[ad_1]

USD/JPY News and Analysis

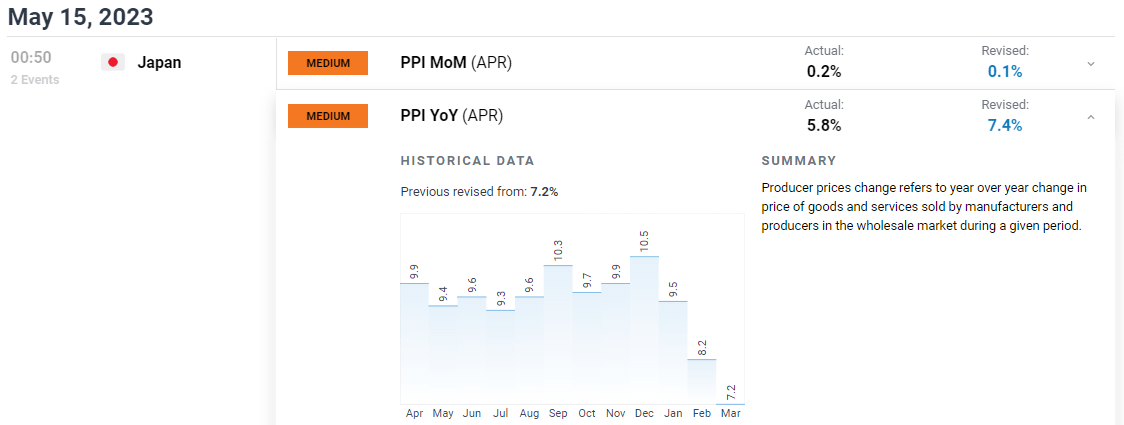

- Japanese Yen dips after inflation data shows positive signs (PPI heads lower)

- USD/JPY levels to watch: recent dollar strength entices bears ahead of key level of resistance

- Major risk events: US debt ceiling, regional banks, Q1 Japanese GDP and CPI and Fed speakers

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

See what out analysts think of the yen in Q2

Japanese Yen Dips after Inflation Data Shows Positive Signs

Japanese PPI cooled in April compared to the same time last year and continues to rend lower. In addition, Japan’s CPI and core CPI figures have seen successive lower prints after reaching highs in January. Lower inflation reduces pressure on new Bank of Japan (BoJ) head Mr Kazuo Ueda to change ultra-dovish monetary policy.

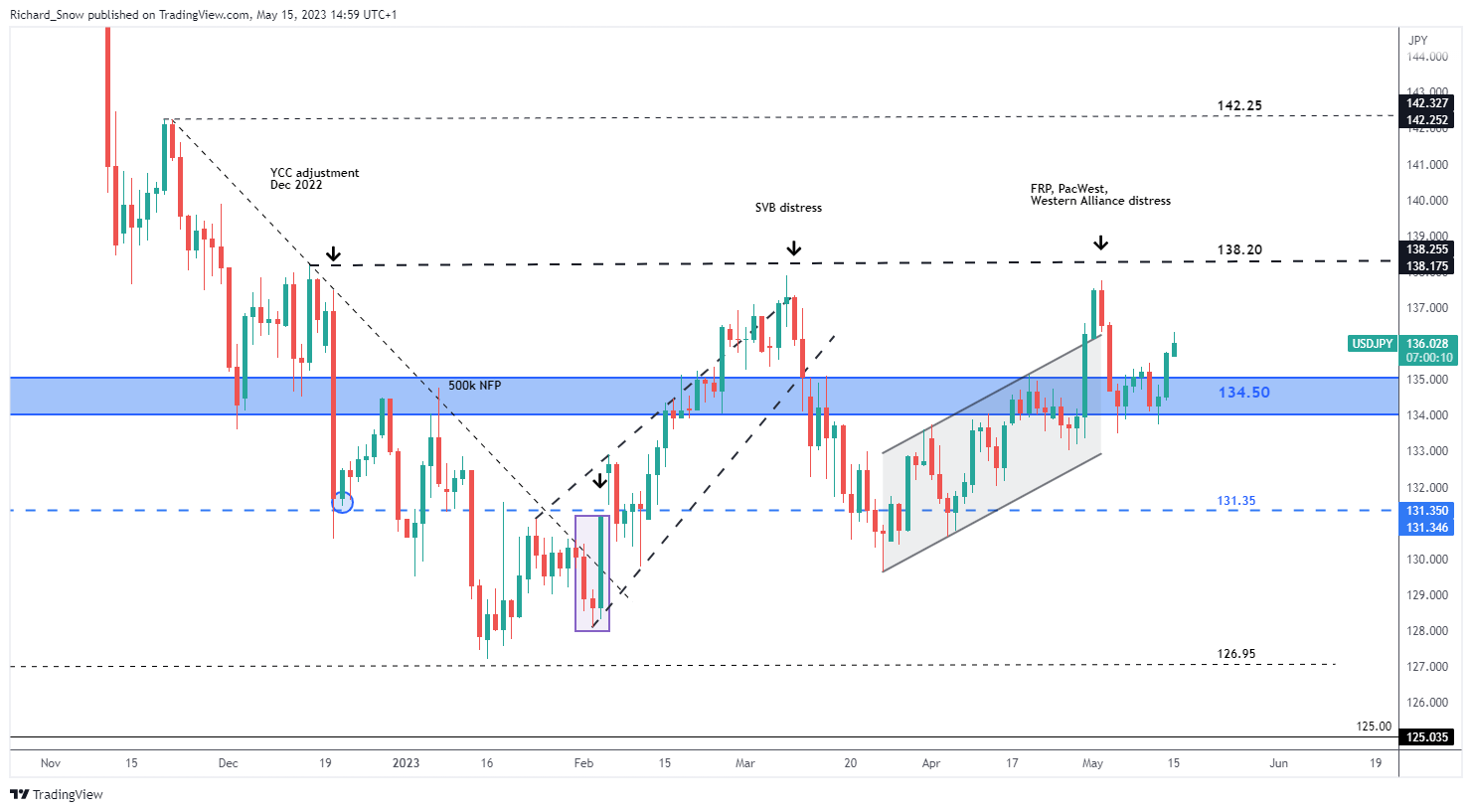

USD/JPY Levels to Watch

USD/JPY continues to add to last week’s gains after finding support at the lower end of the zone at 134.00. However, upside potential is massively limited at 138.20 – a level that has evaded USD/JPY bulls twice before. In fact, both attempts failed to reach the level and turned some distance below.

A short history of bank distress in 2023 reveals the safe-haven characteristics of the yen remains strong. In March when the SVB saga unfolded, USD/JPY plummeted and again, earlier this month, there was another spate of concern as JP Morgan absorbed First Republic Bank with PacWest and Western Alliance the next distressed lenders on the chopping block it would appear. With the US regional banking sector experiencing a continued loss of confidence, coupled with the looming debt ceiling deadline, risk aversion could come back into play over the next three weeks. In that event, levels to the downside include 134 and 131.35.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

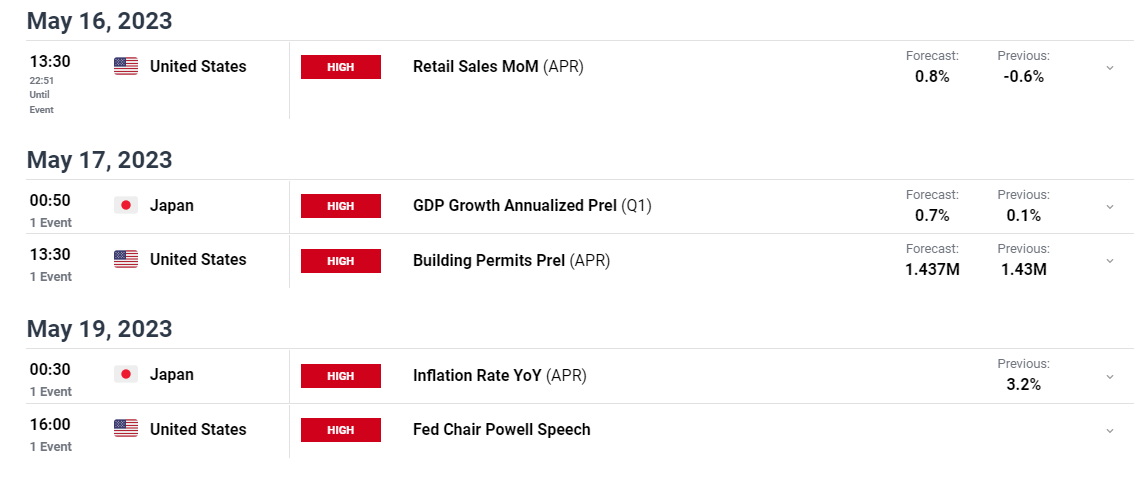

Scheduled Risk Events this Week

Dominating risk events this week is likely to be the current impasse between Republicans and Democrats over the US debt ceiling. 1 June has been identified as the day the US government would have to prioritise its spending to avoid a default. Previously, collaboration has tended to pick up during the two weeks prior to the deadline and so markets will be eagerly awaiting tomorrow’s discussions.

Apart from that, Japanese GDP for Q1 is due on Wednesday, with inflation data to follow on the Friday – the same day Jerome Powell is due to speak at a Fed hosted event titled ‘Perspectives on Monetary Policy’

Customize and filter live economic data via our DailyFX economic calendar

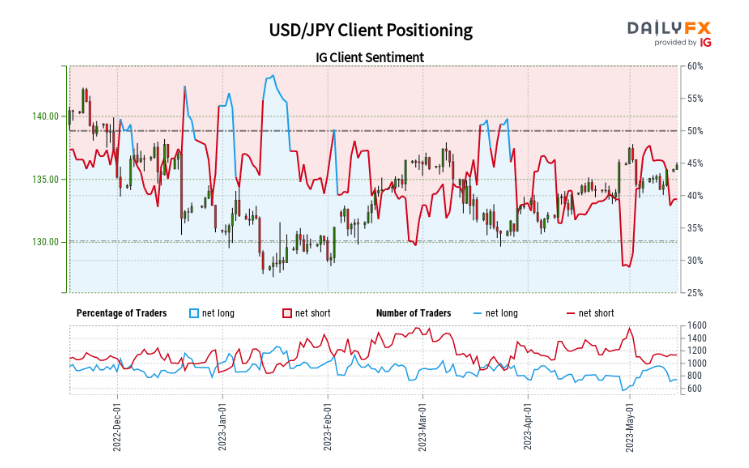

IG Client Sentiment Hints at Continued Bullish Move

USD/JPY:Retail trader data shows 38.69% of traders are net-long with the ratio of traders short to long at 1.58 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

The number of traders net-long is 4.59% higher than yesterday and 21.63% lower from last week, while the number of traders net-short is 10.31% higher than yesterday and 17.82% higher from last week.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link