[ad_1]

Welcome back to Distributed Ledger. This is Frances Yue, crypto reporter at MarketWatch.

Late Wednesday, Ethereum completed its long-anticipated Shanghai, or Shapella upgrade, which allows holders to withdraw the ether that they locked up for months, if not years, for rewards.

It is the biggest transition for Ethereum since its “Merge” upgrade in September, when the blockchain overhauled the way it operated.

Ethereum once relied on the so-called “miners,” who use computers to solve complicated mathematical puzzles to secure the blockchain. After the “Merge”, the network counts on validators, or ether holders who stake, or lock up, their coins to verify new transactions.

These validators are rewarded with certain amounts of new coins, which allow them to earn passive income without selling the ether they hold.

However, holders who staked their ether were unable to withdraw their coins and the rewards, until the Shanghai upgrade solved that problem.

Find me on Twitter at @FrancesYue_ to share any thoughts on crypto, this newsletter, or your personal stories with digital assets.

Ether’s rally

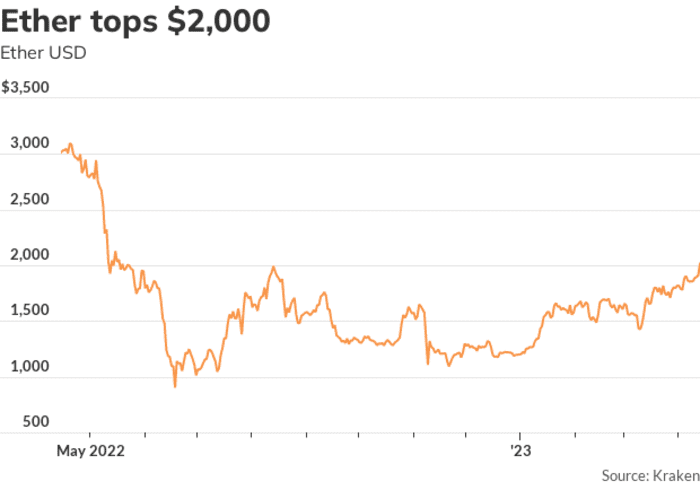

Ether rallied after the upgrade, and is trading above $2,000 for the first time since August, 2022, despite that some market participants earlier expected the Shanghai upgrade to lead to selling pressure on ether in the short term

Ether is trading above $2,000 for the first time in eight months

Uncredited

The Ethereum beacon chain, where ether are staked, saw net withdrawal of over 100,000 ether in the past 24 hours, according to data from Nansen. Meanwhile, over 800,000 ether, or about 4% of total staked ether and rewards on Beacon chain, are waiting in the queue to be withdrawn.

More than 96% of the withdrawal volume so far comes from investors who pulled out their rewards, instead of their entire stakes, according to data from Flipside Crypto.

The majority of staked ether were held by “strong hands” or “true believers” of the Ethereum network, who are less likely to withdraw large amounts of ether, according to Dave Weisberger, the CEO and co-founder of CoinRoutes.

In fact, as the Shanghai upgrade reduces liquidity concerns for staking ether for some investors, it might encourage more institutions to participate in staking, noted Weisberger.

“In short, staking has been de-risked for market participants now, and this means that it’s actually more attractive to stake,” Weisberger said in emailed comments.

Ether vs. bitcoin

For several weeks leading up to the Shanghai upgrade, ether underperformed bitcoin, as some traders shorted ether and went long bitcoin on fears that some unstaked ether will get sold.

Meanwhile, the U.S. banking crisis last month boosted bitcoin’s price, as the crypto’s supporters touted it as a hedge against more bank failures and tighter Federal Reserve monetary policy. “There was a very clear narrative on a macro level related to bitcoin,” said David Martin, director of institutional coverage at FalconX.

Read: Bitcoin at ‘redemption arc’ as banking pressures rise, says AllianceBernstein

However, Martin said he expects ether to outperform bitcoin in the next month or so following the Shanghai upgrade.

The upgrade might attract more investors into buying and staking their ether and would also lay ground for Ethereum’s future upgrades, which might improve the network’s other functionalities such as transaction speeds, Martin said.

Crypto in a snap

Bitcoin rallied 7.8% in the past week and was trading at above $30,000 on Thursday, according to CoinDesk data. Ether gained 3.7% in the same period to above $2,000.

| Biggest Gainers | Price | %7-day return |

| Radix | $0.08 | 68% |

| Injective | $6.68 | 20.9% |

| Render | $1.61 | 19.9% |

| Solana | $24.62 | 17.3% |

| Arbitrum | $1.36 | 9.3% |

| Source: CoinGecko as of April 13 |

| Biggest Decliners | Price | %7-day return |

| Klaytn | $0.25 | -7.7% |

| Frax Share | $9.09 | -6.3% |

| Lido DAO | $2.43 | -6.2% |

| WhiteBIT Token | $4.81 | -6% |

| Dogecoin | $0.09 | -5.9% |

| Source: CoinGeko as of April 13 |

Crypto companies, funds

Shares of Coinbase Global Inc.

COIN,

rallied 12% for the week to around $68.80. MicroStrategy Inc.

MSTR,

advanced 17.9% thus far on the week, to $342.02.

Crypto mining company Riot Blockchain Inc.

RIOT,

‘s shares gained 47% to $13.47 as of Thursday. Shares of rival Marathon Digital Holdings Inc.

MARA,

jumped 43% to $11.40 over the past week. Ebang International Holdings Inc.

EBON,

traded 12% higher over the past week to around $5.99.

Overstock.com Inc. shares

OSTK,

added 1.5% to $18.50 over the week.

Shares of Block Inc.

SQ,

formerly known as Square, declined 5% to $64.59 for the week thus far. Tesla Inc.

TSLA,

shares edged up 0.5% to $186.01.

PayPal Holdings Inc.’s

PYPL,

stock was up 0.6% over the week to trade at around $75.39. Nvidia Corp.’s

NVDA,

dipped 1% to $267.64 for the past week.

Advanced Micro Devices Inc.

AMD,

shares was unchanged for the week at $92.51.

Among crypto funds, ProShares Bitcoin Strategy

BITO,

rallied 9.4% over the week to $18.23 Thursday, while counterpart Short Bitcoin Strategy ETF

BITI,

tumbled 8.9% to $19.35. Valkyrie Bitcoin Strategy ETF

BTF,

advanced 9% over the past week to $11.96, while VanEck Bitcoin Strategy ETF

XBTF,

went up 8.7% to $30.41.

Grayscale Bitcoin Trust

GBTC,

increased 11% over the past five days to $17.90 on Thursday.

Must-reads

[ad_2]

Source link