[ad_1]

EUR/USD Technical Highlights:

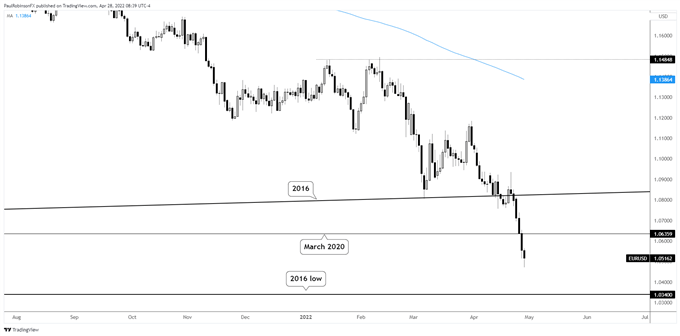

- EUR/USD tanking, took out the March 2020 lows

- The 2016 lows are within view at this point

- Will we see parity? Maybe, but don’t be surprised if not

The EUR/USD is tanking hard with the USD on a roll against all major currencies. The March 2020 low at 10636 provided zero support this week, and on that we are looking at the lows from back in 2016 at 10340.

It is a big level for sure, as after that we are looking at the worst levels in nearly 20 years, and yes possibly parity. It will be interesting to see first, though, how the 2016 low is handled with momentum so strong. Sentiment is clearly very bearish in the Euro and the risk of a reversal, or even a temporary reprieve is growing significantly.

Perhaps a reversal will occur around the 10340 level. A sharp turnaround from just above or below the level could indicate that selling has become exhausted and a move higher will ensue. But until we see some type of bullish price action it isn’t good risk/reward to try and buy a falling knife.

If the 2016 low don’t hold, then calls for parity will grow louder. I recall back in 2015 when the Euro was in a free-fall the market consensus was parity and worse was imminent. And then it suddenly wasn’t. While the 2015 low wasn’t ‘the’ low it was pretty close with that low occurring in the 10400s.

Not saying this time will be the same, but with the trade becoming so one-way, even if parity is in the cards, we may first see an oversold bounce. Existing shorts may want to employ a trailing stop strategy, while fresh shorts look risky at this juncture. However, a rally and failure at the March 2020 low at 10636 could offer an entry. Would-be longs may be best served by waiting for some type of buying to show before taking a crack at fishing for a bottom.

EUR/USD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link