[ad_1]

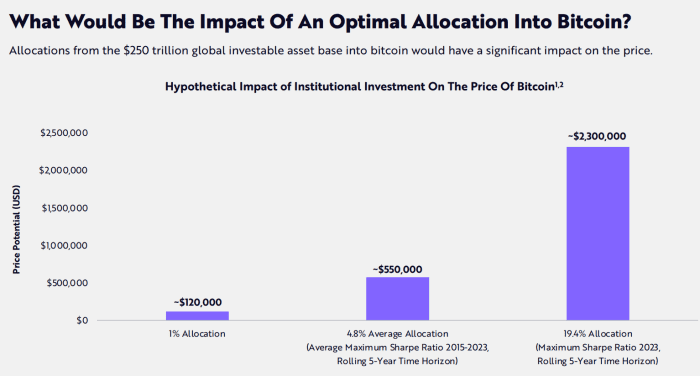

Cathie Wood’s ARK Investment Management estimates bitcoin prices could skyrocket to $2.3 million on the back of an “optimal allocation” to the crypto currency from a massive global investable asset base.

ARK made that estimate in its latest annual research report on “big ideas,” which pegged the global investable asset base at $250 trillion. A 19.4% allocation to bitcoin would correspond to bitcoin prices at around $2.3 million, a chart in the report shows.

ARK INVESTMENT MANAGEMENT’S BIG IDEAS 2024 REPORT

ARK, founded by its chief investment officer Wood, is among several firms that recently launched spot bitcoin ETFs approved by the U.S. Securities and Exchange Commission in January.

Shares of the ARK 21Shares Bitcoin ETF

ARKB,

which has $665 million of assets under management, were rising 0.8% on Friday morning, according to FactSet data, at last check.

Bitcoin prices are volatile, raising worries over what even a small exposure to the cryptocurrency could do to investors’ portfolios should prices crash. Prices of bitcoin

BTCUSD,

were trading at around $43,177 on Friday morning, FactSet data show, at last check.

[ad_2]

Source link