[ad_1]

British Pound, GBP/USD – Prices, Charts, and Analysis

- BoE warns of a ‘sharp economic slowdown’.

- UK inflation to hit 10%+ in Q3.

- Sterling hits multi-year lows.

The Bank of England (BoE) hiked interest rates by 0.25% to 1% on Thursday, in line with market expectations, but warned that inflation may hit double-digits in Q3 and that growth may turn negative in 2023. This double-dose of bad news sent an already weak British Pound tumbling lower with any minor rebounds being sold again. The Monetary Policy Committee, on Thursday, highlighted the risks the UK economy faces in the months ahead, opining that rampant inflation had caused a material deterioration in the UK growth outlook. The Bank of England is trapped between a rock and a hard place in trying to reduce price pressures by hiking rates while keeping the economy stimulated to prevent stagflation. In our Q2 fundamental GBP outlook, we highlighted this very problem, and nothing has changed since then.

BoE Hikes Rates, British Pound Slumps on Outlook Warning

A fairly quiet UK economic calendar next week with the only data of note, the monthly and annual GDP read, released on Thursday. For all market-moving economic data and events, refer to the DailyFX calendar

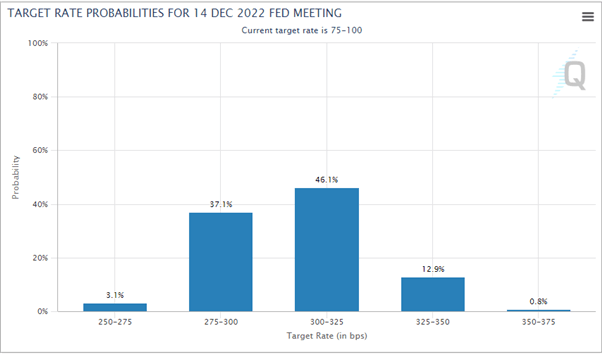

The British Pound has had another poor week with Thursday’s BoE inflation and growth warnings adding to downward pressure on GBP. Cable (GBP/USD) has also been hit by the continued surge in the value of the US dollar which earlier in today’s session hit its highest level since December 2002. With the Federal Reserve anticipated to hike interest rates by another 200+ basis points over the rest of the year, the US dollar will remain bid in the months ahead.

CME Fed Watch – May 6, 2022

The daily GBP/USD chart shows the pair printing a 1.2276 low earlier in today’s session, a level last seen in July 2020. Recent support levels have been unable to stem losses in the pair and if sentiment remains negative then 1.2000 may come under pressure. To the upside, the 1.2640 level will act as first-line resistance and looks like a difficult level to break.

GBP/USD Daily Price Chart – May 6, 2022

Retail trader data show 82.43% of traders are net-long with the ratio of traders long to short at 4.69 to 1. The number of traders net-long is 1.92% higher than yesterday and 4.75% higher from last week, while the number of traders net-short is 3.24% lower than yesterday and 4.87% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link