[ad_1]

Australian Dollar, AUD/USD, AUD/JPY, Technical Analysis, Retail Trader Positioning – Talking Points

- Retail traders are increasingly betting bullish the Australian Dollar

- AUD/USD, AUD/JPY risk falling amid this contrarian warning sign

- Still, further losses entail passing through prominent zones of support

Retail traders appear to be increasing their bullish bets on the Australian Dollar despite recent losses in the currency. This can be seen by taking a look at IG Client Sentiment (IGCS), which tends to behave as a contrarian indicator. Long bets are on the rise for AUD/USD and AUD/JPY, could this be a warning sign of further pain to come for the exchange rates?

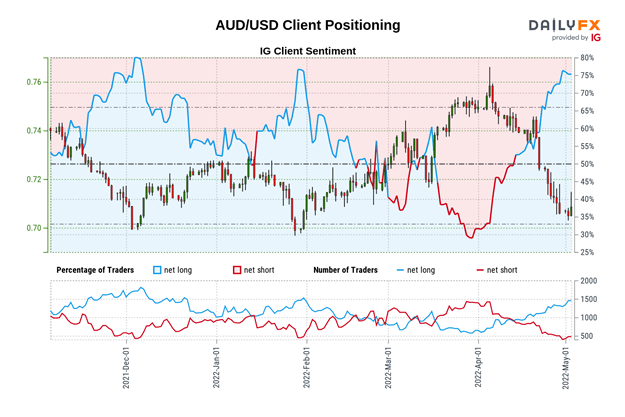

AUD/USD Sentiment Outlook – Bearish

The IGCS gauge shows that about 74% of retail traders are net-long AUD/USD. Since most traders are biased to the upside, this hints price may continue falling. This is as upside exposure has increased by 5.2% and 17.97% compared to yesterday and last week respectively. With that in mind, the combination of current sentiment and recent changes is offering a stronger bearish contrarian trading bias.

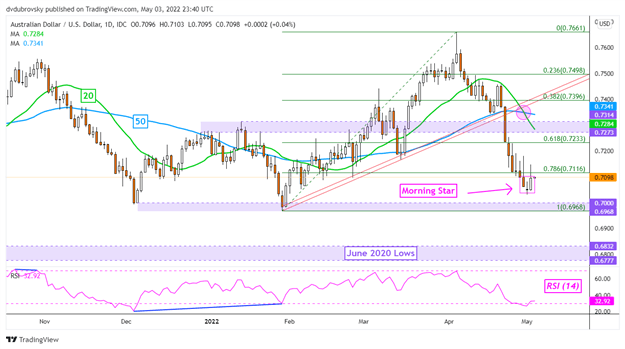

AUD/USD Technical Analysis

On the daily chart, AUD/USD is coming off the worst month (-5.62% in April) since September 2014. Recently, the pair has left behind a bullish Morning Star candlestick pattern. Given further upside confirmation, this could hint at more gains to come. There is quite the room to go before the 20-day Simple Moving Average (SMA) will come into view to perhaps hold as resistance, maintaining the downtrend. On the downside, the 0.6968 – 0.7000 support zone is what stands between AUD/USD and lows from June 2020 (0.6777 – 0.6832).

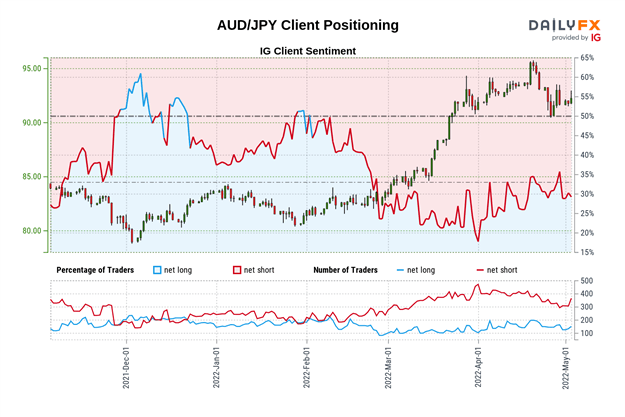

AUD/JPY Sentiment Outlook – Bearish

The IGCS gauge shows that about 37% of retail investors are net-long AUD/JPY. Since the majority of them are still biased to the downside, this suggests that prices may rise. However, upside exposure increased by 30.14% and 15.15% compared to yesterday and last week respectively. With that in mind, the combination of recent changes in sentiment that the price trend may soon reverse lower.

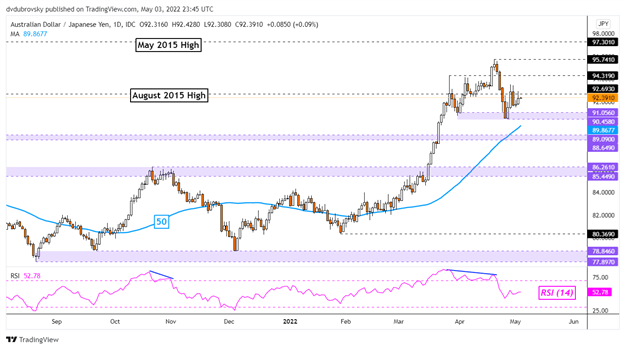

AUD/JPY Technical Analysis

AUD/JPY remains lower than the peaks achieved in April. In fact, the last week of the previous month was the worst performance (-1.45%) since November 2021. Immediate support appears to be the 90.458 – 91.056 range. A break under could be an increasingly bearish price signal that would place the focus on the 50-day SMA, which could still maintain the upside focus. Uptrend resumption entails a push above 95.741, exposing the May 2015 high.

*IG Client Sentiment Charts and Positioning Data Used from May 3rd Report

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

[ad_2]

Source link