[ad_1]

AUD/USD, ASX 200 Analysis

Recommended by Richard Snow

Get Your Free AUD Forecast

Australian inflation beat estimates for the final quarter of 2023, coming in at 4.1% vs 4.3% expected and lower than the prior 5.4%

Customize and filter live economic data via our DailyFX economic calendar

AUD/USD Turns Lower Ahead of FOMC Statement This Evening

The Aussie dollar eased against the US and Kiwi dollars as well as the Japanese yen after better-than-expected inflation data provided greater clarity on future rate cuts. The RBA has found dealing with inflation rather tricky, having to reinstitute rate hikes twice as price pressures proved difficult to contain.

Having only stopped hiking the cash rate in November, market expectations were on the cautious side when it came to the magnitude of rate cuts anticipated for 2024 but now there is an expectation of 50 basis points coming off the benchmark interest rate.

The pair trades within an ascending channel which appears a lot like a bear flag when you consider the sharpness of the bearish move before it. Price action attempted to break lower but looks on track to close within the bounds of the channel unless the Fed has something to say about that. In the event the Fed signal a preference not to cut in March, USD could see limited gains, lowering AUD/USD in the process. Alternatively, should markets get the impression that March is more likely, the dollar may come under some pressure, lifting AUD/USD.

Recommended by Richard Snow

How to Trade AUD/USD

AUD/USD trades in the vicinity of a notable confluence of support around the 0.6580 level; which coincides with the 200 simple moving average (SMA) and channel support. A conclusive break below the channel highlights the January swing low at 0.6525 before 0.6460 – the May 2023 swing low. However, the MACD indicator reveals a slowing of bearish momentum, with a bullish crossover in sight. AUD/USD levels to the upside include the channel high of 0.6624 and 0.6680 the pre-pandemic low.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

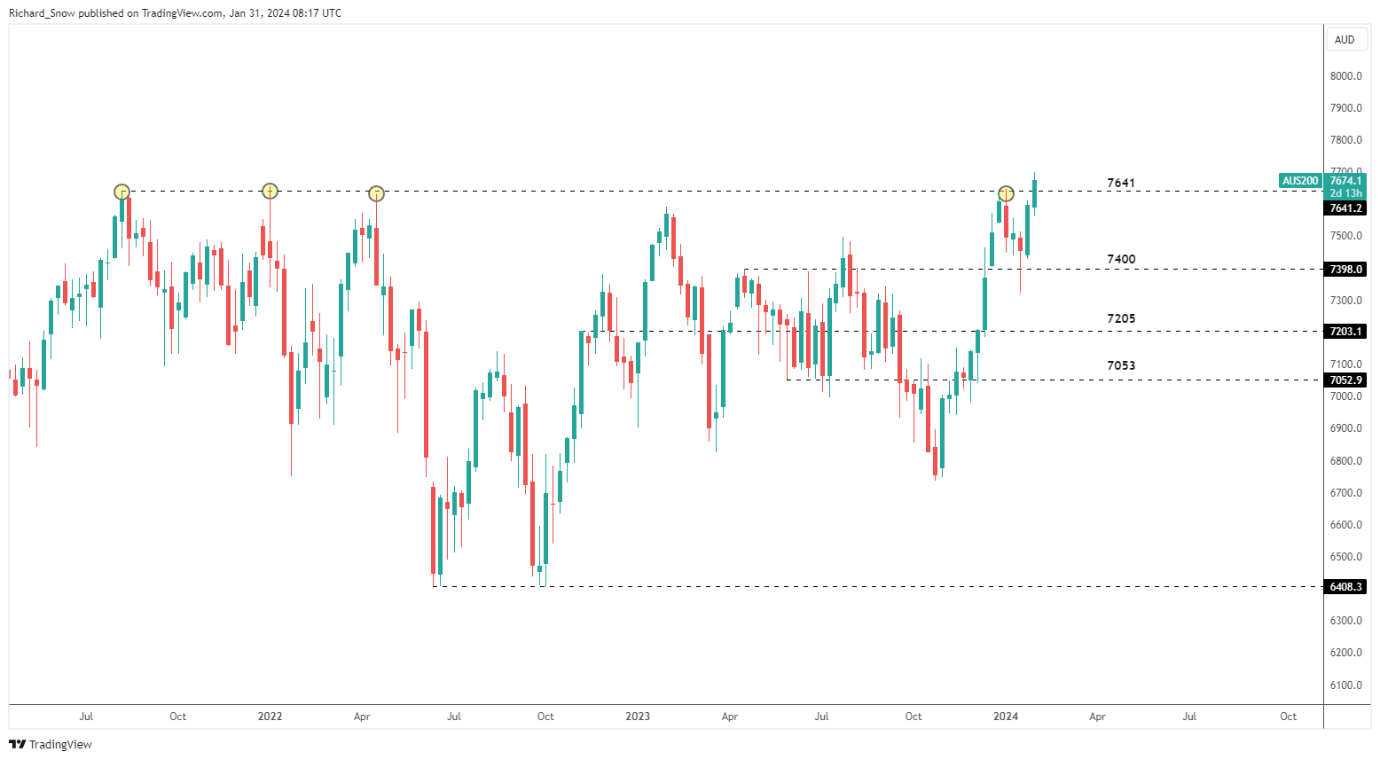

ASX 200 prints new all-time high as Lingering Suspicion of Further Hikes Diminish

The Australian stock market (ASX 200) has reached a new all-time high, boosted by recent inflation data that revealed progress in the fight against price pressures. Improving sentiment around China is also likely to add somewhat to the optimism around Aussie stocks despite the Chinese bourse failing to halt a three-day decline. The IMF upgraded its forecast of Chinese GDP in recognition of fiscal support measures instituted by officials.

The index rose above the prior all-time high of 76.41, trading as high as 7682.30 before closing slightly below the high.

ASX 200 Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link