[ad_1]

GBP/USD, EUR/USD Prices, Charts, and Analysis

- Latest Uni of Michigan data will have pleased the Fed.

- Fed pushback against excessive rate cut expectations is only partially working.

Download our complimentary Q1 US Dollar Technical and Fundamental Forecast

Recommended by Nick Cawley

Get Your Free USD Forecast

The US dollar is drifting lower in early European trade as the FOMC blackout period kicks in. Federal Reserve staff are not allowed to speak publicly between a week before the Saturday preceding a FOMC meeting and the Thursday following the meeting. Federal Reserve members have been very vocal in the last two weeks, pushing back against what they deem as excessive rate cut expectations. This pushback has worked to some extent, with market forecasts for 2024 rate cuts trimmed by around 30 basis points to a current reading of 133 basis points. These new expectations however have not fed into the US equity space with the S&P, Dow Jones and Nasdaq 100 all posting fresh all-time highs.

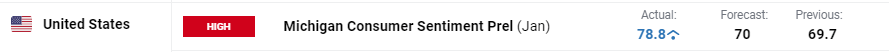

Last Friday’s University of Michigan surprised to the upside with the January consumer sentiment release hitting highs last seen in July 2021.

According to the Uni of Mich report, ‘Consumer sentiment soared 13% in January to reach its highest level since July 2021, showing that the sharp increase in December was no fluke. Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations. Over the last two months, sentiment has climbed a cumulative 29%, the largest two-month increase since 1991 as a recession ended. For the second straight month, all five index components rose, with a 27% surge in the short-run outlook for business conditions and a 14% gain in current personal finances.’

University of Michigan Survey of Consumers

At the end of the week we have the latest Core PCE report, the Fed’s preferred inflation indicator. US price pressures are seen moving lower and back towards the central bank’s 2% target.

For all market-moving events and data releases, see the real-time DailyFX Calendar

Learn how to trade the news with our free guides

Recommended by Nick Cawley

Introduction to Forex News Trading

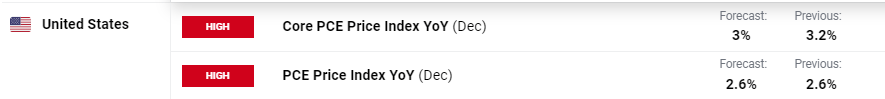

Cable is currently trading on either side of 1.2700 with very little to focus on today. Support at 1.2667 is followed by 1.2643 (50-day simple moving average) and 1.2628 (38.2% Fibonacci retracement). A move higher will find resistance at 1.2742 before a cluster of recent highs, and 23.6% Fib retracement, all the back to 1.2828.

GBP/USD Daily Chart

Chart Using TradingView

IG retail trader data show 43.90% of traders are net-long with the ratio of traders short to long at 1.28 to 1.The number of traders net-long is 3.12% lower than yesterday and 2.66% higher than last week, while the number of traders net-short is 6.12% higher than yesterday and 0.65% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

To See What This Means for GBP/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | 7% | 9% | 8% |

| Weekly | -2% | 4% | 1% |

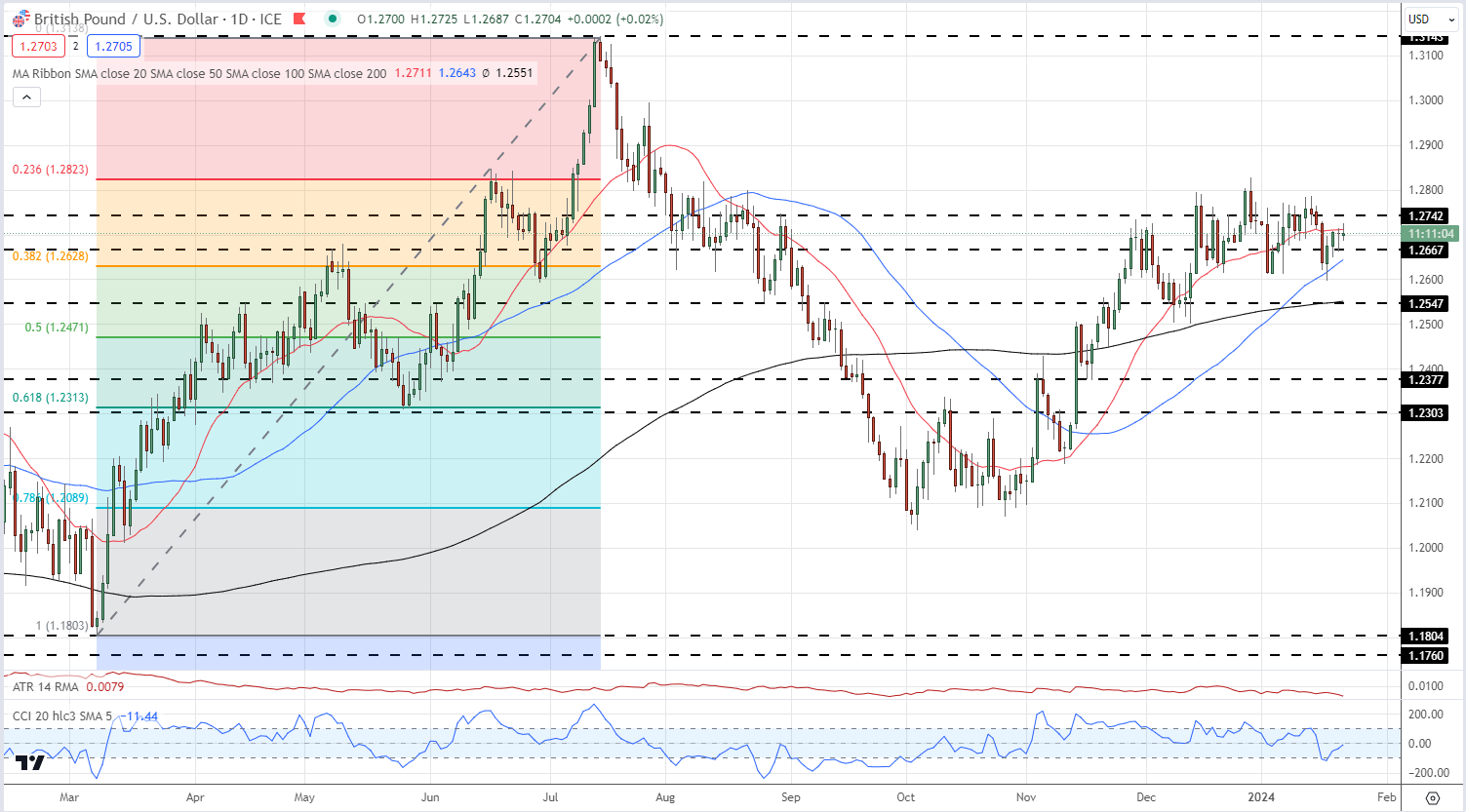

The highlight of the central bank calendar this week is the ECB’s monetary policy decision and press conference on Thursday. Policy settings are likely to be left unchanged but it is President Lagarde’s language that will need to be followed closely. Any talk of a rate cut timetable may send the single currency spinning lower.

EUR/USD Daily Chart

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link