[ad_1]

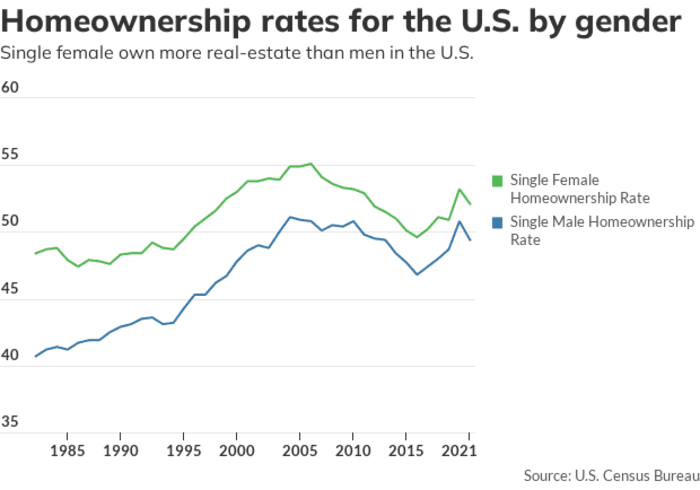

Single women own more homes in America than single men do.

Women have come a long way in real estate in the last few decades. Until the early 1970s, it was legal for banks to refuse a loan to an unmarried woman without a male co-signer.

Two pieces of legislation changed that: In 1968, the Fair Housing Act was passed, and in 1974, the Equal Credit Opportunity Act boosted homeownership among women. In the years since, the number of women who own property in the U.S. has surged, as seen in the chart below.

As of 2023, single women made up 17% of all home buyers, compared with 9% for single men, according to a report released Monday by Bankrate.com. Couples, married or unmarried, accounted for 70% of all home purchases.

A separate report by LendingTree released last month found that single women own about 10.76 million homes, while single men own about 8.12 million. “Put another way, single women own an average of 12.9% of the owner-occupied homes in the 50 states, versus 10.06% among single men,” it said.

Kathy Cummings, a senior vice president at Bank of America

BAC,

told Bankrate that she can recall a time when baby boomers expected to get married before becoming homeowners.

“Now, the trend is reversing,” Cummings said. “The message is reversing. You don’t need a man anymore.”

Homeownership rates by gender, based on Census Bureau data.

Louisiana has the highest share of homes owned by single women, while North Dakota and South Dakota were the only U.S. states where single men owned a greater share of homes than single women, LendingTree said.

According to the Bankrate report, the median age of a single woman buying her first home was 38, compared with 37 for a typical single male home buyer.

Women also spend 2% more than men when they buy a house, but they sell for 2% less.

In 1981, only 11% of homebuyers were single women, according to another survey by the National Association of Realtors. In 2023, that share rose to 17%. The highest share of female buyers was in 2006, the NAR said, at 22%.

The NAR had a few ideas about why women are exceeding men in homeownership rates: Women purchase homes to be close to family and friends and are more likely to report buying a home due to a change in family situation such as divorce, death of a spouse or the birth of a child, among other factors.

[ad_2]

Source link