[ad_1]

GOLD OUTLOOK

- U.S. inflation in focus tomorrow.

- XAU/USD testing key area of confluence.

- IG client sentiment: Bearish.

XAU/USD FUNDAMENTAL BACKDROP

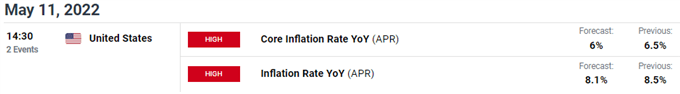

Tomorrow’s U.S. inflation print is expected to come in lower than prior (see calendar below) which has sparked a reaction from markets around the U.S. economy possibly reaching its inflationary peak.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

This would be welcomed by the Federal Reserve and should lower rate hike expectations. We have already seen the Fed’s Bostic (Atlanta Fed President) state his preference for 50bps hikes yesterday, which could see more followers later tonight as a host of Fed speakers are scheduled.

Gold being considered an inflation hedge by many, will lose its allure however, real yields may look to increase as the impact of inflation decreases. Real yields are highly correlated to the yellow metal and rising real yields traditionally point to lower gold prices – the opportunity cost of holding gold increases making it less attractive to investors. This being said, U.S. Treasury yields may also fade somewhat but real yields should remain on the up.

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily gold price action shows the medium-term trendline support zone under pressure for the fourth time since August 2021 and a break below (coinciding with the 1850.00 psychological level) could incentivize a significant move lower.

While the Relative Strength Index (RSI) remains close to oversold territory, there is still room for further price depreciation. The key will be a daily candle close below the aforementioned support zones before looking at any additional price fall.

Resistance levels:

- 1900.00

- 100-day EMA (yellow)

Support levels:

- 1844.60/200-day SMA/trendline support

- 1832.51 (23.6% Fibonacci)

- 1800.00

IG CLIENT SENTIMENT POINTS TO SHORT-TERM WEAKNESS

IGCS shows retail traders are currently distinctly LONG on gold, with 83% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a downside bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Source link