[ad_1]

While some of Wall Street’s top firms are maintaining their bullish year-end price targets for the S&P 500, one research firm has already reassessed its 2023 outlook for the large-cap benchmark as rising Treasury yields continue to weigh on risky assets.

Seaport Research Partners on Monday lowered their S&P 500 index

SPX

target for the end of this year to 4,500 from 4,650, citing increasing volatility in financial markets that signals growing liquidity concerns.

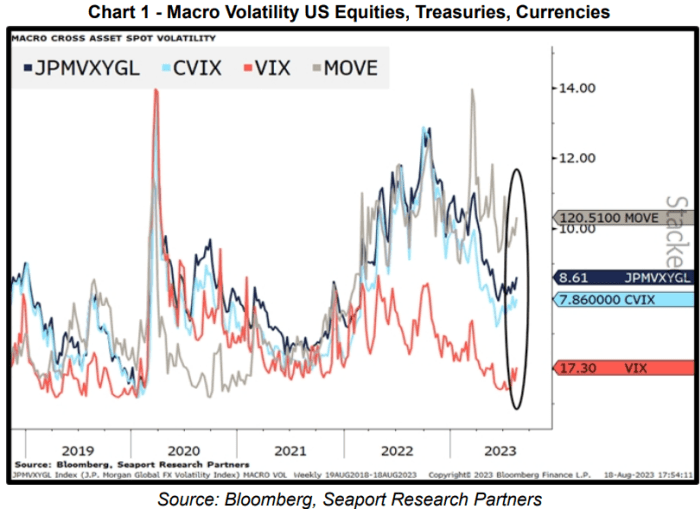

“The MOVE Index of the U.S. Treasury Volatility and the DXY Index of relative Dollar crosses are both rising which signals a risk-off backdrop to us as liquidity tightens,” said Victor Cossel, macro strategist at Seaport Research Partners.

The ICE BofA MOVE Index, which tracks fixed-income volatility, rose to a reading of 130.69 on Monday, the highest level since July 10, according to FactSet data. The ICE U.S. Dollar Index

DXY,

which tracks the greenback’s performance against a basket of rivals, jumped 0.3% to 103.57 on Tuesday afternoon. It was one of the index’s highest closes since June 12, according to FactSet data.

Meanwhile, the CBOE Volatility Index, or VIX

VX00,

remains “subdued” relative to the uptick in bond and currency volatility measures, but Cossel and his team expect it to “catch up” with its global macro volatility peers (see chart below). They envision the current tactical pullback for the S&P 500 to extend further toward the 4,200 level in the near term.

The S&P 500 finished 0.3% lower, at 4,387 on Tuesday afternoon. The large-cap index is also on course for its biggest monthly drop of 2023, according to FactSet data.

SOURCE: BLOOMBERG, SEAPORT RESEARCH PARTNERS

See: U.S. stocks may bounce this week, but summer selloff is only halfway done, analysts warn

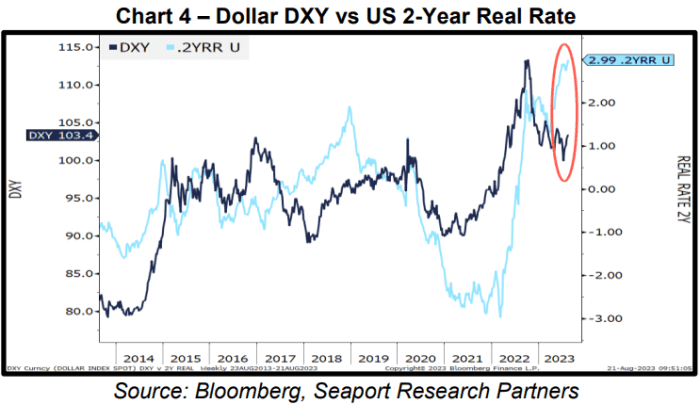

“Declining inflation break evens and rising yields suggest sovereign fiscal concerns to us as real interest rates break out higher,” said Cossel. “Further real rate tightening risks a continued equity hiccup.”

Read: Rise in Treasury yields is almost entirely due to one factor, strategist says

U.S. Treasury yields retreated on Tuesday, but still hovered near multiyear highs. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was at 4.327% on Tuesday after closing at its highest level since November 2007 a day before, according to Dow Jones Market Data. The yield on the 30-year Treasury

BX:TMUBMUSD30Y

slipped 4.5 basis points to 4.410% on Tuesday after settling at its highest level since 2011 in the previous session.

Meanwhile, real interest rates — based on the yield on 10-year Treasury inflation-protected securities, or TIPS — were trading at around 2%, the highest level since 2009, according to data from Board of Governors of the Federal Reserve System.

Real rates are a measure of yields minus expected inflation.

“Real interest rates breaking out is our main concern because the dollar remains decoupled from rising real rates. A strengthening dollar would undermine the risk asset and liquidity tailwind that underpinned our prior more constructive 1H bias,” he said.

SOURCE: BLOOMBERG, SEAPORT RESEARCH PARTNERS

See: Rise in Treasury yields is almost entirely due to one factor, strategist says

However, Cossel still thinks markets will “force the issue” for the Federal Reserve to “blink in a dovish manner” to ensure financial stability, likely some time in the second half of 2023. “Such policy intervention later this year may support risk assets which ultimately resolve higher from current levels by year-end, leaving us neutral, not bearish on equities,” he added.

U.S. stocks ended mostly lower on Tuesday with the Dow Jones Industrial Average

DJIA

down 174 points, or 0.5%, to 34,288, while the Nasdaq Composite

COMP

gained less than 0.1%

[ad_2]

Source link