[ad_1]

Crude Oil Price Talking Points

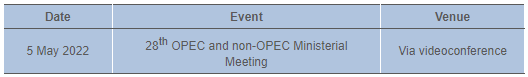

The price of oil bounces along the 50-Day SMA ($103.96) after reversing ahead of the April low ($95.28), and the Organization of Petroleum Exporting Countries (OPEC) Ministerial Meeting on May 5 may keep crude price afloat as long as the group retains a gradual approach in boosting supply.

Crude Oil Price Outlook Hinges on OPEC Ministerial Meeting

The price of oil is little changed from the start of the week as it appears to be stuck in defined range, but crude may exhibit a bullish trend over the coming months as the 50-Day SMA ($103.96) retains the positive slope from earlier this year.

Source: OPEC

As a result, developments coming out of the OPEC meeting on may prop up the price of oil if the group retains the current production schedule, and current market conditions may push crude to test the April high ($109.20) as OPEC plans to “adjust upward the monthly overall production by 0.432 mb/d for the month of May 2022.”

In turn, expectations for limited supply paired with the recovery in crude demand casts a bullish outlook for the price of oil as OPEC’s most recent Monthly Oil Market Report (MOMR) acknowledges that “world oil demand is projected to average 100.5 mb/d, which is 0.4 mb/d lower than the previous month’s estimates and approximately 0.3 mb/d higher than 2019,” and the group may continue to carry out a gradual approach in boosting production as “oil market fundamentals and the consensus on the outlook pointed to a well-balanced market.”

With that said, failure to test the April low ($95.28) may keep the price of oil on pace with the 50-Day SMA ($103.96), and crude may attempt to test the April high ($109.20) if OPEC retains the current production schedule for the coming months.

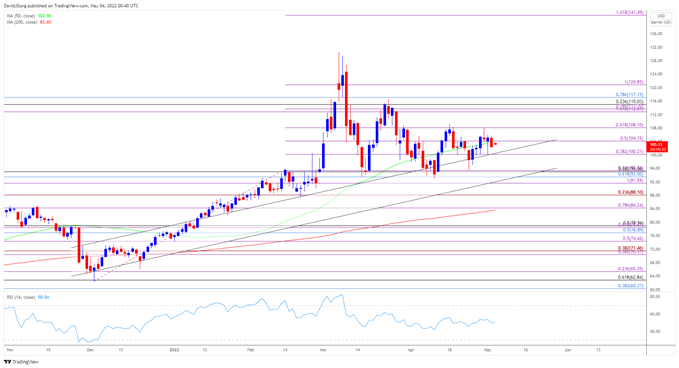

Crude Oil Price Daily Chart

Source: Trading View

- The price of oil appears to be stuck in a narrow range after clearing the opening range for April, but the positive slope in the 50-Day SMA ($103.96) instills a positive outlook for crude as price bounces along the moving average.

- The failed attempt to test the April low ($95.28) has pushed the price of oil back towards the $104.20 (50% expansion) region, but need a break/close above $108.10 (61.8% expansion) to open up the $112.80 (161.8% expansion) to $113.70 (78.6% expansion) region.

- Next area of interest comes in around the $115.00 (23.6% retracement) handle followed by the $117.20 (78.6% retracement) region.

- However, failure to break/close above the $108.10 (61.8% expansion) area may keep the price of oil within the April range, with a move below the $100.20 (38.2% expansion) region bringing the Fibonacci overlap around $93.50 (61.8% retracement) to $95.30 (23.6% expansion) back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Source link