[ad_1]

Most Read: Gold Price Outlook – Fundamentals & Technicals at Odds, What Now for XAU/USD?

The yen posted small losses against the U.S. dollar on Friday, after a positive performance in the previous session, weighed down by comments by Bank of Japan’s Governor Kazuo Ueda indicating that inflation in the country is ebbing rapidly, and that the sustainability of the price goal is not yet in sight.

Ueda’s dovish remarks indicate that policymakers remain hesitant to pull the trigger and finally abandon negative borrowing costs, diminishing the likelihood of a surprise rate hike at the BoJ’s March meeting—an outcome that certain traders on Wall Street had been speculating on.

Looking ahead, for the Japanese currency to mount a lasting recovery, we’d need to see yield differentials to start favoring the yen. This is unlikely to happen meaningfully before the BoJ ends its sub-zero rate policy. Recent signals from the central bank hint that this shift could happen in April.

For an extensive analysis of the Japanese yen’s medium-term prospects, download our complimentary quarterly forecast now!

Recommended by Diego Colman

Get Your Free JPY Forecast

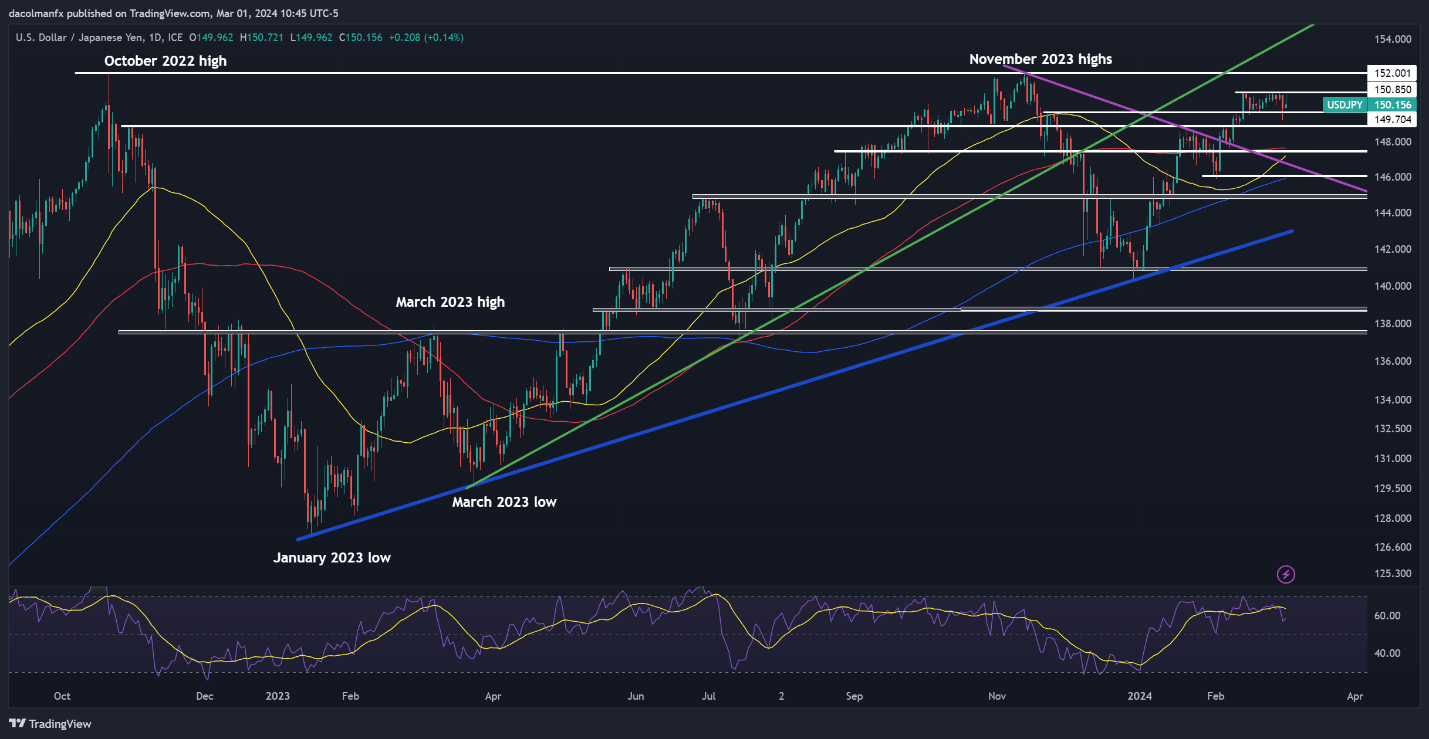

From a technical standpoint, USD/JPY took a turn to the upside heading into the weekend, bouncing off support at 149.70. If gains accelerate in the coming days, resistance emerges at 150.85. On further strength and clearance of this region, attention will fall squarely on the 152.00 handle.

On the flip side, if bears return and push prices decisively below 149.70, selling impetus could gather traction, paving the way for a possible retracement towards 148.90. Subsequent losses beyond this key floor could precipitate a descent towards 147.50, marginally above the 100-day SMA.

Keen to understand how FX retail positioning can provide hints about the short-term direction of USD/JPY? Our sentiment guide holds valuable insights on this topic. Request your free copy now!

| Change in | Longs | Shorts | OI |

| Daily | -12% | 8% | 3% |

| Weekly | -24% | 8% | 0% |

USD/JPY FORECAST – TECHNICAL CHART

[ad_2]

Source link