[ad_1]

Shares of Zillow Group Inc. slumped toward a two-year low Friday, as Wall Street analysts continued to slash their price targets in the wake of the real estate information company’s upbeat first-quarter results but disappointing outlook.

Zillow’s more-active Class C shares

Z,

pared intraday losses as much as 13.4% to be down just 3.2% in afternoon trading, but were still headed for lowest close since April 2020. The Class A shares

ZG,

were down as much as 14.8% before bouncing to be down 3.8%.

The company reported late Thursday big first-quarter profit and sales beats, but provided a second-quarter revenue outlook that was well below analyst projections, citing an “uncertain” housing market outlook.

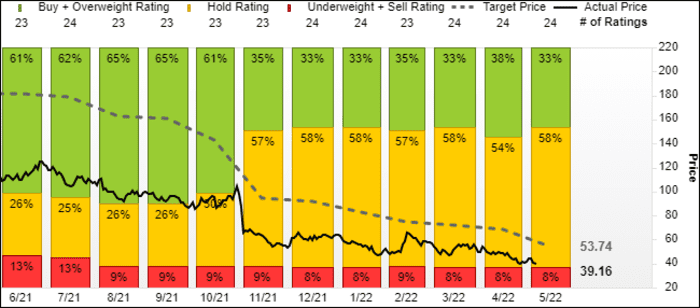

Although none of the 24 analysts surveyed by FactSet lowered their ratings, no less than 13 cut their stock price targets. The average target for the C shares fell to $53.74, down 20.9% from $67.95 at the end of April. That marks the 15th-straight month that the average target has fallen, and now sits 73.6% below the record-high average target of $203.26 in February 2021.

FactSet

Meanwhile, although only one-third of the Street’s analysts are bullish on the stock, the new average target still implied about 40% upside from current price levels.

The Street’s worry is that, whatever the company’s results in the previous three-month period, fast-rising mortgage rates and home prices could tip the housing market into a recession.

Don’t miss: ‘I think we’re in the final innings.’ Pimco’s Kiesel thinks the housing market has hit its top.

Analyst Mark Mahaney at Evercore ISI said despite “bright spots” in Zillow’s results and the company’s optimism about its ability to turn the business around, “macro uncertainty awaits.” He slashed his target on the stock to $47 from $84, while keeping his rating at in line.

“[S]oftening consumer transaction trends amid the turbulent housing market have led us to stay cautious in the near term,” Mahaney wrote in a note to clients. “Valuation is arguably attractive, but we remain on the sidelines until we have greater visibility into newer product initiatives and the return to premium growth.”

Barclays analyst Trevor Young said given the company’s outlook, which he believes may be optimistic in the current market environment, “investors are grappling with a somewhat dour outlook for residential real estate” in the near term.

“This combination won’t sit well with investors in this tape, in our view, and downside risks are renewed,” Young wrote in a research note.

He reiterated his underweight rating on Zillow, to remain on of only two bears on the stock, and cut his target down to $36 from $50.

FactSet, MarketWatch

Benchmark’s Daniel Kurnos slashed his stock price target to $65 from $115, but remained one of the Street’s eight bulls, as his new target still implied more than 70% upside from current levels.

He said that despite handily beating first-quarter expectations and a fresh $1 billion stock repurchase program, investors continue to digest “softening transactional trends,” and a housing market that continues to “painfully melt higher on price as listings dry up and rising rates put affordability out of reach.”

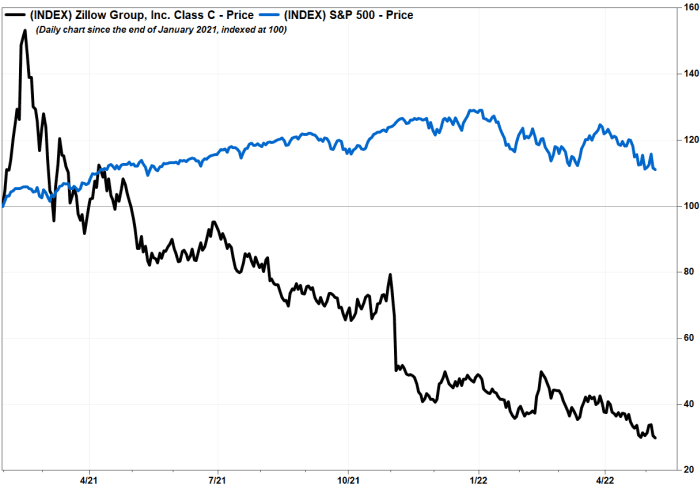

Zillow’s C shares have now plunged 39.7% year to date, and have plummeted 80.7% since the Feb. 16, 2021 record close of $199.90. The S&P 500 index SPX has dropped 13.9% year to date.

[ad_2]

Source link