[ad_1]

Artificial Intelligence is not only the latest and hottest stock-market buzz term, it promises to lead a long-term drive toward new capabilities and efficiency. Some people are already frightened of the new technology and some are already making a lot of money from it.

The broad stock indexes are heavily loaded with the largest AI players. You’re already in, and this concentration is likely to increase if you are an index-fund investor. But there are ways to change your exposure to AI, to diversify your exposure while making a broader play on the technology’s deployment, as explained by Ken Laudan of Buffalo Funds and Sean O’Hara of Pacer ETFs.

Nvidia Corp.

NVDA,

lighted a fire under investors, with its shares popping 25% in after-hours trading on Wednesday after the company reported a 13% decline in sales for the first quarter of its fiscal 2024 (ended April 30) from the year-earlier quarter to $7.19 billion, along with a 28% increase in earnings to 82 cents a share. The company, which has been known for leading the market for high-end PC graphics processors, now has what its CEO calls a “killer app” — graphics processing units (GPU) used in AI data processing.

Investors were amazed when Nvidia’s chief financial officer Colette Kress said AI was at an “inflection point” and that fiscal second-quarter revenue was “expected to be $11 billion plus or minus 2%.” If we take out that 2%, we will have sales of $10.78 billion for the fiscal second quarter, for a 50% sequential increase and a 30% increase from a year earlier.

This is nothing short of breathtaking. Now let’s look at three charts for Nvidia. First, its share-price movement from the end of 2021 through the market close on Wednesday:

FactSet

Nvidia’s share price dropped 50% during 2022. This year through Wednesday, the stock had risen 109% and it closed slightly higher than it is price at the end of 2021.

Keep in mind these charts don’t reflect the price action following Nvidia’s announcement, which was made following Wednesday’s close.

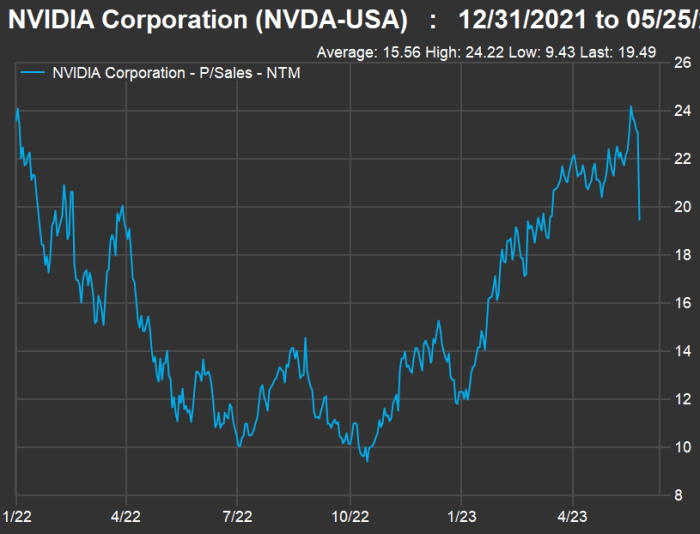

Now let’s take a look at the movement of forward price-to-sales ratios for the stock, based on rolling 12-month consensus earnings-per-share estimates among analysts polled by FactSet:

FactSet

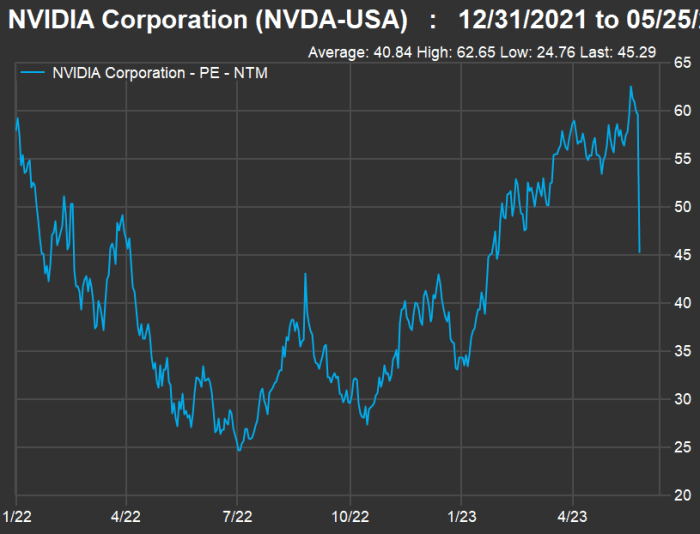

And now forward price-to-earnings ratios:

FactSet

These are high valuations, and they haven’t baked-in all the changes in analysts’ estimates that will follow the Wednesday report from Nvidia — or the share-price pop. But it is interesting that the P/E ratio is only 2.3 times the price-to-sales ratio. For the S&P 500

SPX,

the forward P/E of 18.1 is eight times the forward price-to-sales ratio of 2.2. For the S&P 500 information technology sector, the forward P/E is 25.1, which is more than four times the sector’s forward price-to-sales ratio of 4.3.

Read: ‘Unprecedented’ and ‘unfathomable.’ Nvidia makes jaws drop on Wall Street as stock explodes higher.

This underscores how profitable Nvidia is. For the fiscal first quarter, the company net income margin (earnings divided by sales) was 28%, up from 20% a year earlier.

More Nvidia coverage:

- After Nvidia’s blowout guidance, here is the percent of revenue other companies will get from AI this year.

- Nvidia barrels toward rare $1 trillion valuation after putting a doportfolllar figure on AI boost

Your AI exposure and other ways to play the budding industry

Ken Laudan is the portfolio manager of the Buffalo Large Cap Fund, which is rated four stars (out of five) by Morningstar for its investor share class

BUFEX,

and three stars for its institutional share class

BUIEX,

The institutional shares have annual expenses of 0.78% of assets under management, which is lower than the 0.93% expense ratio for the institutional shares. But the institutional shares have a lower rating because they have only been available since July 2019.

During an interview, Laudan pointed out that the Buffalo Large Cap Growth Fund’s benchmark, the Russell 1000 Growth Index

RLG,

is already heavily weighted toward technology companies that seem to be getting more focused on AI every day. Together, Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Alphabet Inc.

GOOGL,

GOOG,

and Nvidia make up 26.5% of the portfolio of the iShares Russell 1000 Growth ETF

IWF,

Add Apple to those four companies and the percentage for the top five companies in the Russell 1000 climbs to 39.4%.

Meta Platforms Inc.

META,

makes up only 0.58% of the Russell 1000 right now, but Laudan expects this percentage to climb close to 3% when the index is rebalanced in June, taking this group of six companies to well over 40% of the index. He expects Meta to reverse its market-share decline over the past two years, and believes the company is “leveraged to AI benefits.”

“Meta has said 40% of time spent on Instragram springs from AI suggestions.,” he said.

And if you are invested in an S&P 500 index fund, you also have high concentration in these six companies, which make up nearly 25% of the SPDR S&P 500 ETF Trust

SPY,

When discussing Nvidia, Laudan said “nobody is better positioned to extract money from AI.”

“But it has 90% of datacenter GPUs today,” he added. So the question is whether or not a lower-cost competitor can move into the space.

He suggested that investors holding individual stocks think carefully about how companies will be affected by AI. The stock market always looks ahead, and can react quickly to any hint of a problem. Laudan named Chegg Inc.

CHGG,

as an example. Shares of the online education services provider fell 48% on May 2 after Chegg said student interest in ChatGPT was lowering its subscription growth rate.

Microsoft has been a major investor in OpenAI, the developer of ChatGPT.

“Beyond capturing the early-market leadership position, Microsoft has an enormous opportunity to accelerate its own organic growth rate with the remarkable thrust of AI,” Laudan said. For example, with an estimated 300 million Office 365 subscribers, Microsoft will be able to charge more for some of them to use its 365 Copilot, which according to the company can enhance creativity while also making it easier for users to produce a variety of document types in Word and make better use of analysis with Excel.

Getting back to competition, Laudan acknowledged the leading positions of the largest tech companies, but he also said that, so far, they had been “swimming in their own lanes.” There may some crossover and greater competition, and he wants to “sort some of that out before moving to overweight positions [relative to the Russell 1000] in any of those names.

Laudan said that the potential problems with AI underscored the need for regulation. He said political leaders “need to get it right from the beginning.” When asked how it could be possible for legislators to address unknown threats, he said “part of that is being adaptive and then to elevate as you learn more.”

Three providers of network security products and services are Palo Alto Networks Inc.

PANW,

CrowdStrike Holdings Inc.

CRWD,

and Fortinet Inc.

FTNT,

“They are all incorporating AI into their cybersecurity technologies,” he said.

He mentioned two other companies benefiting from the implementation of AI: Accenture PLC

ACN,

which provides various services to help corporate customers adapt to new technologies, and Arista Networks Inc.

ANET,

whose ethernet switches can help companies to scale-up AI. But he added that both companies were more likely to hit growth inflection points in 2024 than in 2023.

A different approach: nuts and bolts of AI

Sean O’Hara, the president of Pacer ETF Distributors believes investors should look to gain exposure in related industries that will benefit from the rollout of AI as companies try to use the new technology to become more efficient.

“In order for that to happen, the world needs massive amounts of additional computing supply. That supply will be fulfilled by the data centers and the components manufacturers that supply the servers that power the cloud and many other technologies,” he said during an interview.

Two of Pacer’s exchange-traded funds can fit the bill, with exposure to different industries tied to AI.

O’Hara described the $635 million Pacer Data & Infrastructure Real Estate ETF

SRVR,

as a “less correlated” play on AI. The exchange-traded fund holds shares of real-estate investment trusts and other companies that own and lease data centers and cell towers. The portfolio is concentrated, with only 17 stock holdings, which are weighted by market capitalization. Holdings are limited to 10% of the portfolio when it is rebalanced quarterly. Here are its largest 10 holdings:

| Company | Ticker | Country | % of portfolio |

| Equinix Inc. |

EQIX, |

U.S. | 16.6% |

| American Tower Corp. |

AMT, |

U.S. | 15.7% |

| Crown Castle Inc. |

CCI, |

U.S. | 14.3% |

| Cellnex Telecom S.A. |

CLNX, |

Spain | 5.3% |

| Iron Mountain Inc. |

IRM, |

U.S. | 5.1% |

| Infrastructure Wireless Italiane S.p.A. |

INW, |

Italy | 5.0% |

| Keppel DC REIT |

AJBU, |

Singapore | 5.0% |

| Chorus Ltd. |

CNU, |

New Zealand | 4.9% |

| SBA Communications Corp. Class A |

SBAC, |

U.S. | 4.6% |

| SES SA FDR (Class A) |

SESG, |

Luxembourg | 4.3% |

| Source: Pacer ETFs | |||

Click on the tickers for more about each company, ETF or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

For exposure to manufacturers of components needed for the AI rollout, the Pacer Data and Digital Revolution ETF

TRFK,

focuses on companies in developed markets that derive at least 50% of revenue from “the use, transmission or storage of data and the ancillary services that enable these processes.” TRFK was launched in June, so it is still very small. It is weighted by market capitalization with limits to avoid overconcentration.

Here are its largest 10 holdings (out of 80), which all happen to be U.S. companies:

| Company | Ticker | % of portfolio |

| Nvidia Corp. |

NVDA, |

10.3% |

| Broadcom Inc. |

AVGO, |

9.8% |

| Cisco Systems Inc. |

CSCO, |

6.9% |

| Advanced Micro Devices Inc. |

AMD, |

6.1% |

| Palo Alto Networks Inc. |

PANW, |

4.5% |

| Intel Corp. |

INTC, |

4.2% |

| Snowflake Inc. Class A |

SNOW, |

4.2% |

| VMware Inc. Class A |

VMW, |

3.9% |

| Fortinet Inc. |

FTNT, |

3.8% |

| Motorola Solutions Inc. |

MSI, |

3.5% |

| Source: Pacer ETFs | ||

Don’t miss: 20 AI stocks expected to post the highest compound annual sales growth through 2025

[ad_2]

Source link