[ad_1]

BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Crude inventories weigh on Brent ahead of OPEC next week.

- Fading USD may find some relief today leaving Brent exposed.

- Hesitant price action on daily chart.

Recommended by Warren Venketas

Get Your Free Oil Forecast

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Brent crude oil has been rather stagnant yesterday and today with crude oil inventories showing increases via both API and EIA reports. The more recent EIA data saw a 533Mbbls rise from the prior week keeping Brent crude prices limited. After news around OPEC+ officials expectation to keep oil production the same, upside for Brent crude seems to be hesitant ahead of next week’s meeting. Caution has stemmed from doubt centering around the Chinese re-open as well as the Russia/Ukraine conflict.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

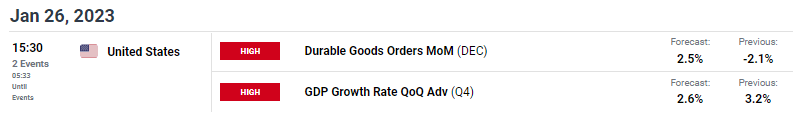

With no oil specific data scheduled today, the focal point shifts to the USD via durable goods orders and GDP for Q4. Durable goods is projected higher largely due to an influx of orders for Boeing while the less marketed initial jobless claims will be closely watched as well. The labor market in the U.S. is slowly becoming more and more important showing know signs of easing just yet therefore keeping the Fed on its toes in terms of navigating a soft landing. Should the below data come in as expected, the dollar may gain some traction leaving crude oil prices under pressure (traditionally inverse relationship).

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

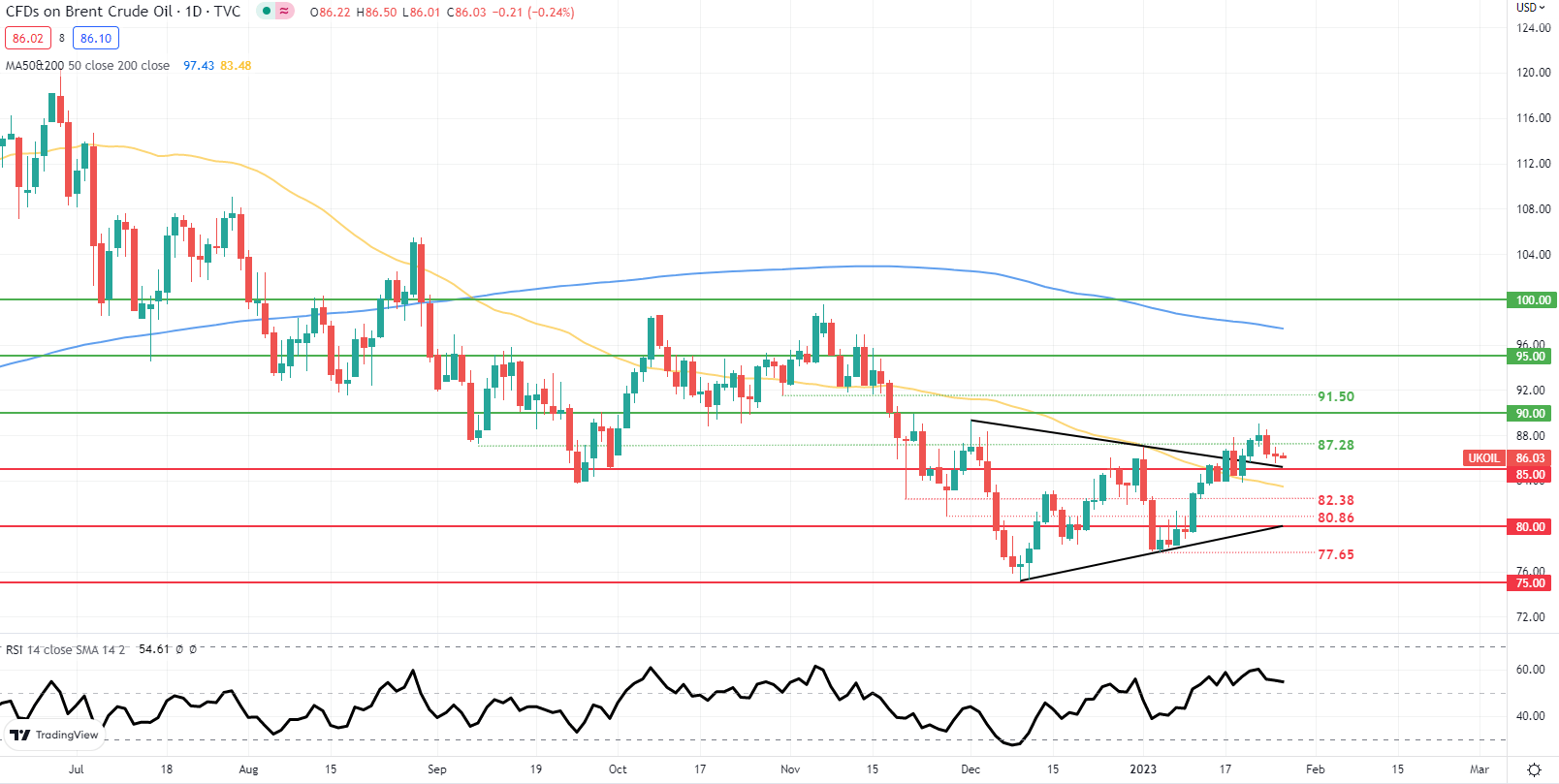

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily Brent crude chart has not rallied post triangle breakout (black) but is taking its cues from the greenback of late. No real conviction is being exhibited by market participants and today’s economic data could provide some short-term volatility.

Key resistance levels:

Key support levels:

- 50-day MA (yellow)

- $82.38

- $80.86

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are NET LONG on Crude Oil, with 66% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Source link