[ad_1]

NASDAQ 100, USD/JPY, GOLD FORECAST

- The Fed’s monetary policy announcement will steal the spotlight on Wednesday

- No interest rate changes are expected, but the central bank is likely to update its forward guidance

- This article analyzes the technical outlook for gold prices, USD/JPY and the Nasdaq 100

Recommended by Diego Colman

Forex for Beginners

Most Read: Gold Price Forecast – Fed Decision to Guide Trend, Critical Levels For XAU/USD

The Federal Reserve is set to unveil its first monetary policy decision of the year this Wednesday. This high-profile event is likely to trigger higher-than-normal volatility in the upcoming trading sessions, so traders should be prepared for the possibility of treacherous market conditions and, perhaps, wild price swings.

According to consensus expectations, the Fed is likely to maintain its key interest rate unchanged, within the present range of 5.25% to 5.50%. The institution led by Jerome Powell may also opt to drop its tightening bias from the post-meeting statement, effectively and officially signaling a transition towards an easing stance.

While economic resilience argues for retaining a hawkish tilt, the central bank could begin leaning towards a more dovish approach, fearing that delaying a “pivot” may inflict needless damage to the labor market. Acting early, essentially, mitigates the risk of having to implement more extreme accommodative measures when the economy has already begun to roll over.

Access a well-rounded view of the U.S. dollar’s outlook by securing your complimentary copy of the Q1 forecast!

Recommended by Diego Colman

Get Your Free USD Forecast

It’s still an open question whether the central bank will lay the groundwork for the first rate cut in the March meeting, but if it subtly endorses this trajectory, yields, especially short-dated ones, could see a precipitous retracement. Such an outcome could bode well for stocks and gold prices but would be bearish for the U.S. dollar.

In the event of the FOMC leaning on the hawkish side to maintain flexibility and ample room to maneuver, yields and the U.S. dollar will be well positioned for a strong rally, as traders unwind dovish bets on the monetary policy outlook. This scenario may create a challenging backdrop for both the equity market and gold prices.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you are looking for—don’t miss out, download the guide now!

| Change in | Longs | Shorts | OI |

| Daily | -2% | -2% | -2% |

| Weekly | -3% | -12% | -7% |

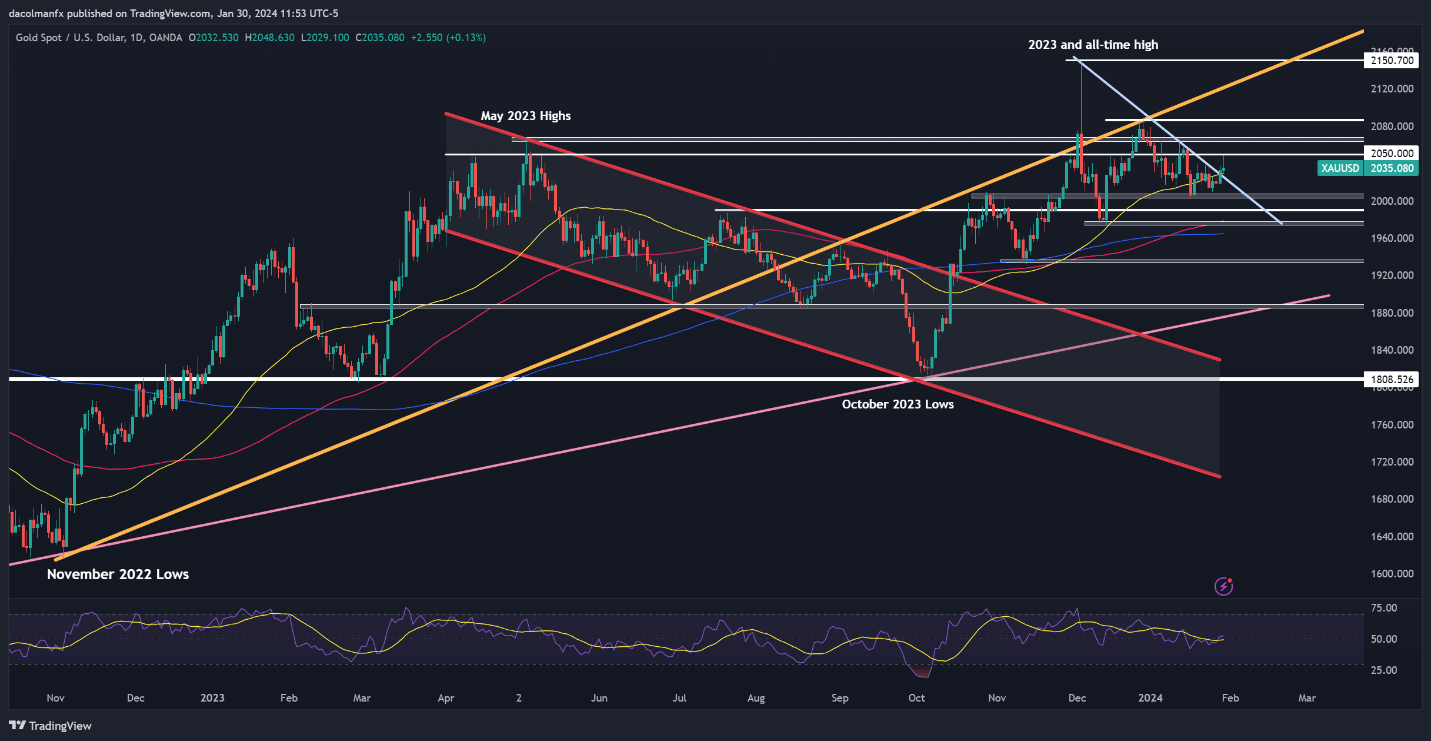

GOLD PRICE TECHNICAL ANALYSIS

Gold climbed above trendline resistance on Monday but has struggled to sustain the breakout, with prices retracing previously accumulated gains on Tuesday. If the pullback intensifies and results in a drop below the 50-day SMA, we could soon see a retest of $2,005. On further weakness, all eyes will be on $1,990.

On the other hand, if buyers return and spark a meaningful rebound, the first line of defense against a bullish offensive appears at $2,050, followed by $2,065. Further upward momentum from this juncture could potentially establish the conditions for a rally toward $2,065.

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

For a complete overview of the Japanese yen’s technical and fundamental outlook, make sure to download our complimentary quarterly forecast!

Recommended by Diego Colman

Get Your Free JPY Forecast

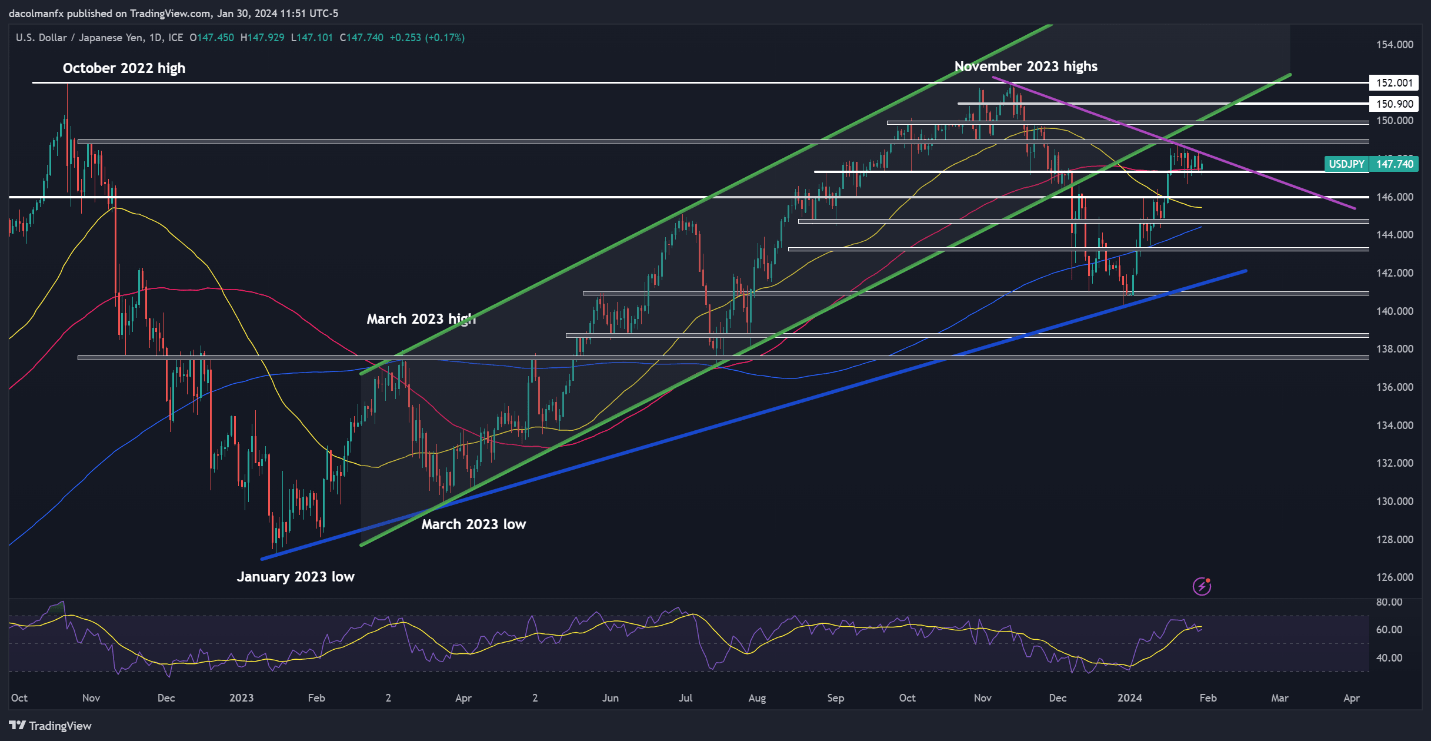

USD/JPY TECHNICAL ANALYSIS

USD/JPY sold off earlier in the week but managed to rebound off the 100-day simple moving average – key technical floor. If gains pick up impetus over the coming days, primary resistance is positioned at 148.20, followed by 149.00. Looking higher, the crosshairs will be on the 150.00 handle.

In case of a bearish reversal, initial support appears at 147.40. Prices are likely to stabilize in this area during a retracement and on a retest, but if a breakdown occurs at some point, the exchange rate will have fewer obstacles to gravitate toward the 146.00 handle.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

If you’re looking for an in-depth analysis of U.S. equity indices, our first-quarter stock market trading forecast is packed with great fundamental and technical insights. Get it now!

Recommended by Diego Colman

Get Your Free Equities Forecast

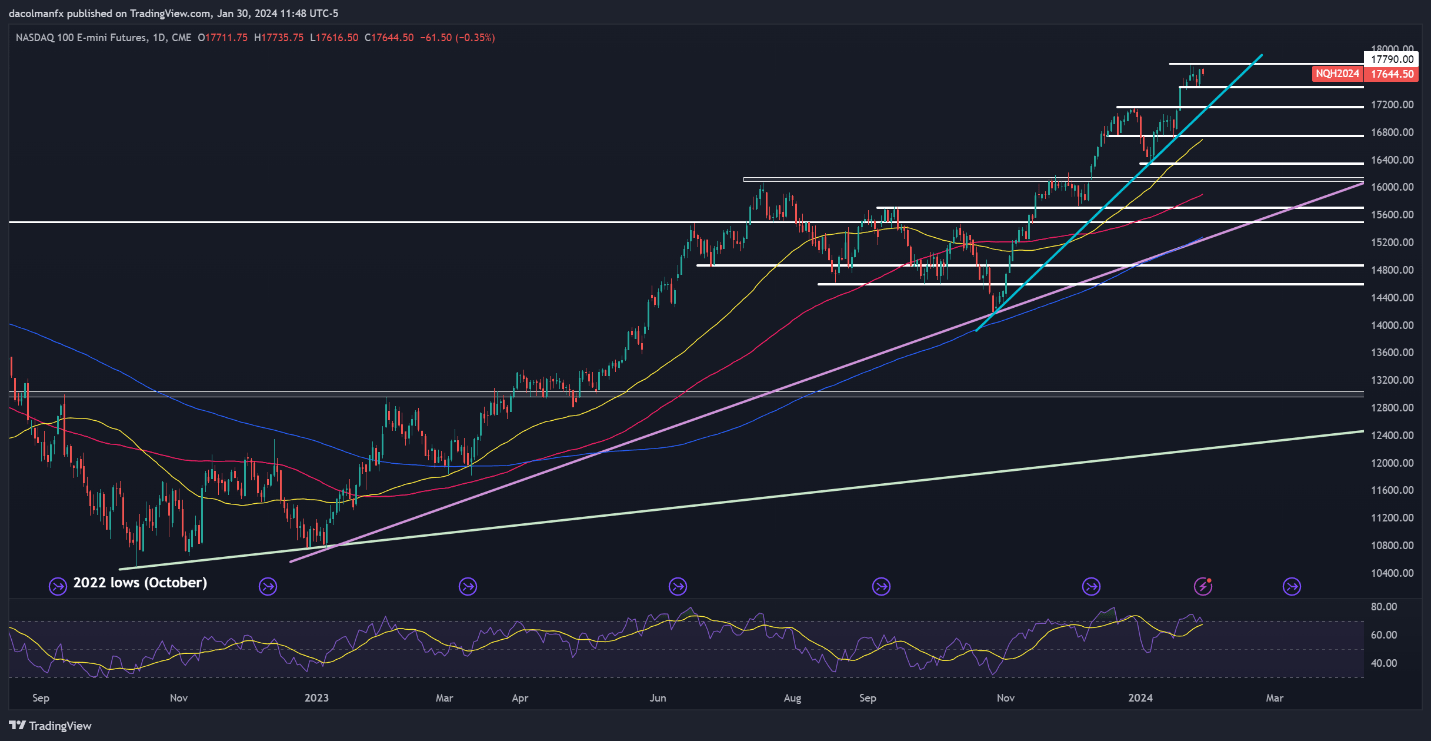

NASDAQ 100 TECHNICAL ANALYSIS

While the Nasdaq 100 remains entrenched in a solid uptrend, there are signs that a correction could be on the horizon in light of overbought market conditions and the index’s proximity to a significant resistance zone near 17,790. In the event of a large pullback, support lies at 17,450, followed by 17,150.

Conversely, if the bulls maintain their dominance in the market and successfully propel prices above resistance at 17,790, FOMO mentality is likely to pull skeptical investors off the sidelines and boost sentiment, setting the stage for a possible rally above the psychological 18,000 level.

NASDAQ 100 TECHNICAL CHART

[ad_2]

Source link