[ad_1]

USD/JPY Analysis

- The Japanese Finance Minister Suzuki seeks to be ‘fully prepared’ regarding FX moves

- USD/JPY continues into the danger zone, approaching 155.00

- Get your hands on the Japanese Yen Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free JPY Forecast

Japanese Finance Minister Suzuki Seeks to be ‘Fully Prepared’ Regarding FX Moves

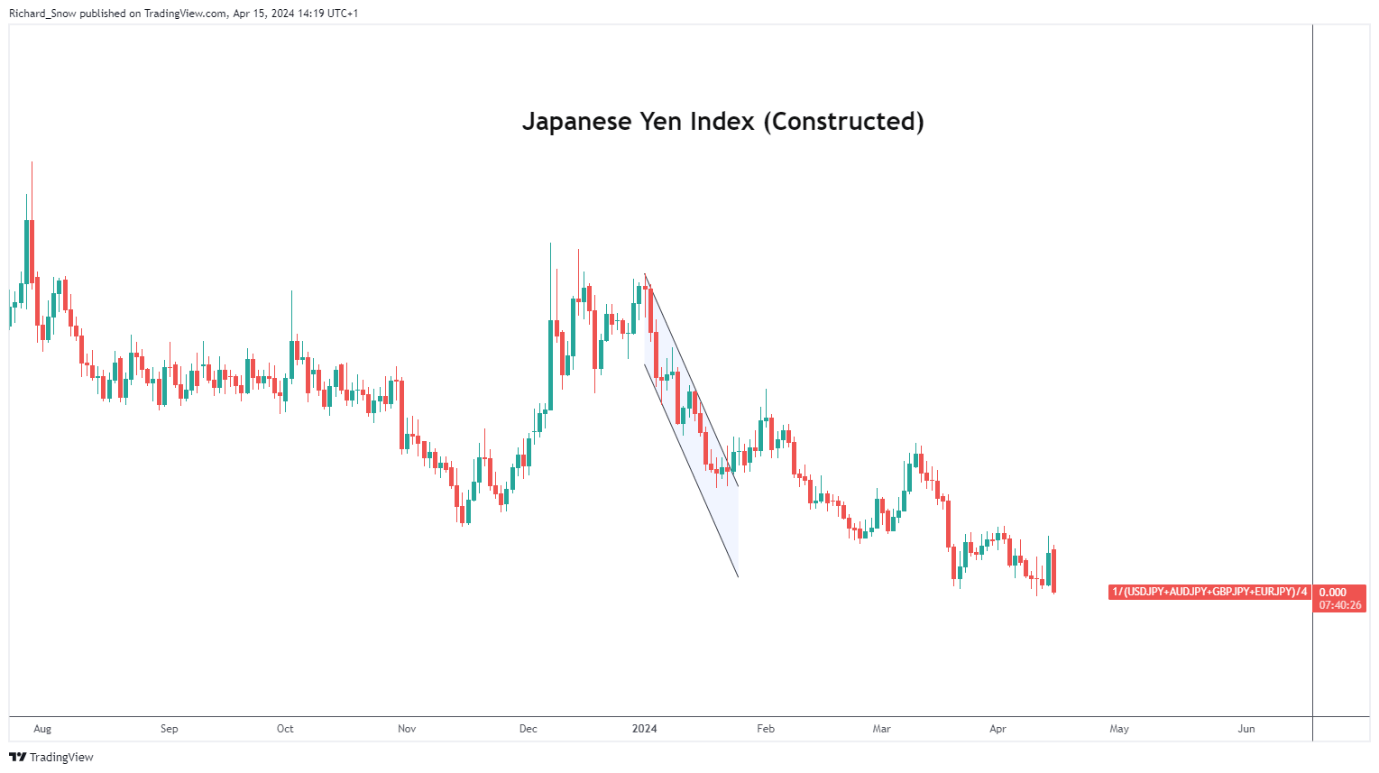

A simple, equal weighted index measuring the performance of the Japanese yen revealed a broad decline in the currency versus a basket of major currencies. The yen got the week off to a bad start, eliciting a response form the Japanese Finance Minister Suzuki. Mr Suzuki mentioned, “I want to be fully prepared” regarding forex moves and is closely monitoring forex moves.

Previously, Japan’s former currency official Watanabe mentioned that authorities are more likely to consider FX intervention at a level of 155.00 on USD/JPY. Officials have mentioned many times that they are not targeting specific levels but instead monitor undesirable, volatile moves (depreciation).

Japanese Yen Index (Equal Weighting of GBP/JPY, USD/JPY, EUR/JPY and AUD/JPY))

Source: TradingView, prepared by Richard Snow

USD/JPY Continues into the Danger Zone, Approaching Crucial 155.00 Level

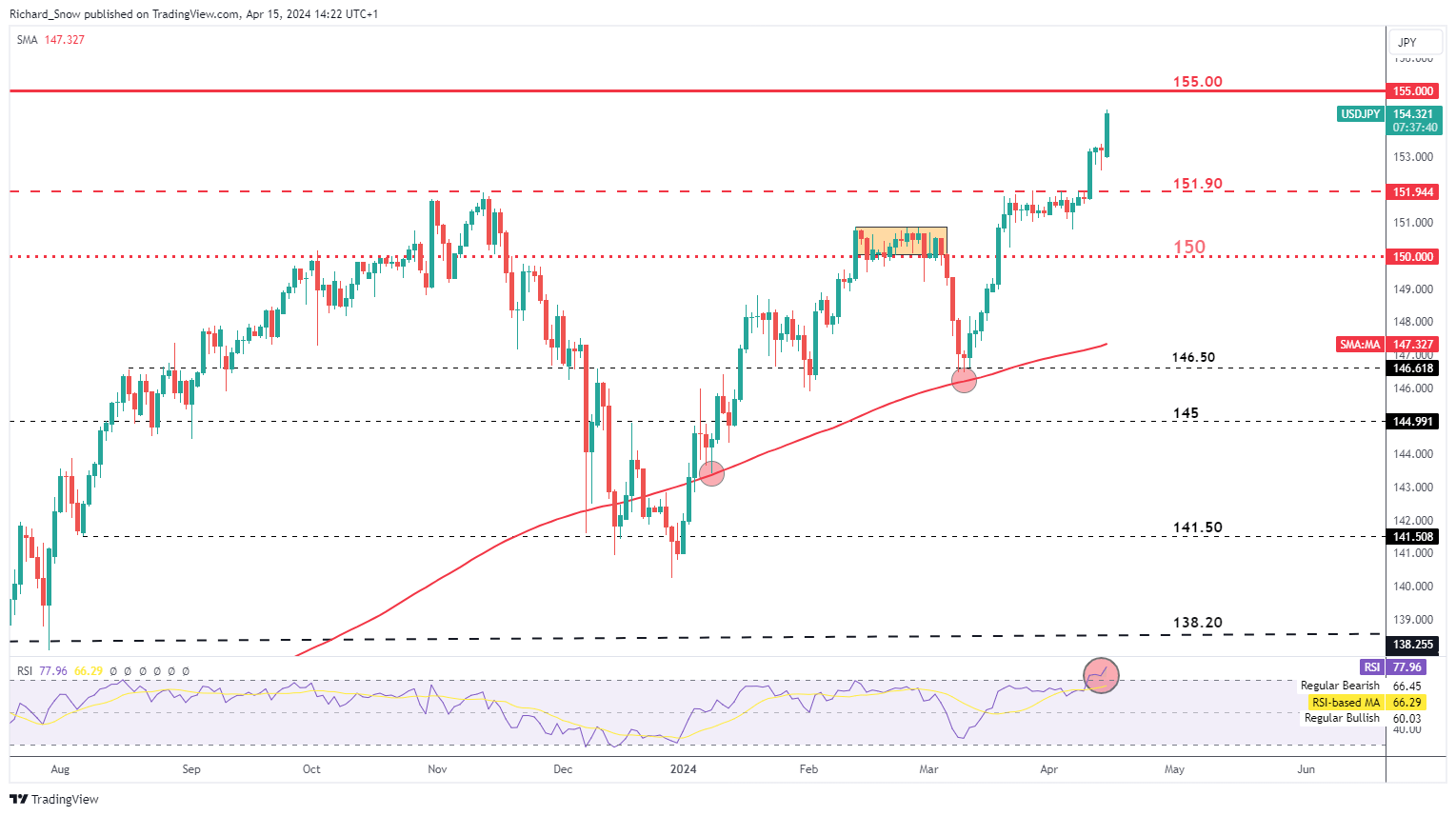

USD/JPY accelerated closer to the 155.00 level at the start of the week as the dollar remains at elevated levels. 152.00 was initially the line that the market dared not cross but the high-flying greenback pushed the boundary until markets felt comfortable above the 152.00.

Traders appear to have become emboldened by the lack of urgency in communication out of Tokyo and continue to bid the pair higher still. The RSI reveals that the pair trades well within overbought territory and shows few to no signs of moderating.

Long trades from here present an unfavourable risk-to-reward ratio, considering the warning issued by the former currency official Watanabe about 155.00 potentially being the tripwire for a major response (FX intervention). 155.00 appears as stern resistance with 152.00 and 150 representing levels that could come into plat at a moment’s notice if Tokyo feels it is necessary to take action. Thereafter, 146.50 comes into view.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | 21% | 2% | 5% |

| Weekly | 8% | -9% | -6% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link