[ad_1]

The S&P 500’s largest companies have seen “unrelenting” outperformance over the past decade, but history shows the biggest stocks typically fail to keep up their market-beating run, according to the asset allocation team at Jeremy Grantham’s GMO.

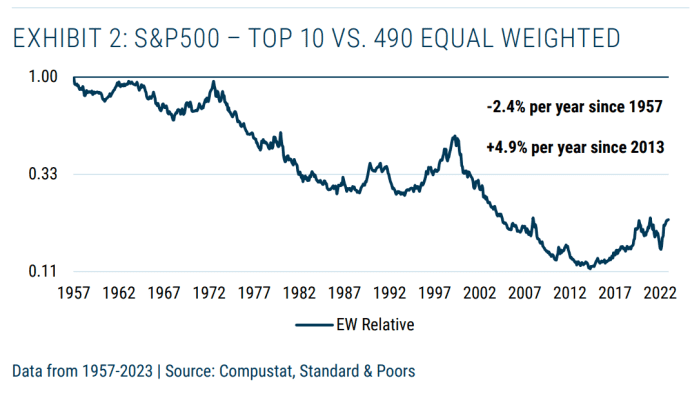

By some measures, “big is generally anything but beautiful,” GMO’s co-head of asset allocation Ben Inker and team member John Pease, said in the investment firm’s first-quarter letter to clients. Citing data from 1957-2023, they found that nine of the 10 largest stocks in the S&P 500 underperformed on average in the year following that ranking.

GMO QUARTERLY LETTER 1Q 2024

The largest stocks generally become the biggest by “becoming expensive, and this anti-value tilt has historically been quite costly, explaining most of these companies’ poor relative returns,” said Inker and Pease. “Since 1957, the 10 largest stocks in the S&P 500 have underperformed an equal-weighted index of the remaining 490 stocks by 2.4% per year.”

The S&P 500 has become significantly more concentrated, according to the GMO team. The firm was co-founded in 1977 by legendary investor Grantham, who has long warned of market bubbles.

The top seven companies in the S&P 500 have swelled to 28% of the index, from 13% a decade earlier, as their returns far outpaced the average stock in the U.S. equities gauge, the firm’s letter shows.

Big Tech stocks known as the Magnificent Seven — a group of megacap companies in the S&P 500 that includes Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Google parent Alphabet Inc.

GOOGL,

GOOG,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

Facebook parent Meta Platforms Inc.

META,

and Tesla Inc.

TSLA,

— are closely watched by investors after skyrocketing in 2023.

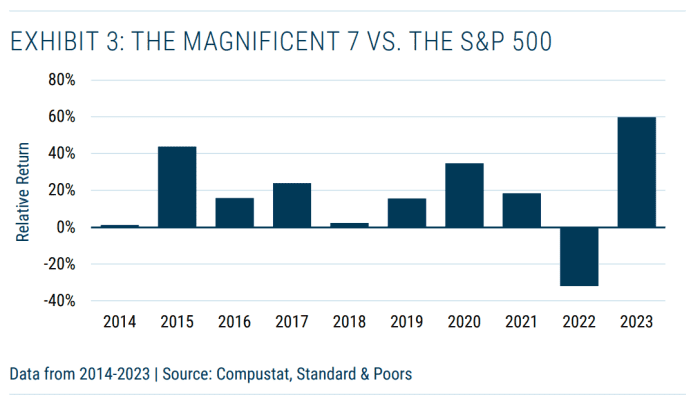

“Biasing portfolios against the very largest stocks” over the past decade has been “a disaster,” particularly last year, but it’s been “lucrative” for most of history, according to the GMO letter.

“The break in the consistent downward trend of cap-weighted underperformance reflects the magnificence of the Magnificent Seven,” the letter says. “In 2023, as their monicker became part of the common lexicon, they outperformed the S&P 500 by an almost unimaginable 60%.”

The S&P 500 index climbed 24.2% in 2023, surging on the back of Big Tech’s gains, according to FactSet data.

The stock-market benchmark briefly eclipsed 5,000 for the first time in history on Thursday, before pulling back slightly, while still ending at its ninth record close of 2024.

See: S&P 500 touches 5,000 for first time. Here’s what it means for the market.

“As far as mega caps go, they have been practically unparalleled in their outperformance” over the past decade, with 2022 being the sole year they failed to the market, wrote Inker and Pease.

GMO QUARTERLY LETTER 1Q 2024

“This performance came in part from the unusual cheapness of mega caps at the start of the decade,” while the companies also grew earnings “at a breakneck pace,” according to GMO.

“Microsoft and Amazon did so by reinventing themselves,” said Inker and Pease. “Apple, Alphabet, Meta, Nvidia, and Tesla took over their primary industries.”

Read: Stock-market investors fear a megacap meltdown. Here’s what history says.

But based on data from 1957-2023, the largest 10 companies have on average “substantially trailed the average S&P 500 stock,” a chart in GMO’s quarterly letter shows.

GMO QUARTERLY LETTER 1Q 2024

Meanwhile, the capitalization-weighted S&P 500 index

SPX

has gained 4.8% this year through Thursday, according to FactSet data. Only four stocks in the Magnificent Seven are beating the S&P 500 so far in 2024, including Nvidia, Meta, Amazon and Microsoft, FactSet data show.

“Ten years ago, the index was more than twice as diversified,” Inker and Pease wrote. “We have never seen – over any 10-year period – a decline (or increase) in diversification of the magnitude we have just witnessed.”

Also read: S&P 500 looks ‘accident prone’ as it nears 5,000 milestone

[ad_2]

Source link