[ad_1]

One of the biggest scams in crypto now is rug pulls, in which investors put money into a project — such as NFTs — with an expectation of receiving something in particular, only to be met with broken promises. For instance, the makers of the $SQUID token, based on the popular South Korean television show “Squid Game,” absconded with more than $3 million without delivering anything. Blockchain analytics firm Chainalysis calls rug pulls “the biggest threat to trust in cryptocurrency” and says that, in 2021, rug pulls accounted for $7.7 billion in stolen crypto.

But the combination of a popular crypto trend along with concomitant scams has come around before. In 2017, at the time of the first major crypto craze, investors were throwing money into initial coin offerings (ICOs).

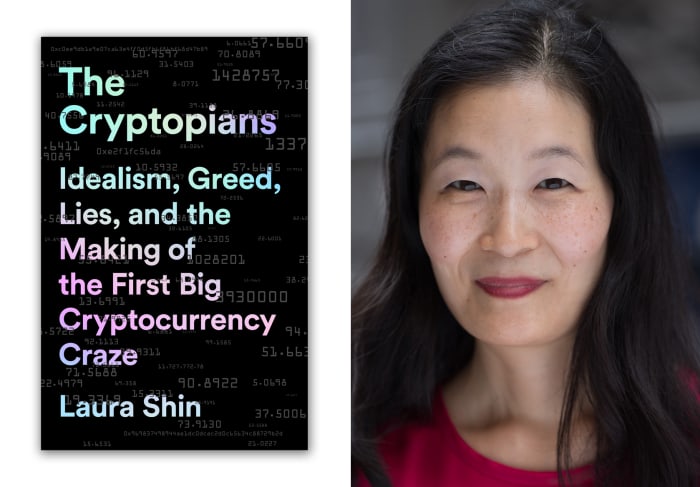

As depicted in my new book, “The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,” the early ICOs were primarily done by true crypto enthusiasts with at least a vision for a truly decentralized application. However, once people realized that it was possible to raise money from everyday investors by promising to build a new crypto token, suddenly a lot of get-rich-quick types dived in, preying on people who were, themselves, gambling in hopes of a massive payday.

By the end of 2017, $5.6 billion had poured into ICOs, as people sent bitcoin

BTCUSD,

and ether, the asset native to Ethereum

ETHUSD,

from their crypto wallets into the hands of both seriously intentioned innovators and unscrupulous opportunists.

Scammers took advantage of the money sloshing around and the crypto newbies. Some created fake websites that looked exactly like legitimate websites. There, they’d trick people into giving away the private keys to their crypto wallets. Others join Slack groups dedicated to these coins, created fake identities, and sent fake urgent notices that would utilize FOMO to trick people into giving away their private keys.

That year, in mid-September, when the speculative party was in full swing, a security company estimated that 17,000 victims had fallen for such scams.

If you are new to crypto, it’s important to remember some basic security practices to ensure that your first forays don’t end in an unintentionally cleaned-out wallet. Here are three tips you can use to navigate crypto safely and securely:

1. Don’t put in more money than you can afford to lose.

Crypto is different from other kinds of digital money. When you log into your bank account and move money around, that’s not actually digital money. It’s analog money overlaid with a digital veneer. If you do something that results in the loss or theft of that money, you can ask your bank or other financial institution to help you recover it.

Crypto, on the other hand, and this includes similar objects such as NFTs, are truly digital objects, and they function more like digital cash. If you lose it, it’s finders, keepers. There is no centralized authority to manage all the money or recover lost value for you. Since the movement of crypto is tracked on decentralized ledgers known as blockchains, there’s no central authority that can change the ledger for you. The only way you’d receive any lost funds is if your hacker or phisher or scammer decided to send it back to you (which, since this is the crazy world of crypto, has actually happened, but I wouldn’t bank on it).

When you’re first starting out, your intention should be to put in some amount of money in order to learn how to transact safely and securely in crypto — to adopt the sort of behaviors you’ll need to use going forward in order not to lose your precious tokens. Think of your first forays as educational investments, so if you do get rug pulled, it will merely sting.

2. Learn the security models in crypto and choose what works best for you

In your experiments, try securing your coins different ways. In crypto, a popular mantra is “Not your keys, not your coins.” This refers to crypto exchanges being hacked, leading to many users losing some or all of their coins. If a third party is holding the private keys to your coins, you’ve effectively delegated security to them, which means that you’re out of luck if they mess up.

PublicAffairs

While a number of people therefore prefer to secure their own coins, that also has its risks. There are famous tales of people who, in their attempts to secure their crypto stash from hackers, have instead locked themselves out. They misplace passwords or throw away hard drives, while others are too lax with their security and end up being phished out of their money.

There’s no one right way for everyone to safekeep their crypto, but have a sense, based on your personality and lifestyle, which model would work best for you. If you choose a hybrid model, determine how much to keep on an exchange or under your own watch and for what purpose.

3. Do your own research

It surprises me how many people, especially acquaintances who barely know me, ask me which cryptos they should buy. Let’s say that I were unwise enough to recommend something specific. If these people then bought that coin, they would have no idea what news would be a good reason for them to sell, nor would they know how this fit into their overall portfolio, nor would they know on what time horizon they should be holding that crypto.

If you’re blindly following someone else’s advice for your investments, who will you blame if they go south? The person who recommended that coin, or yourself for not understanding what you were buying?

Just like anything else you would put your money into, you should have an understanding of why you’re buying a specific crypto asset or NFT. What does it do? How does it differ from other cryptos? Why is this one more likely to succeed than another? What news event would make you rethink your investment and sell?

If there’s anything I’ve learned in seven years of covering crypto, it’s that this is a wild new world. If you don’t take it too seriously and don’t risk too much, it can be intellectually stimulating and enjoyable. Especially if you know how to transact safely.

Laura Shin writes about crypto and hosts the Unchained podcast. She is the author of “The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze” (PublicAffairs, 2022).

More: Before you buy bitcoin, answer these 4 overlooked yet crucial questions

Also read: The real-life ‘Wolf of Wall Street’ is now a crypto guru. That’s a sign of a looming reckoning.

[ad_2]

Source link