[ad_1]

Inflation is on everyone’s mind, and consumers are frustrated not only with price increases but with “shrinkflation” — when a familiar product suddenly comes in a much smaller package.

Obvious remedies include switching to lower-price or private label products and even doing without certain items. But one company that makes premium products seems to be powering through with a focus on quality. As part of a broad look at inflation for consumer products, Tonya Garcia explains Procter & Gamble’s strategy, which has translated to excellent performance for its stock over the past year.

More inflation coverage:

- There’s a big hole in the Fed’s theory of inflation — incomes are falling at a record 10.9% rate

- How can retirees hedge inflation risk?

A weekend of Buffett and a good 2022 for Berkshire Hathaway

MarketWatch photo illustration/Everett Collection, iStockphoto

So far this year, shares of Berkshire Hathaway

BRK.B,

have risen 11%, while the S&P 500 has declined 10%, with dividends reinvested. CEO Warren Buffet will lead the conglomerate’s annual meeting on Saturday. These are some questions to expect.

Here’s more to consider:

How about some bitcoin in your 401(k)?

The Bitcoin 2022 Conference in Miami.

Marco Bello/Getty Images

Fidelity Investments will soon allow companies with 401(k) plans to offer employees the option of holding bitcoin

BTCUSD,

within their retirement accounts. Alessandra Malito considers which investors might be well-served having some of their retirement savings in the virtual currency, while Brett Arends argues against it.

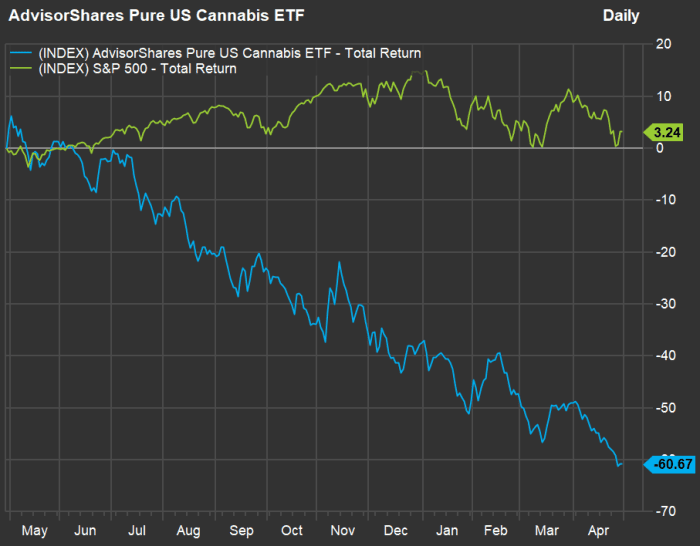

Lessons learned from the crash of marijuana stocks

FactSet

While the S&P 500 returned 3.2% over one year through April 28 with dividends reinvested, the AdvisorShares Pure US Cannabis ETF

MSOS,

plunged 61%.

Michael Brush shares a new set of seven investment rules that apply to everyone, even though they have been learned from the the marijuana stock debacle.

More beaten-down companies: Many tech stocks that have crashed are still too expensive to buy

A big retirement move that went wrong

At the ocean in Westerly, R.I.

Lisa Watts

If you are planning a retirement move, there may be some important elements you haven’t thought of. Lisa Watts tells the story of how she and her husband made a retirement move, regretted it, tried another spot and finally got it right with yet another move.

- See the “Where Should I Retire?” column for more ideas for locations, and you can try your own custom search

- Try MarketWatch’s retirement location tool for your own custom search. It includes data for more than 3,000 U.S. counties and incorporates climate risk.

The housing market is already slowing down

iStockphoto

When factoring-in home price increases and rising interest rates, the monthly mortgage loan payment for an average-priced house in the U.S. has increased 50% over the past year, Jacob Passy reports.

But there are early signs that the Federal Reserve’s moves to slow an overheated economy are having an effect — pending home sales have fallen.

More housing coverage:

- ‘It will take time for surging mortgage rates to rebalance the market’: Home prices continue to skyrocket, but buyers could see relief soon

- ‘Should we wait to see how the market plays out?’ I want to purchase a rental home. Is this a good time?

Betting against Cathie Wood

MarketWatch illustration/iStockphoto

In this week’s ETF Wrap, Christine Idzelis looks into short-sellers’ profitable trades against Cathie Wood’s Ark Innovation ETF

ARKK,

More thoughts about Elon Musk and Twitter

Tesla and SpaceX CEO Elon Musk.

Getty Images

On April 25, Twitter’s

TWTR,

board of directors agreed for the social media company to be acquired by Tesla

TSLA,

CEO Elon Musk for $44 billion in cash subject to a shareholder vote. Early on April 29, shares of Twitter were changing hands for $49.88 — 8% below the $54.20 take-out price.

Here’s a sampling of the latest related coverage:

I-bonds have high yields and maybe

Getty Images/iStockphoto

Series I savings bonds are available directly from the U.S. Treasury They are now yielding 7.12%, but are expected to have their yields raised to above 9% in May, based on the inflation rate. The rates are reset every six months in May and November.

John Lim explains five ways you can use I-bonds right now to improve your overall financial health.

Another possible way to treat the coronavirus

Getty Images/iStockphoto

Jaimy Lee looks into the use of generic drugs to help people with Covid-19 stay out of hospitals.

The unfolding solar utility market

A rendering of a possible energy storage system.

Getty Images/iStockphoto

Here’s a deep look into the development of combined solar power plants and energy storage facilities by three people at Lawrence Berkeley National Laboratory in Berkeley, Calif.

Steinway and other IPOs

Lang Lang plays on the Steinway Spirio high resolution player piano in Paris.

Getty Images

Ciara Linnane shares five things investors need to know about Steinway as the piano maker prepares to go public again.

More coverage of initial public offerings and their aftermaths:

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.

[ad_2]

Source link