[ad_1]

IMF World Economic Outlook Overview

- IMF upgrades global growth as ‘soft landing’ hopes gain traction

- Oil and gold receive a minor lift in the moments after the release. AUD/USD undecided

- Major risk events ahead: BoE, Fed rate decisions, Mega-cap earnings and NFP

- Stay up to date with the major considerations for equity markets in the first quarter of the year by downloading our dedicated equities forecast for Q1 below:

Recommended by Richard Snow

Get Your Free Equities Forecast

IMF Upgrades Global Growth as ‘Soft Landing’ Hopes Gain Traction

The International Monetary Fund, or IMF, upgraded its outlook on global economic growth as major economies reveal their resilience. Disinflation also continues to push prices lower, supporting a potential soft landing in 2024 while acknowledging risks related to geopolitical conflicts which could affect global trade. In addition, the IMF also highlighted the potential for stubborn price pressures if reducing interest rates loosens financial conditions too much.

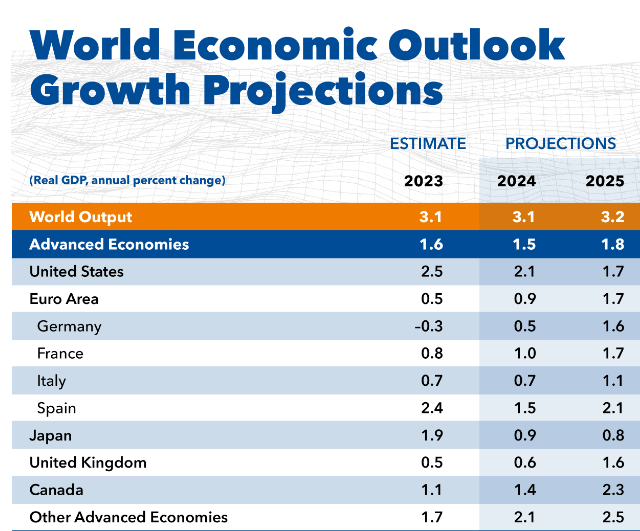

The IMF provided an update on its global growth forecast, seeing the 2024 estimate rise from 2.9% back in October, to 3.1%. The organisation foresaw greater than expected resilience in the US, seeing its estimate for growth in 2024 rise from 1.5% to 2.1% for 2024. The organisation also acknowledged China’s fiscal efforts to jump start the local economy, seeing estimated growth rise from 4.2% to 4.6% this year.

IMF Upgrades its Global Economic Outlook

Source: IMF World Economic Outlook

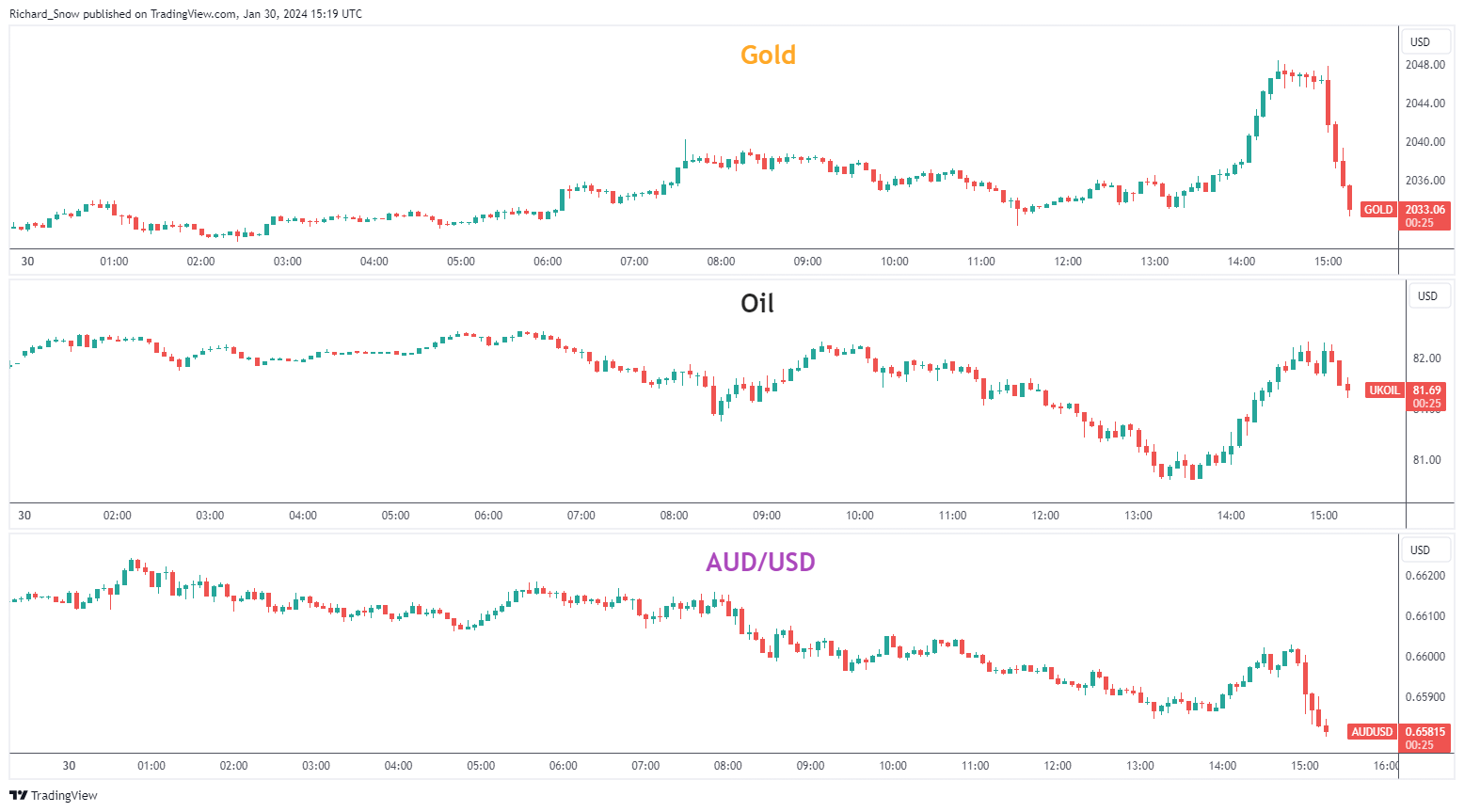

Markets have responded positively as gold and oil both moved higher in the wake of the update, although, gold has since reverted back to prices observed before the report was released. Oil received a boost, and remains a market filled with complexity amid supply chain uncertainty along the Red Sea and a rosier global economic outlook. API data later today, EIA storage figures and the NFP print on Friday provides oil traders with lots to think about this week.

AUD/USD, the last chart shown below, is generally reflective of risk sentiment and hadn’t really seen a long-lasting advance in the minutes after the IMF’s update. The Aussie dollar is procyclical in nature which means it exhibits a strong correlation with the S&P 500, although this has weakened recently and may be something to keep an eye on if Aussie/China fortunes deteriorate in relation to the US.

Multi-Asset Performance in the Moments Following the IMF’s Global Growth Upgrade

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link