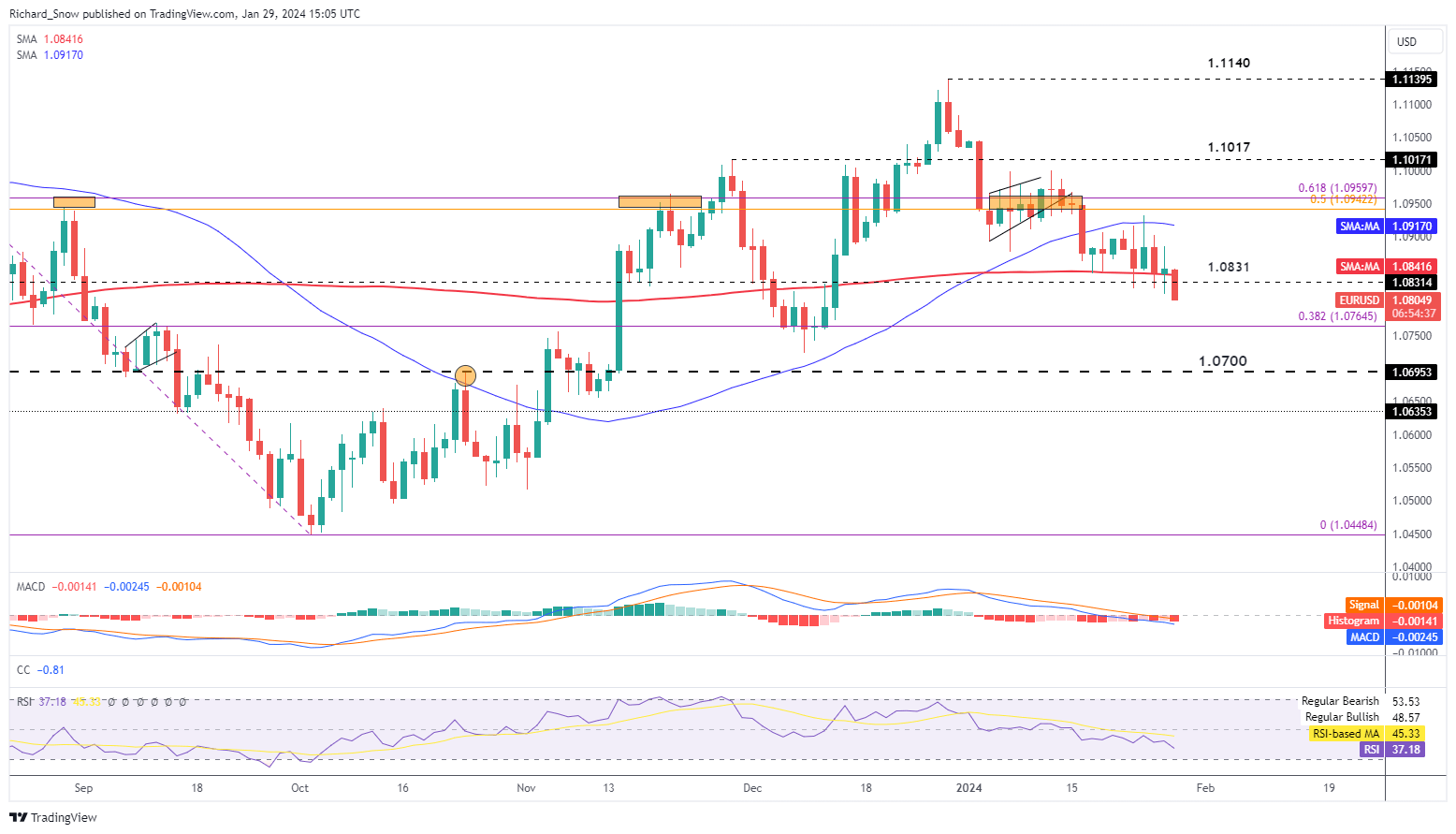

EUR/USD has dropped below the prior low observed yesterday and trades will below 1.0830 – a prior level of interest. The pair also appears breaks below the 20 simple moving average which had provided dynamic support over the last eight trading sessions on a closings basis.

The 38.2% Fibonacci retracement of the 2023 decline presents the next level of support at 1.0764 followed by 1.0700. Resistance appears at the blue 50-day simple moving average, then the zone at 1.0950.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free EUR Forecast

GBP/USD Could Test Range Support This Week

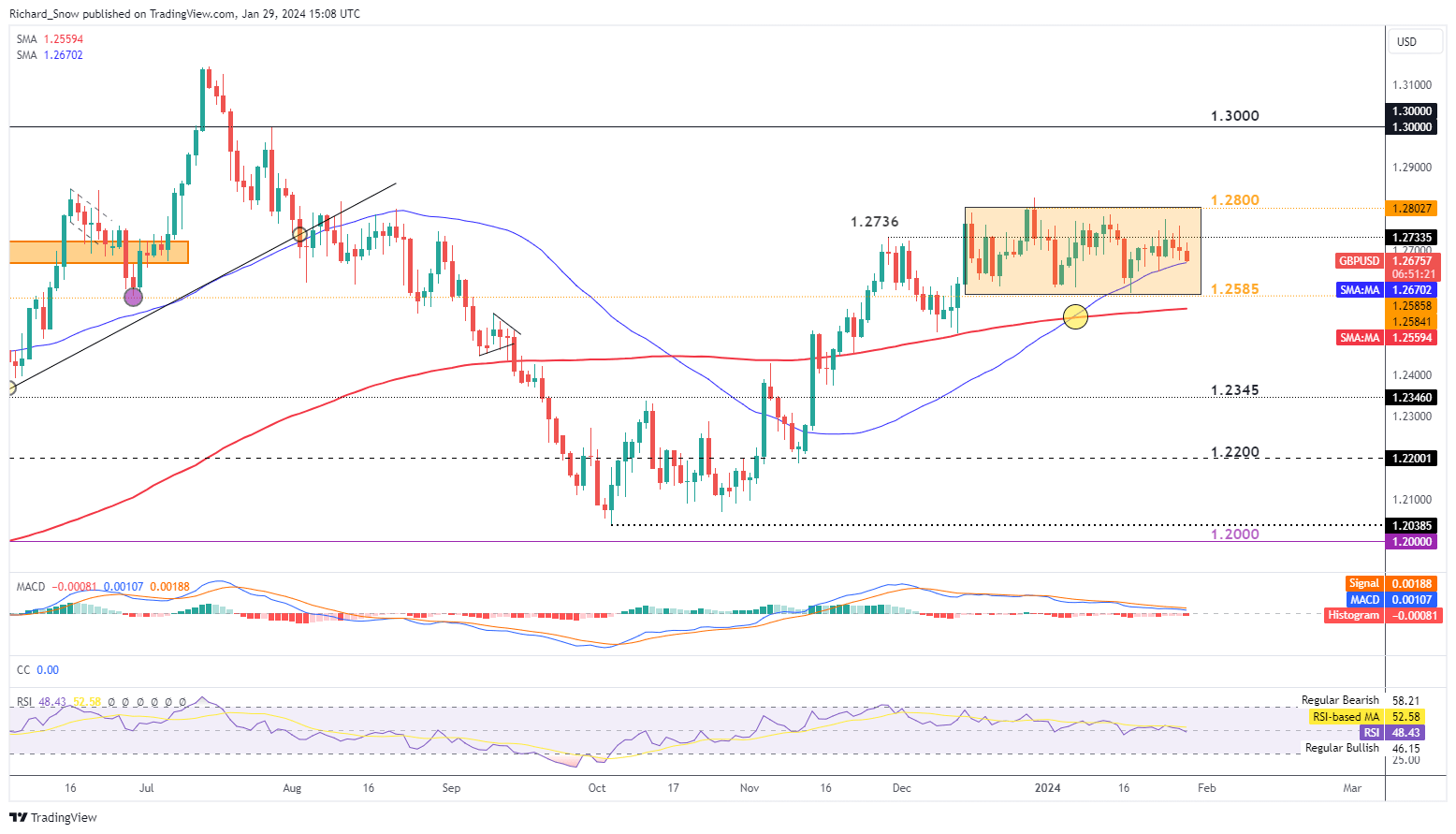

GBP/USD trades within the broad range as price action has been largely side-ways with a well-defined trough and peak. The blue 50 SMA has provided dynamic support for the pair which is not directly under threat of a move to the downside.

Support appears at 1.2585, followed by the 200 SMA (red line). The MACD indicator reveals the general bearish momentum which could see the pair test channel support this week. The Bank of England provides an update on its interest rate settings and updated quarterly forecasts to help markets gain insight into the committees thinking. Should the bank remain unmoved and issue a dovish address, sterling may come under further pressure.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

USD/JPY suggests the yen may find it difficult to depreciate from here

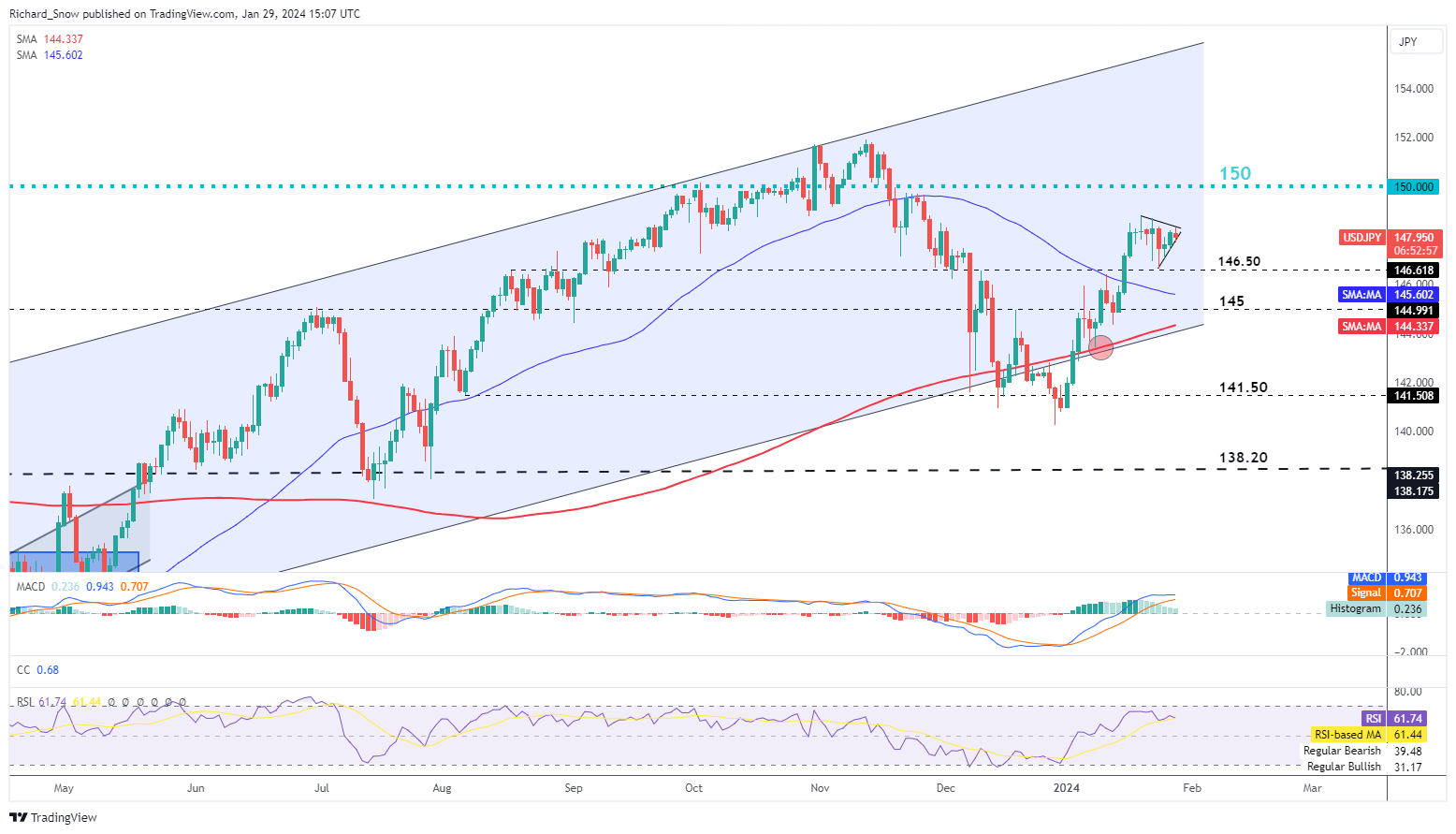

USD/JPY price action appears to have formed a bullish pennant, a bullish continuation pattern. On an intra-day basis though, USD/JPY is down on the day thus far when the likes of EUR/USD and GBP/USD both appear susceptible to dollar strength. The yen has often been driven by the first eventual interest rate hike from the BoJ in years but easing inflation had tempered those expectations. After this month’s Bank of Japan (BoJ) meeting, the yen appears to have stopped depreciating at the very least and could push back against the dollar unless incoming data points show disinflation. However, the BoJ Governor Ueda himself stated that the likelihood of the 2% inflation target being hit is steadily rising and this is despite the two consecutive months of lower CPI readings.

150 is still the key level to the upside while 146.50 and 145 are levels to monitor to the downside. The RSI nears overbought territory, signalling that a pullback in due course would not be out of the ordinary.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free JPY Forecast

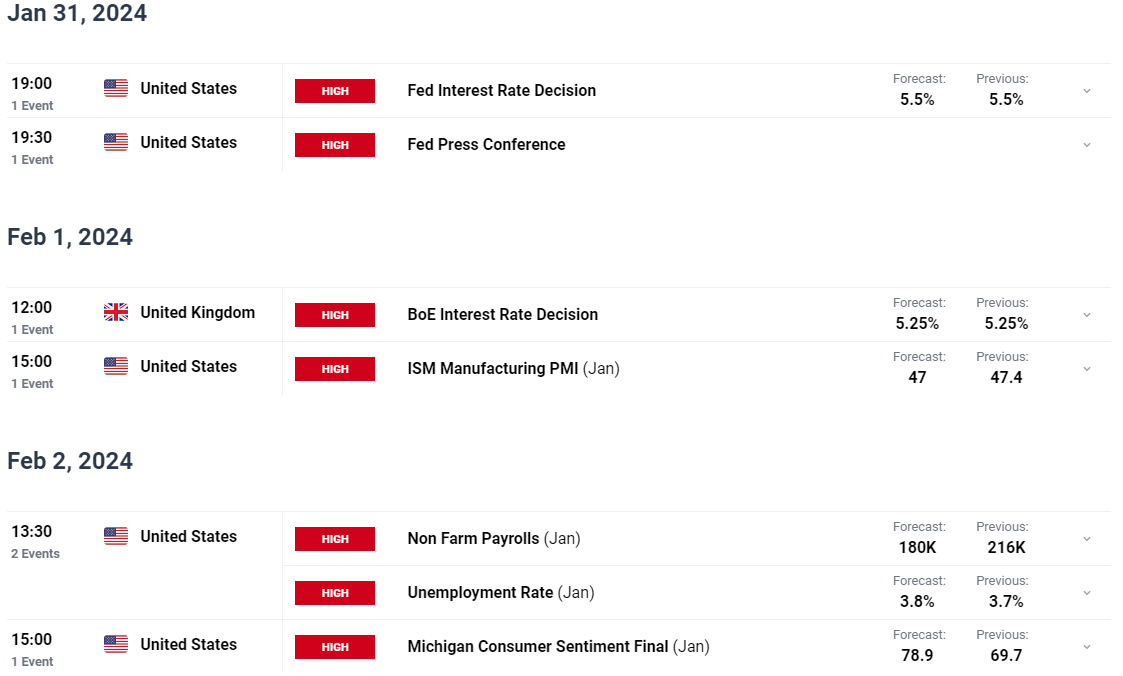

Major Risk Events for the Week Ahead:

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link