[ad_1]

Australian Dollar Talking Points

AUD/USD is little changed from the start of the week following the kneejerk reaction to the larger-than-expected rise in the US Producer Price Index (PPI), and fresh data prints coming out of Australia may prop up the exchange rate as employment is expected to increase for the fifth consecutive month.

AUD/USD Rebounds from Weekly Low with Australia Employment on Tap

AUD/USD bounces back from a fresh weekly low (0.7392) even as the US PPI widens to 1.4% from 0.9% per annum in February, which exceeded projections for a 1.1% print, and the exchange rate may attempt to retrace the decline from the yearly high (0.7661) as it snaps the series of lower highs and lows seen during the previous week.

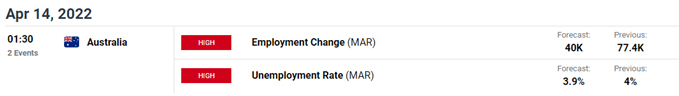

Look ahead, the update to Australia’s Employment report may generate a bullish reaction in AUD/USD as the economy is anticipated to add 40.0K jobs in March, while the jobless rate is expected to narrow to 3.9% from 4.0% during the same period, which would mark the lowest reading since the data series began in 1978.

Record-low readings of unemployment may sway the Reserve Bank of Australia (RBA) as the “central forecast is for the unemployment rate to fall to below 4 per cent this year and to remain below 4 per cent next year,” and the central bank may come under pressure to adjust the forward guidance for monetary policy at its next meeting on May 3 as “higher prices for petrol and other commodities will result in a further lift in inflation over coming quarters.”

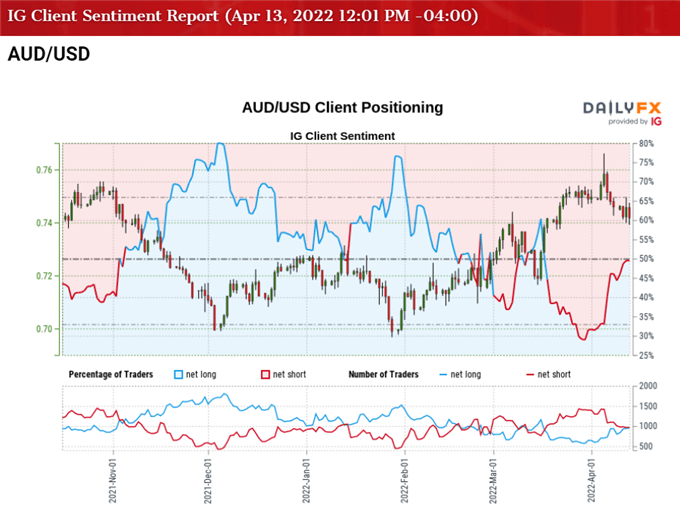

Until then, AUD/USD may stage a larger recovery as it snaps the series of lower highs and lows from last week, but a further decline in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

The IG Client Sentiment report shows 51.30% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 1.05 to 1.

The number of traders net-long is unchanged than yesterday and 29.91% higher from last week, while the number of traders net-short is 7.23% lower than yesterday and 27.78% lower from last week. The jump in net-long interest has fuel the recent flip in retail sentiment 30.56% of traders were net-long AUD/USD last week, while the decline in net-short position comes as the exchange rate bounces back from a fresh weekly low (0.7392).

With that said, another rise in Australia Employment may prop up AUD/USD as it puts pressure on the RBA to normalize monetary policy sooner rather than later, and the exchange rate may attempt to retrace the decline from the yearly high (0.7661) as it snaps the series of lower highs and lows seen during the previous week.

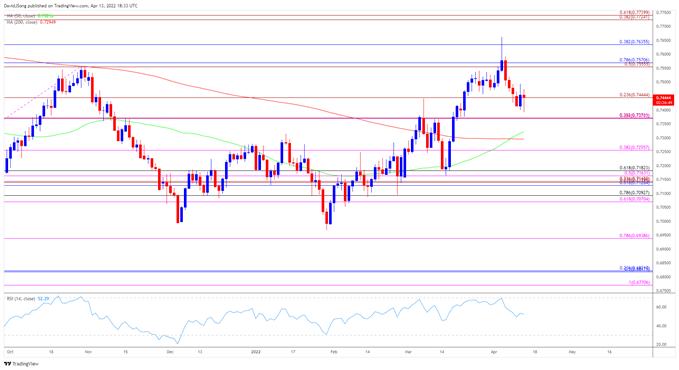

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD cleared the October high (0.7556) earlier this month as it climbed to a fresh yearly high (0.7661), with the 50-Day SMA (0.7322) establishing a positive slope as it pushes above the 200-Day SMA (0.7295) for the first time since July.

- However, the recent rally in AUD/USD failed to push the Relative Strength Index (RSI) into overbought territory amid the lack of momentum to close above the 0.7640 (38.2% retracement) region, with the move below 0.7440 (23.6% expansion) bringing the 0.7370 (38.2% expansion) area on the radar.

- A break/close below the 0.7370 (38.2% expansion) region may push AUD/USD back towards the 50-Day SMA (0.7322), with a move below the 200-Day SMA (0.7295) opening up the 0.7260 (38.2% expansion) area.

- At the same time, failure to break/close below 0.7370 (38.2% expansion) may generate a rebound in AUD/USD as it snaps the series of lower highs and lows from last week, with a move above the 0.7560 (50% expansion) to 0.7570 (78.6% retracement) area bringing the 0.7640 (38.2% retracement) region back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Source link