[ad_1]

USD/JPY News and Analysis

Recommended by Richard Snow

See what our analysts foresee in JPY in Q3

BoJ’s Household Survey Sees Higher Prices for Longer in Japan

A central bank survey on household inflation expectations revealed that households expect inflation to average a massive 10.5% in one year’s time. In addition, the percentage of respondents anticipating rising prices 5 years from now rose from 75.4% to 79%.

Considering this latest data alongside the fastest rising wage growth seen in almost two decades, conditions in Japan appear to be improving. With actual inflation above target and inflation expectations at such extreme levels, pressure is beginning to mount on the Bank of Japan (BoJ) to walk back years of ultra-accommodative monetary policy put in place to stoke a healthy level of inflation. With longer-term yields capped by the BoJ, the Japanese yen becomes the release valve where markets place their bets on BoJ policy adjustments.

USD/JPY Technical Levels to Watch

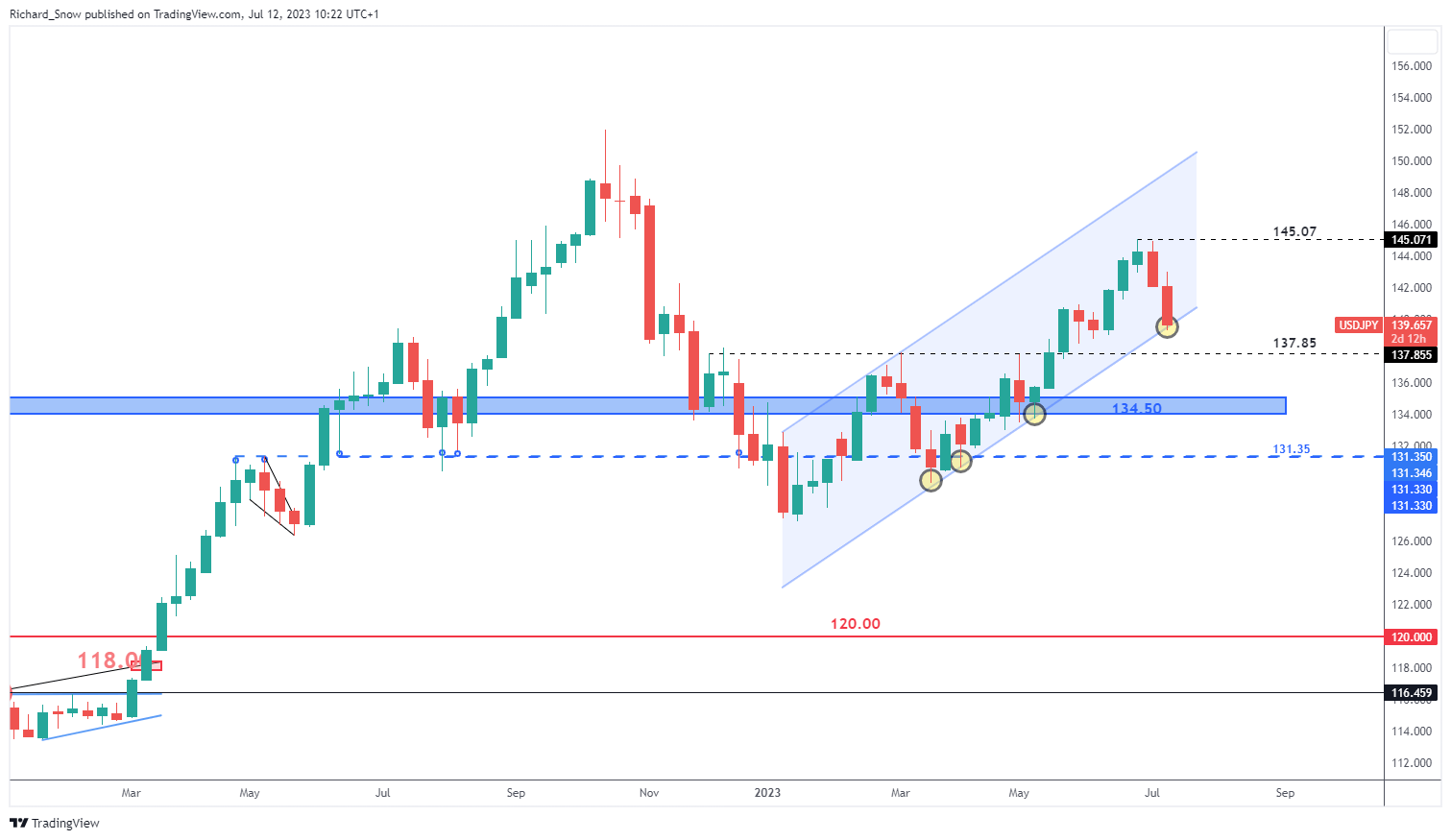

The weekly USD/JPY chart reveals the pace of the latest decline as the weekly candle tests the prior multi-month ascending channel. The under side of the channel has provided sufficient support upon prior tests but given the speed of the recent move, this area will need to be watched closely. A break and close on the weekly candle bodes well for USD/JPY bears, with 137.85 as the next level of support.

USD/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade USD/JPY

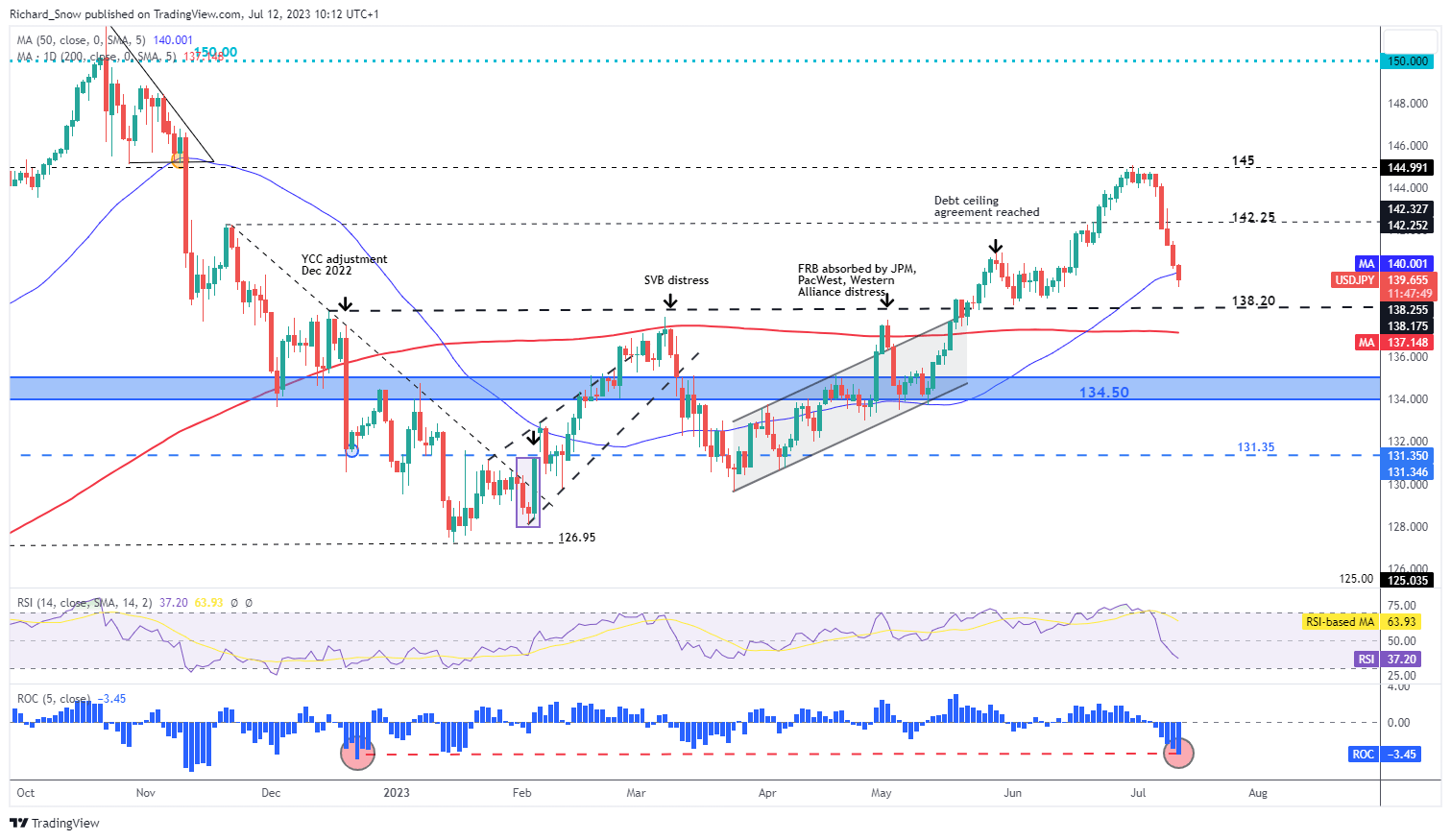

The daily chart (with annotations) shows the importance of the Japanese yen as a safe haven and now as markets appear to be reshaping their views on the entrenched policy stance of the BoJ.

Today, price action moves through the 50 simple moving average with 138.20 next in sight before the 200 day simple moving average comes into focus. Earlier I mentioned the pace of the directional move and the rate of change indicator at the bottom of the chart shows that it is the fastest 5-day decline since late 2022. The trade off with such a market is anticipating the pullback and potentially missing out on further declines. Nevertheless, the market shows little signs of reversing, with the RSI not yet in oversold territory. US core CPI ought to influence short term moves from here.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

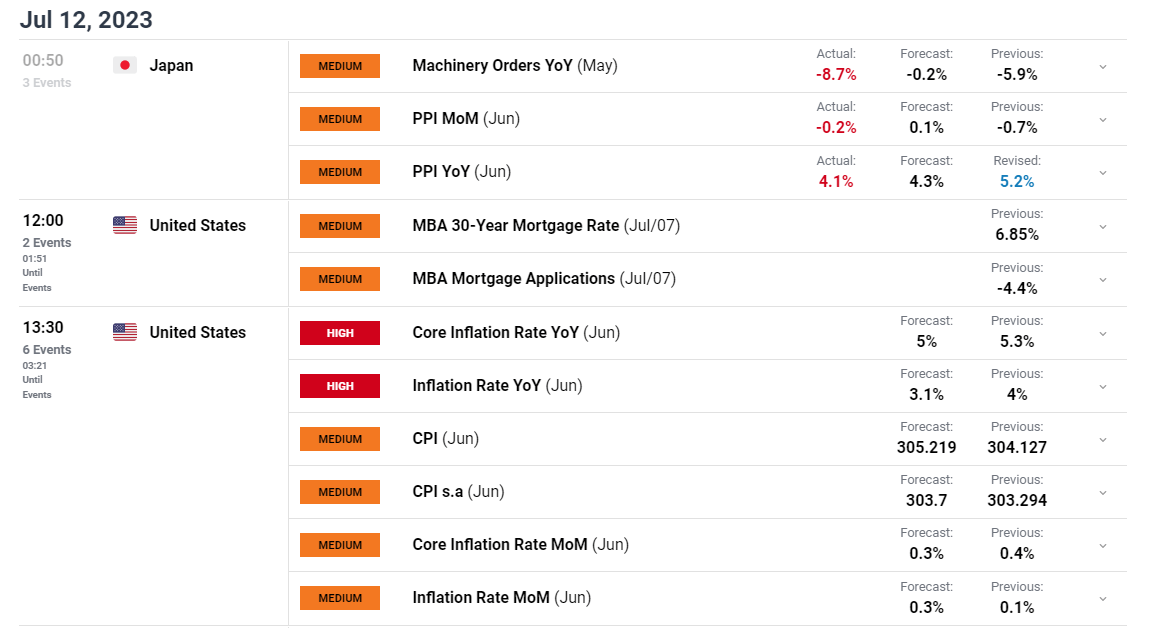

Main Risk Events Ahead

The biggest item on the agenda this week is the US CPI print where lower prints are expected on both headline and core data points. Core inflation has proven to be sticky, although, last month’s print showed minor progress resulting in core CPI edging below the 5.4 to 5.7 percent range which had persisted for months. Forecasters see even further progress being made later today with core to drop to 5% and headline inflation to reach 3.1%.

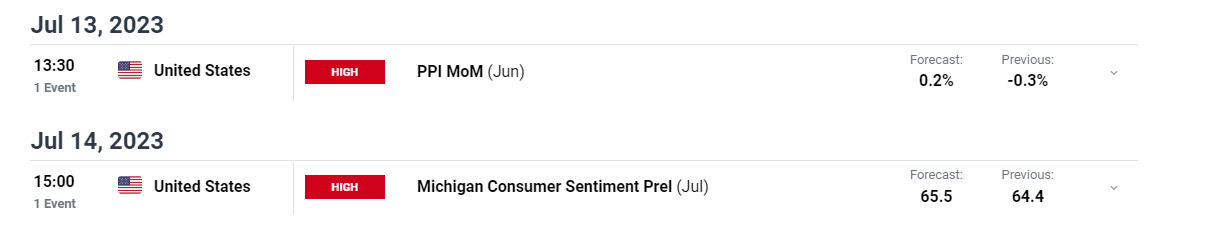

A print below or inline may see a continuation of the dollar sell off and by extension, a bearish continuation in USD/JPY. Staying with inflation, US PPI is up next where another lower print is anticipated as input prices continue to decelerate.

Customize and filter live economic data via our DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Stay up to date with the latest market themes and moves

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link