[ad_1]

The housing market is nothing if not unpredictable.

Mortgage rates have skyrocketed, and the housing market has taken a beating. But don’t expect 2023 to turn into a buyers market just yet, according to housing experts.

Will 2023 will be a good year for a prospective buyer? It depends on your location, your income, and whether you’re a buyer or seller, Odeta Kushi, deputy chief economist at First American, told MarketWatch.

Others are less diplomatic. “2023 will shape up to be a nobody’s market. Neither sellers nor buyers will see any significant headway,” George Ratiu, manager of economic research at Realtor.com, told MarketWatch.

“For sellers, the reality is that the prices that they were hoping to get based on the last few years are simply no longer there,” he explained. “For buyers, prices have shot up so high in the last two years that even a 10% to 20% discount is not going to get them a bargain.”

Here’s how experts see the housing market play out in 2023:

Good news: More homes for sale

The experts mostly agree that inventory — or the number of homes available for sale — will increase in 2023.

“We will have more inventory than in the last two years,” Ratiu said. But homes for sale are staying on the market longer, he added.

Redfin’s

RDFN,

deputy chief economist, Taylor Marr, said that the typical home has been sitting on the market for about two months now. “There are a lot of homes out there just waiting for a buyer,” he added.

Builders are also putting new homes on the market, and are pulling out all the stops to boost sales.

In some markets out West, expect “much more inventory than before the pandemic,” Jeff Tucker, senior economist at Zillow

Z,

told MarketWatch.

“Markets like Phoenix and Las Vegas, which saw a boom in sales during the pandemic, are experiencing a glut of homes.”

Markets like Phoenix and Las Vegas, which saw a boom in sales during the pandemic, are experiencing a glut of homes, Tucker said. “There are a lot of homes on the market, and that does put downward pressure on prices,” he added.

In most of the big markets, inventory is low due to a couple of reasons.

“There is less inventory because homeowners are unwilling to give up their ultra-low mortgage rates,” Lawrence Yun, chief economist and senior vice president of research at the National Realtors Association, told MarketWatch.

“Most people refinanced into an approximately 3% rate in 2020 and 2021,” he added. “Selling and buying a new home means having a 6.5% mortgage rate, so even a trade-down in home size and price will mean a higher monthly mortgage payment.”

Some homeowners also are turning to the rental market instead of dealing with a tough selling environment.

Good news: Less competition, bidding wars

Many homeowners will not so fondly recall the frenzied pandemic days of intense bidding and going over budget just to close a deal on a home.

Given the sharp decline in housing sales, bidding wars may have become a relic of the bygone pandemic era in 2023.

“The buying conditions … will be unambiguously better for buyers in 2023,” Tucker said, “especially in the first half of the year, compared to the first half of 2022.”

““The buying conditions … will be unambiguously better for buyers in 2023, especially in the first half of the year, compared to the first half of 2022.””

Buying conditions include the number of homes to choose from, the competition they encounter for the homes, and being forced to go above list price, “and some other ancillary aspects of that like feeling rushed, because every home gets snapped up in a single weekend,” Tucker explained.

Under pressure, many buyers had waived contingencies like financing or appraisal or inspection, he added. Those pressures would have eased as the market cooled down.

“Because the market has softened so much, all those buying conditions will be a lot more favorable for buyers, especially compared to the frenzied market conditions of the first half of last year,” Tucker said. “So that’s really good news for buyers.”

For instance, according to a Realtor.com survey from the fall, a growing share of sellers said that buyers are asking for repairs to be made following home inspections.

The housing market is “tilting away from the hyper-competitive environment where sellers pretty much called the shots, to one in which buyers have a lot more negotiating power,” Ratiu noted.

Bad news: Mortgage rates will stabilize – but won’t come down that much

Mortgage rates have soared over the last year, but expect them to stabilize and fall slightly, which will be helpful for some buyers.

The rise in rates is the housing story of 2022, as the U.S. Federal Reserve slammed the brakes on an ultra-low rate environment, making mortgages more expensive.

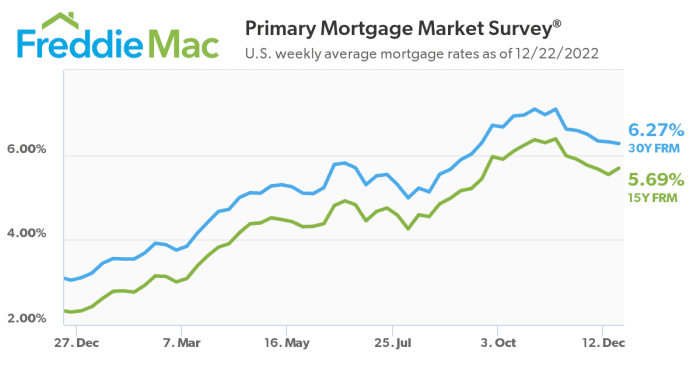

Here’s how rates have surged over the past year, effectively doubling, and even reaching the 7% threshold in November 2022:

Freddie Mac’s survey shows how mortgage rates reached a peak in November.

Data and graphic: Freddie Mac

“Mortgage rates are very tough to forecast. But there is reason to believe that we’ll see mortgage rates start to stabilize next year, as inflation stabilizes a bit,” Kushi said, “so that will help on the kind of affordability and consumer confidence front.”

Kushi said that the consensus forecast is for rates to end 2023 at around 6%.

The Mortgage Bankers Association expects rates to fall to 5.4% by the end of 2023.

“We’ve seen mortgage rates surge tremendously this year, adding roughly between $800 to $1,000 a month extra to the monthly payment simply compared to a year ago,” Ratiu said.

Expect rates to remain elevated, he added, which means if incomes don’t rise as much, then “the cost of financing a home purchase will remain expensive.”

Bad news: Home prices will drop in some markets, but will still be expensive

Given the jump in rates, many renters or prospective buyers are staying on the sidelines, given that finances don’t quite make sense for them to buy. And that’s weighing on home prices.

But don’t expect deep discounts, or a housing crash.

Mark Zandi, chief economist at Moody’s Analytics, told MarketWatch that he expects home prices in the U.S. to fall by as much as 10% peak-to-trough over the next 2 to 3 years. That means that prices will drop, but keep in mind that they’ve also increased by 40% since the pandemic hit.

“I don’t expect U.S. house prices to crash,” Zandi added. “Of course, if the economy suffers a recession, then the house-price declines will be more significant, but even then a crash seems like a stretch.”

Sales of existing homes have plummeted, which has begun to put pressure on home prices. According to the NAR, the median sale price of an existing home has come down from a peak of over $410,000 in June to $370,700 in November.

Ratiu noted that many home sellers have resorted to price cuts to get their home sold: “20% of the homes listed on Realtor.com had price reductions in November,” he said. “So I expect that to be a part of the market in 2023, which is good news.”

“‘20% of the homes listed on Realtor.com had price reductions in November … So I expect that to be a part of the market in 2023, which is good news.’”

Redfin said its stats were more or less the same nationally, but in some markets, price cuts are steeper – such as more than half of homes.

“Not only are buyers able to offer under asking today, but they’re also able to get credits from sellers to put towards their closing costs, and also to pay points to bring their mortgage rates down,” Marr said.

So where is the slowdown is playing out? “The West is facing the strongest house-price deceleration, and price declines from the peak,” Kushi said. “Specifically Zoom

ZM,

markets that saw the biggest growth over the course of the pandemic.”

Zoom markets include Salt Lake City, Boise, and other popular second-tier cities where people moved to work remotely

But while prices aren’t increasing per se, they’re still expensive, particularly given that incomes have not risen as much, even in the midst of high inflation in the U.S.

According to an October report from the Dallas Fed, despite the strong job market, “a majority of workers are finding their wages falling even further behind inflation,” with a median decline of 8.6% in the second quarter of 2022.

Nonetheless, if mortgage rates fall to 6%, and house prices also fall, “even if incomes stay flat, that means affordability will improve relative to today,” Kushi contended. “So there’s a case to be made that affordability will improve by the end of next year.”

Bottom line: Affordability will improve — but it will still be an unbalanced market

Falling mortgage rates and home prices will make homes slightly more affordable in 2023, but not by much. And ultimately, the market isn’t going to be in either the buyer’s or the seller’s court.

“Higher interest rates have sucked the power out from the sellers,” Marr said, “but it’s not necessary that buyers might find it as a big win because of how interest rates are still expected to be. So it’s a bit of a tug of war.”

For 2023, Marr has one piece of advice for all ye prospective home buyers out there.

“Keep an eye out for changes in the market, and that includes what happens with mortgage rates,” Marr said. “If they fell by half a point that could make the difference of your monthly payment being more affordable.”

And also don’t discount homes that have been on the market for longer than usual. There may be some diamonds in the rough.

Realtor.com is operated by News Corp subsidiary Move Inc., and MarketWatch is a unit of Dow Jones, also a subsidiary of News Corp.

Got thoughts on the housing market? Reach out to MarketWatch’s housing reporter Aarthi Swaminathan at aarthi@marketwatch.com

[ad_2]

Source link