[ad_1]

RAND TALKING POINTS & ANALYSIS

- Geopolitics, Fed and Chinese factors at play.

- USD/ZAR rising wedge breakout now limited by support zone.

USD/ZAR FUNDAMENTAL BACKDROP

Macro-economic fundamentals underpin almost all markets in the global economy via growth, inflation and employment – Get you FREE guide now!

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

The South African rand has been largely influenced by global external factors of recent including Federal Reserve interest rate expectations for the FOMC announcement later this week. With almost 100% certainty of a rate pause, other variables such as the war in the Middle East has negatively impacted the rand as investors seek out the safety of the US dollar. That being said, with the conflict being contained within the region, contagion fears are being quelled thus allowing for a rand pullback.

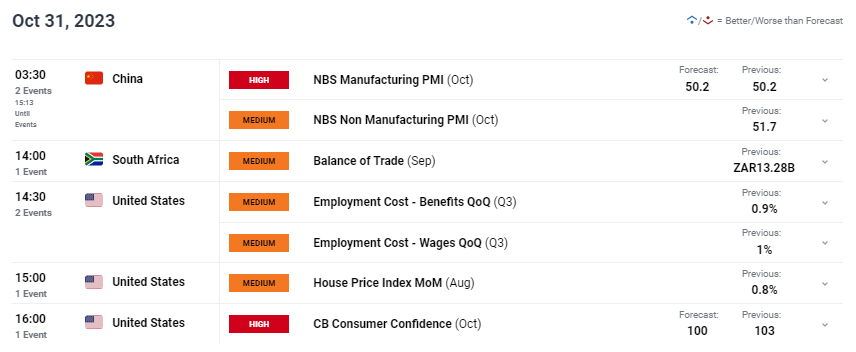

Monday’s trading session has seen the dollar on the backfoot that has led to many dollar priced commodities to rally – many of which are South African linked exports. Without any important economic releases today, our focus will shift to tomorrow’s data (see economic calendar below). The China PMI print will likely be the most influential statistic for the pair due to the close trade relationship between the two nations. After moving back into expansionary territory on the September read, markets will be closely monitoring any major changes to see whether or not the Chinese economy is improving or not. South African balance of trade and US CB consumer confidence will follow keeping the pair relatively volatile throughout the day.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

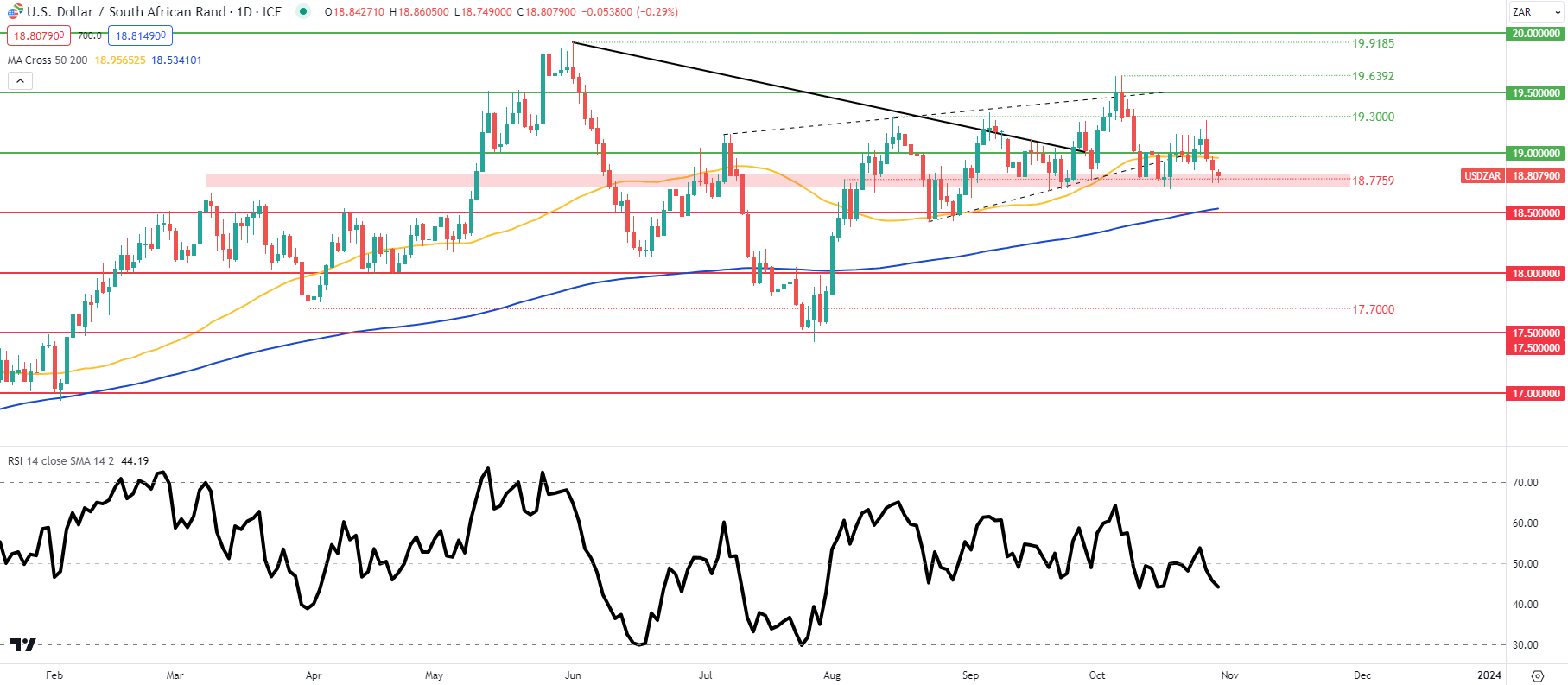

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

Last week’s weekly confirmation candle close below the rising wedge support zone (dashed black line) now keeps the pair around key support (red). This support zone has proven to be significant since March this year and a break below may expose the 200-day moving average (blue) and 18.5000 psychological handle respectively. Supplementing this downside bias is the Relative Strength Index (RSI) that has edged back below the 50 level, indicative of bearish momentum.

Resistance levels:

- 19.5000

- 19.3000

- 19.0000/50-day MA

Support levels:

- 18.7759

- 18.5000/200-day MA

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Source link