[ad_1]

Gold, XAU/USD, Silver, XAG/USD – Technical Outlook:

- Gold and silver continue to tread their respective ranges.

- On their own, this month’s gains in XAU/USD and XAG/USD are not enough to suggest that the outlook for precious metals has changed to bullish.

- What are the key levels to watch?

Recommended by Manish Jaradi

How to Trade Gold

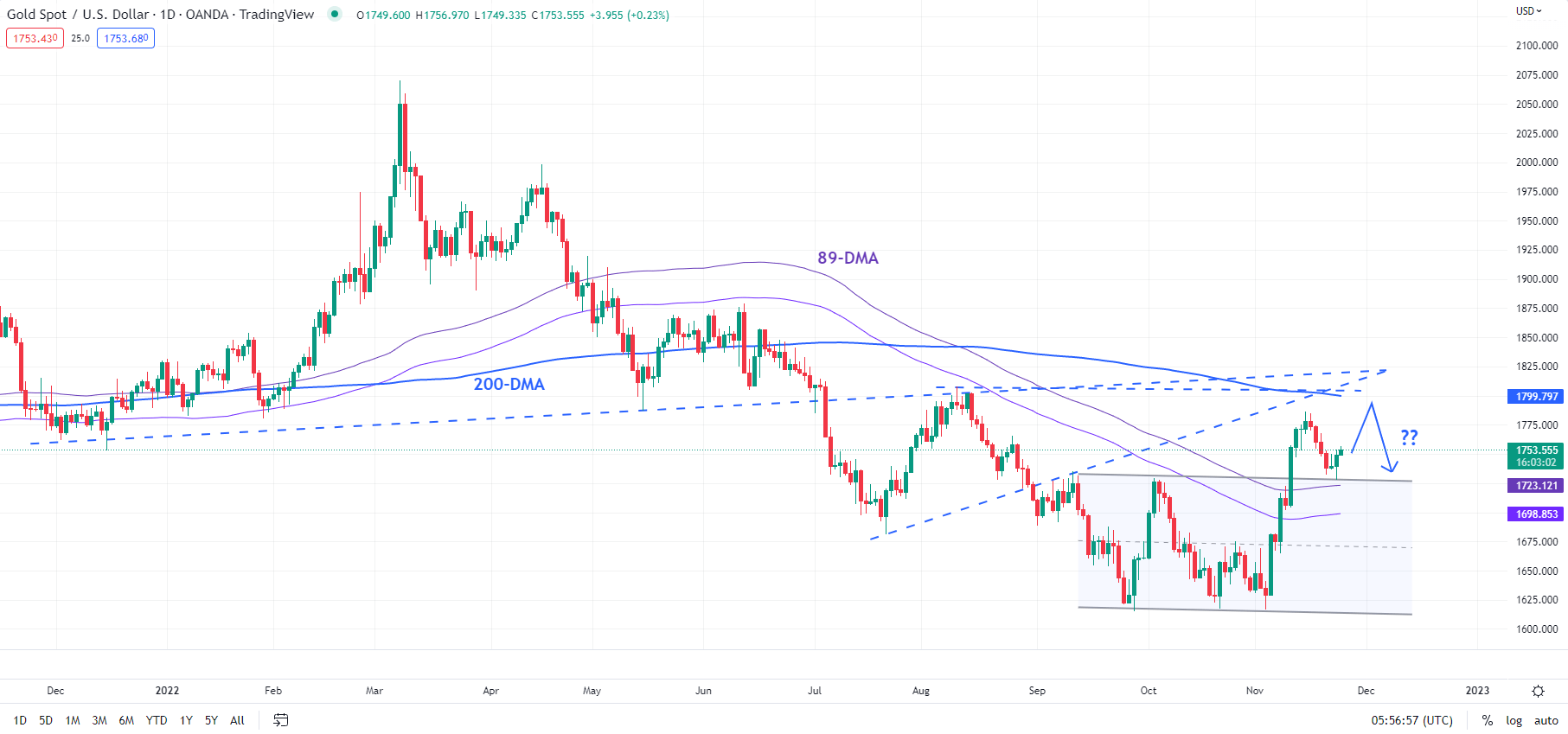

GOLD SHORT-TERM TECHNICAL OUTLOOK – NEUTRAL

The limited retreat this week and still-buoyant momentum suggest that gold could make one more attempt to test key resistance that has been held so far this month.

Last week, XAU/USD turned lower from near a key barrier,a bit earlier than anticipated. The converged ceiling is at 1800-1820, which includes the 200-day moving average and at least three trendline resistances – one from the end of 2021, another from July, and the third from August.

XAU/USD Daily Chart

Chart Created Using TradingView

This follows a break earlier in the month above a key ceiling at the October high of 1729, confirming that downward pressure has faded for now. It is the first time since April that the yellow metal has crossed above an important pivot/price high.

Despite the recent retreat, gold has held a vital cushion – the resistance-turned-support at 1729, roughly around the 38.2% retracement of the November 3-15 rise. Given that the Moving Average Convergence Divergence (MACD) indicator is comfortably in positive territory (indicating that the trend is up), a retest of 1800-1820 can’t be ruled out.

While short-term dynamics point to a ranging scenario, it remains unclear if the rebound this month is a precursor to a reversal (of the downtrend) or a corrective rally given the steep losses this year. In the context of a multi-week picture, the trend remains down.

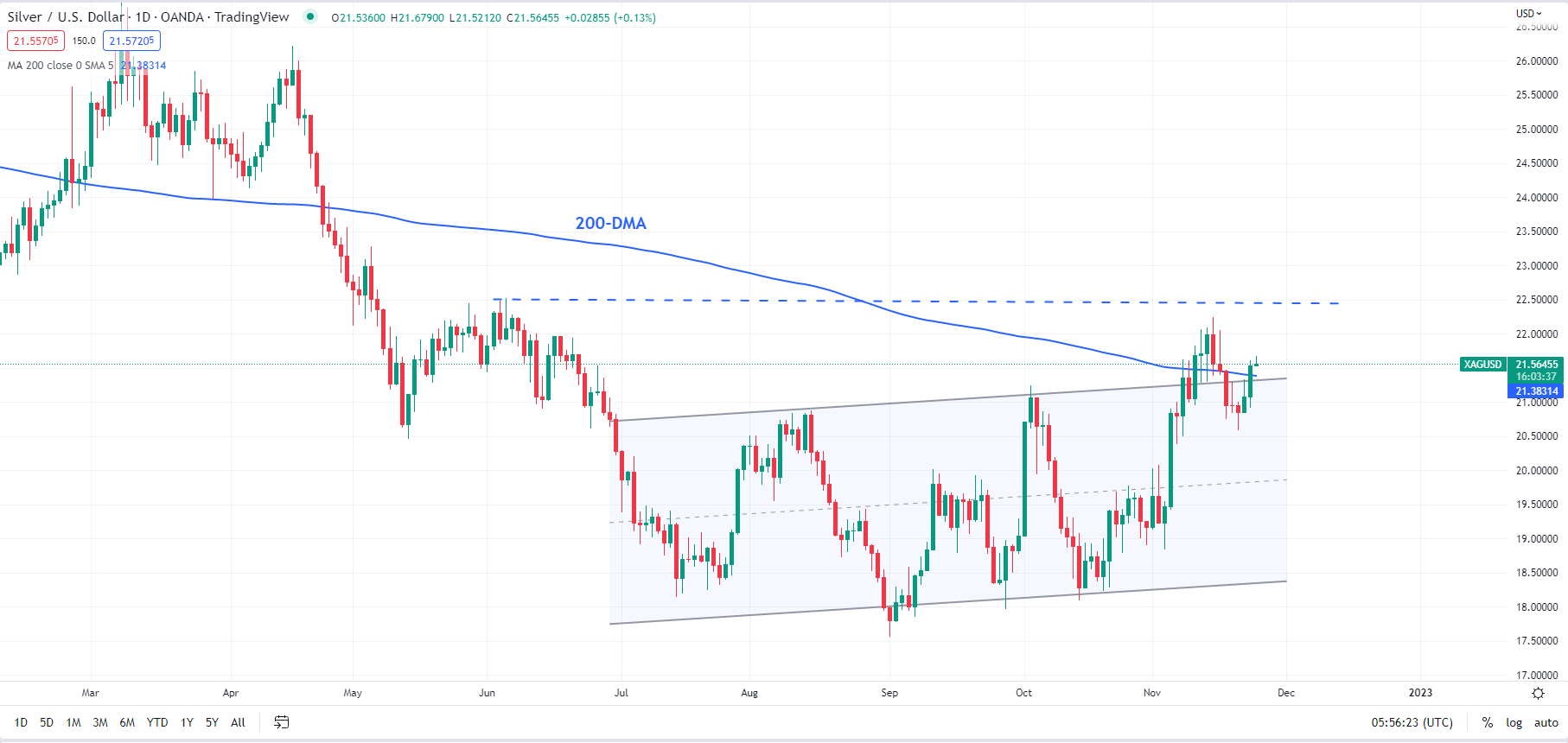

SILVER SHORT-TERM TECHNICAL OUTLOOK – NEUTRAL

While gold has managed to stay under the 200-day moving average, its peer silver briefly rose above the long-term average but failed to stay there. The bearish reversal on November 15, highlighted in last week’s update, has kept a lid on the precious metal.

XAG/USD Daily Chart

Chart Created Using TradingView

The long-term average in XAG/USD is roughly around another hurdle at the top edge of a slightly upward-sloping channel from August, but slightly below the June high of 22.50. This barrier is critical for the short-term outlook. A decisive break above it could clear the path for further gains in XAG/USD.

On the downside, a cross below Monday’s low of 20.55 would reaffirm the range bias in the near term.

Recommended by Manish Jaradi

The Fundamentals of Range Trading

— Written by Manish Jaradi, Strategist for DailyFX.com

[ad_2]

Source link