[ad_1]

The broad U.S. stock indexes are weighted by market capitalization, which can work out well during a bull market, as success is rewarded and index-fund investors have growing allocations to the large-cap stocks that have risen the most. But it can also concentrate a high percentage of your money into a handful of companies.

There are different ways to mitigate this risk. One is to broaden your exposure by adding index funds to your portfolio that aren’t weighted strictly by market capitalization. This can be done with an equal-weighted index fund, and Barry Bannister, an investment strategist at Stifel, expects this approach to outperform the S&P 500 over the next several months.

Another index fund that can broaden your horizons is the Invesco S&P 500 GARP exchange-traded fund

SPGP.

Nick Kalivas, Invesco’s head of factor and core equity product strategy, described the fund’s methodology and discussed its recent performance. GARP stands for “growth at a reasonable price.”

You might be happy with a low-cost fund that tracks the S&P 500

SPX.

After all, the average annual total return for the $408 billion SPDR S&P 500 ETF Trust

SPY

has been 12.5% over the past 10 years through Monday, according to FactSet. For the entire 10-year period, SPY’s return has been 225%. (All returns in this article assume dividends are reinvested and are after expenses.)

But SPY is now 23.9% weighted to five companies: Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

and two common-share classes of Alphabet Inc.

GOOGL,

GOOG,

Apple alone makes up 7.2% of the SPY portfolio.

Another popular index fund, the $198 billion Invesco QQQ Trust

QQQ,

tracks the Nasdaq-100 Index, which had gotten so concentrated that its largest five components made up more than 45% of the total before the index underwent a special rebalancing last month. Even now, the top five holdings of QQQ — Apple, Microsoft, Amazon, Nvidia and Meta Platforms Inc.

META,

— make up 34.1% of the portfolio, with Apple alone at 11.2%.

Long-term investors who have been thrilled with the performance of SPY and QQQ over the years might also worry about a 2022-like scenario, when SPY fell 18.2%, led by the S&P 500 information-technology sector, and QQQ dropped 32.6%.

If you have been pouring money into these or similar cap-weighted index funds through regular investments, you might not want to make radical moves from your index funds. Maybe you could move some money into funds with broader exposure, or perhaps you might direct new investments into other funds.

Getting back to the S&P 500 GARP ETF

SPGP,

this fund changed its strategy to its current one in June 2019. The fund’s portfolio is reconstituted and rebalanced twice a year, on the third Fridays of June and December. Here’s how it has performed over the past three years:

FactSet

Keep in mind that this is only a three-year performance snapshot and that a longer history wouldn’t really be valid, because SPGP’s strategy changed in June 2019. Its outperformance against SPY and QQQ reflects its better performance during the bear market of 2022. So far this year, SPGP has returned 13%, trailing returns of 38% for QQQ and 17% for SPY. This in part reflects QQQ’s very heavy concentration to the largest tech-oriented companies.

In an interview, Kalivas said SPGP’s underperformance relative to SPY so far this year has resulted in part from “some of its exposure to financial stocks during the SVB and Signature Bank dislocation.” Silicon Valley Bank of San Francisco and Signature Bank of New York both failed in March.

The returns are after expenses, which are 0.33% of assets under management annually for SPGP, 0.095% for SPY and 0.2% for QQQ. SPGP is ranked five stars (the highest ranking) by Morningstar within the investment information firm’s U.S. Fund Large Blend category, while SPY is ranked four stars in the same category. QQQ has a five-star rating within Morningstar’s U.S. Fund Large Growth category.

SPGP tracks the S&P 500 GARP Index, which is maintained by S&P Dow Jones Indices. The stock-selection methodology begins with the full S&P 500. Companies are ranked by growth scores based on increases in earnings per share and sales over the trailing 12 reported quarters. After narrowing the list to 150 companies scoring highest for growth, S&P Dow Jones Indices does further screens based on the companies’ returns on equity and ratios of debt to equity and price to earnings.

After a quality score is assigned to each of the 150 companies, the list is pared to the 75 with the highest quality scores. These are then weighted by the growth score for the portfolio. The weighting is limited so that the individual company weightings will range from 0.05% to 5% and that no sector will have more than a 40% weighting.

Here are the top 10 holdings of SPGP:

| Company | Ticker | Industry | % of the Invesco S&P 500 GARP ETF | Forward P/E |

| Diamondback Energy Inc. |

FANG, |

Oil and Gas Production | 2.2% | 7.9 |

| Marathon Petroleum Corp. |

MPC, |

Oil Refining/ Marketing | 2.2% | 8.4 |

| CF Industries Holdings Inc. |

CF, |

Chemicals | 2.2% | 10.6 |

| Nucor Corp. |

NUE, |

Steel | 2.0% | 11.7 |

| Mosaic Co. |

MOS, |

Chemicals | 2.0% | 10.7 |

| Steel Dynamics Inc. |

STLD, |

Steel | 1.9% | 9.2 |

| Coterra Energy Inc. |

CTRA, |

Integrated Oil | 1.9% | 10.8 |

| Moderna Inc. |

MRNA, |

Biotechnology | 1.9% | #N/A |

| APA Corp. |

APA, |

Integrated Oil | 1.8% | 7.8 |

| EQT Corp. |

EQT, |

Oil and Gas Production | 1.7% | 11.3 |

| Sources: Invesco, FactSet | ||||

Click on the tickers for more about each company, including business profiles, financials and estimates.

At first glance, we are looking at a concentration to energy and materials. This may be surprising, with those sectors underperforming the broad market this year. But Kalivas said the allocation reflected the scoring of the companies by growth and quality.

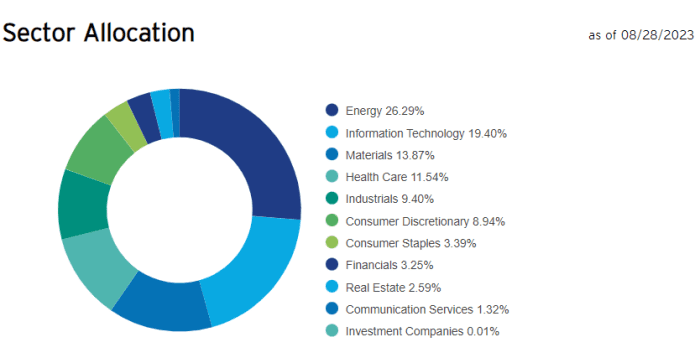

Here is the fund’s current sector allocation:

Invesco

The portfolio is “quite dynamic,” Kalivas said. S&P Dow Jones Indices tested the methodology for the S&P 500 GARP Index going back to the 1990s and found that energy-sector exposure would have ranged from zero to 33%. The allocation “moved around very much, depending on where the growth is,” he said.

Even though SPGP’s methodology is based on growth, the approach also brings value to the fore. The forward price-to-earnings ratios of the listed companies are based on current stock prices and consensus earnings estimates for the next 12 months among analysts polled by FactSet. The ratios are low when compared with the weighted forward P/E of 21.7 for the S&P 500. There is no forward P/E for Moderna Inc.

MRNA,

because the consensus among analysts is for the company to book negative earnings for three of its next four quarters.

Kalivas said SPGP would be ideal for investors “who are worried about paying too much.”

Don’t miss: Meta, Alphabet and 10 under-the-radar media stocks expected to soar

[ad_2]

Source link