[ad_1]

Welcome back to Distributed Ledger. This is Frances Yue, reporter at MarketWatch.

Fears are brewing in financial markets that the U.S. lawmakers won’t be able to reach an agreement to raise the country’s debt limit by X date, or the date that the U.S. government is unable to meet its debt obligations.

Analysts at JPMorgan Chase & Co.

JPM,

on Wednesday said they see the odds of debt ceiling negotiators failing to reach a deal by early June at “around 25% and rising.”

Concerns around a technical default of U.S. government debt have contributed to volatility across financial markets, sending Treasury bills maturing in the first eight days of June above 6%. Yields on such bills briefly topped 7% on Thursday.

As investors search for havens from such tumult, gold and bitcoin are often cited as potential refuges.

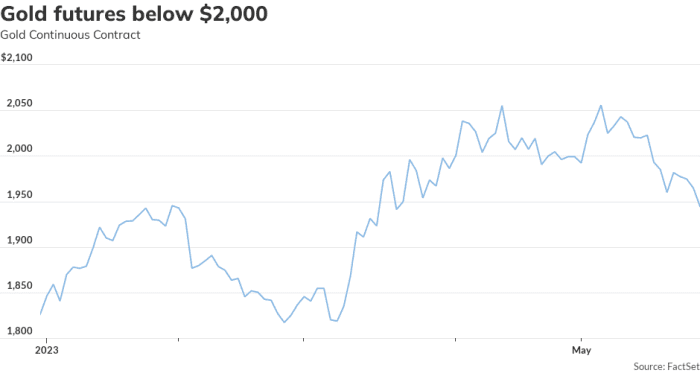

Still, gold futures have been retreating since the most-active contract reached its second-highest settlement on record on May 4.

Bitcoin, which rallied almost 60% so far this year, have also posted lackluster performance for the past few weeks, down 5.8% over the past month.

Are gold and bitcoin effective hedges against a technical default of U.S. government debt? Why are we not seeing a rally as the X date approaches? I caught up with several analysts to ask their views.

Find me on Twitter at @FrancesYue_ to share any thoughts on crypto, gold, or this newsletter.

Is gold the haven?

FactSet

“Generally speaking, gold thrives when there are periods of uncertainty,” said Rhona O’Connell, analyst at StoneX Group. “But if you take that uncertainty too far, then we get to stages where people are sitting on their hands and not really doing very much and that’s what’s happened here.”

Gold futures for June delivery

GC00,

GCM23,

on Thursday declined by $20.90, or 1.1%, to $1,943.70 per ounce on Comex, with prices for the most-active contract posting their lowest finish since March 21, according to FactSet data.

As gold futures price retreat to below $2,000, “I suppose it’s arguable that the bulls might be a bit disappointed,” said O’Connell. But there’s “bound to be a retreat” with gold’s price premium building over the past few weeks, according to O’Connell.

“The fact that gold hasn’t managed to climb any higher given the potential seriousness of the economic consequences should no agreement be reached before the June deadline reflects a prevailing view that ultimately the markets believe some middle ground can be found in time,” Rupert Rowling, analyst at Kinesis Money, wrote in a recent note.

Still, gold’s price stays elevated at levels that were not seen many times in history.

What about bitcoin?

Considering the rally bitcoin had so far this year, it’s “not crazy to see a little bit of pullback, according to Steven Lubka, a managing director at Swan Bitcoin.

Bitcoin gained almost 60% so far this year while still down over 60% from its all-time high in 2021.

Still, if the U.S. ends up defaulting on its debt, and “everyone freaks out, bitcoin could do very well in that scenario,” Lubka said, citing bitcoin’s limited supply, decentralized and non-sovereign properties.

However, not everyone agrees. There is not enough evidence to support the claim that bitcoin could serve as a hedge against the debt ceiling tumult, according to Lapo Guadagnuolo, director at S&P Global Ratings.

“We can’t make that argument because we don’t see that in the data,” Guadagnuolo said.

A rising dollar

The recent strength of the U.S. dollar have also weighed on bitcoin and gold.

On Thursday, the ICE U.S. Dollar Index

DXY,

which measures the currency’s strength against a basket of six major rivals, climbed above 104 to its highest level since March 17, according to Dow Jones market data.

Although a technical default of U.S. government debt could hurt the dollar’s reputation in the long term, it might have little bearing on the immediate reaction, which would resemble a knee-jerk move higher, as my colleague Joseph Adinolfi elaborated here.

As gold is mostly denominated in U.S. dollar and bitcoin’s main trading pairs are dollar-denominated stablecoins, a strong dollar could weigh on both assets.

Still, the debt ceiling debacle in the long term could strengthen the narrative around bitcoin and gold, as “the governance of the worlds fiat system comes into question,” according to Greg Magadini, director of derivatives at Amberdata.

Crypto in a snap

Bitcoin lost 2.8% in the past week and was trading at around $26,360 on Thursday, according to CoinDesk data. Ether declined 0.9% in the same period to around $1,805

| Biggest Gainers | Price | %7-day return |

| marumaruNFT | $0.26 | 201% |

| Render | $2.70 | 19.5% |

| Kava | $1.10 | 14.3% |

| TRON | $0.08 | 10.6% |

| Huobi | $3.12 | 8.4% |

| Source: CoinGecko |

| Biggest Decliners | Price | %7-day return |

| GMX | $52.68 | -14.6% |

| Sui | $0.99 | -13.3% |

| Fantom | $0.33 | -10.1% |

| Stacks | $0.59 | -9.7% |

| Optimism | $1.62 | -9.7% |

| Source: CoinGecko |

Must-reads

[ad_2]

Source link