[ad_1]

BITCOIN AND CRYPTO KEY POINTS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: Fed Steps In to Avoid Systemic Risks After SVB Fallout. Is the S&P 500 Safe?

Bitcoin continued its rally today benefitting from the US Treasury announcement that it would act as a lender of last resort, effectively guaranteeing all US bank deposits, even the uninsured ones. The world’s largest cryptocurrency by market capitalization rallied around 18% on the day and is now up around 25% since Friday last week.

The rally has been somewhat of a surprise given the implosion of SVB and Signature bank, both of whom were seen as crypto friendly institutions. We also saw the decline in USDC over the weekend losing its peg against the US dollar and dropping below the 0.92 handle on Saturday as news around SVB filtered through the crypto market, before rebounding to regain its US dollar peg on Monday. Safety of stablecoins became a hot topic over the weekend particularly on social media as evidenced by the announcement by Changpeng Zhao, CEO of the largest global exchange, Binance. Zhao announced the conversion of some of its branded stablecoin, Binance USD to Bitcoin, Ethereum and its in-house BNB.

COLLAPSE OF SVB A EUREKA MOMENT FOR BITCOIN AND CRYPTO?

Many Bitcoin and Crypto observers however see the collapse of SVB bank as somewhat of Eureka moment for the industry. Some believe that the collapse highlights the flaws in the fractional reserve and traditional money systems and may facilitate an uptick in the adoption and interest of self-custody in the form of hardware wallets.

Looking at the numbers today it is hard to disagree with the view that the spectacular failure of SVB and Signature bank may serve as an ad for the adoption of self-custody and promote cryptocurrencies in a world where the holding of physical cash has become somewhat obsolete and, in some cases, ‘frowned upon’. According to data from Coinglass some $160 million in short bitcoin positions and some $300 million in Crypto positions were liquidated on Monday.

Could it be that despite the growing scrutiny on the Crypto industry and the spectacular downfall of FTX late last year, these recent developments breathe new life into crypto and self-custody adoption…..? I think it is too early to tell, but that hasn’t hampered the enthusiasm of Bitcoin advocates, having the opposite effect instead.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Zain Vawda

TECHNICAL OUTLOOK

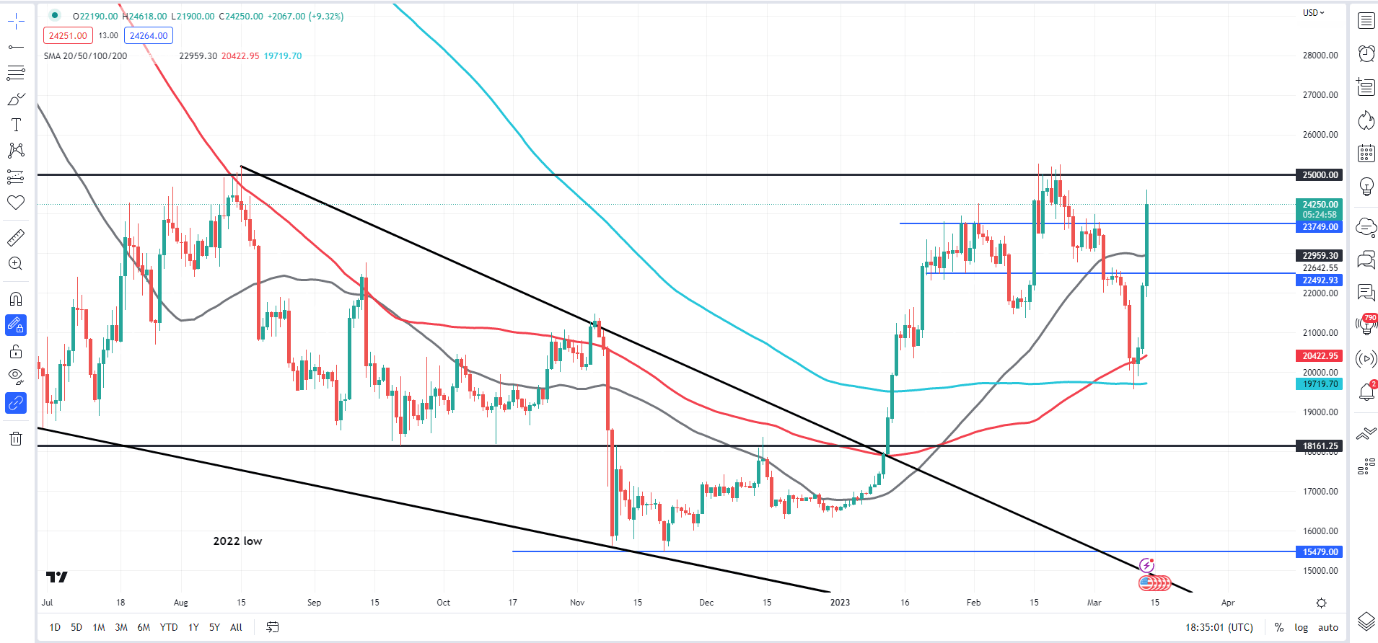

From a technical standpoint the current rally in BTCUSD began on Friday March 10 as it found support at the 200-day MA around the $19700 handle. We had seen a golden cross a few days earlier and one could point to the recent rally as a delayed reaction, however given the macro conditions at play the rally in nonetheless impressive.

On the daily timeframe we have broken two key areas of resistance (Blue lines on the chart) at around $22500 and $23750 respectively with a daily candle close above needed for confirmation of the momentum of the rally. However, the key psychological $25000 handle remains key if we are to see further upside as we have struggled to break above this price point since June 2022. A daily candle close above the $25000 mark opens up the potential for a retest of resistance at $28000 (May 2022 swing low) and beyond that the $30000 mark.

Alternatively, a rejection could see price retest the resistance levels now support at $23750 and $22500 respectively. Exciting times ahead for Crypto and Bitcoin which usually thrives in periods of heightened volatility.

BTCUSD Daily Chart, March 13, 2023.

Source: TradingView, chart prepared by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link