[ad_1]

USD/JPY Analysis, Charts, and Prices

Japanese Yen Prices, Charts, and Analysis

- Verbal central bank intervention boosts the Japanese Yen.

- US PCE (13:30 UK) will be the next driver of US dollar price action.

Download our Complimentary Q1 2024 Technical and Fundamental Japanese Yen Guide

Recommended by Nick Cawley

Get Your Free JPY Forecast

Bank of Japan board member Hajime Takata said today that the central banks’ goal of 2% inflation is ‘finally in sight’, that it is ‘necessary to consider shifting gears from extremely powerful monetary easing’, and that the BoJ should ‘respond nimbly and flexibly toward an exit.’ This hawkish, verbal intervention sent the Japanese Yen higher on the session, with USD/JPY hitting a near two-week low. Market pricing now shows a 61.5% chance of a 10 basis point rate hike at the April BoJ meeting, a 72% chance of a hike at the June meeting, and a 84% chance at the July meeting.

While the Japanese Yen has picked up a bid, the US dollar remains in a holding pattern ahead of today’s PCE inflation report. Core PCE y/y is seen nudging 0.1% lower to 2.8% in January, while PCE price index is seen at 2.4%compared to 2.6% in December.

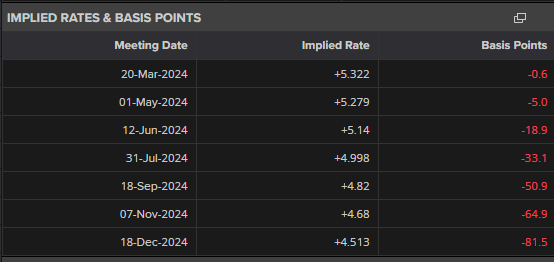

Core PCE is the Fed’s preferred measure of price pressures and any move higher in either of the headline figures will add weight to the Federal Reserve’s current stance of keeping rates at their current levels for longer. The US central bank has been successful this year in tempering aggressive rate cut expectations with the market now in line with the Fed’s thinking of three 25 basis point rate cuts, with the first move fully priced in at the July meeting.

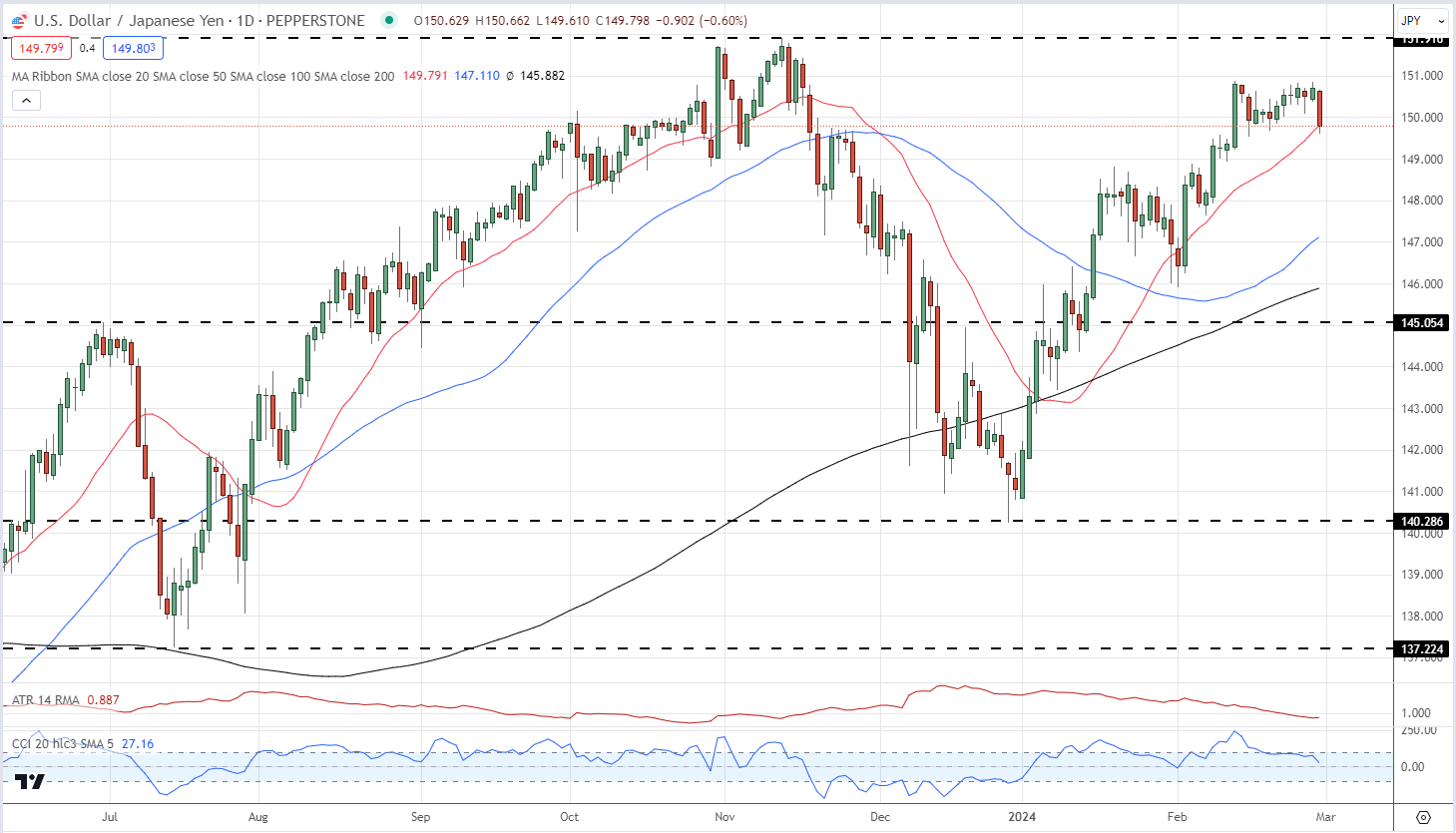

Today’s verbal intervention has likely capped USD/JPY at the 151 level for the immediate future. Lower USD/JPY was one of the market’s consensus trades for 2024 and while the pair have moved higher so far this year, it is looking likely that the path of least resistance is lower. Today’s PCE report may move the US dollar higher if inflationary pressures remain, but this is likely to be a short-term move, especially now that the market has re-priced US rate cuts. Below 149.00 there is a cluster of recent highs and lows and both the 50- and 200-day simple moving averages guarding the 145 level.

USD/JPY Daily Price Chart

Retail trader data shows 25.73% of traders are net-long with the ratio of traders short to long at 2.89 to 1.The number of traders net-long is 1.43% lower than yesterday and 2.28% lower than last week, while the number of traders net-short is 5.35% lower than yesterday and 3.41% lower than last week.

Download the Latest IG Sentiment Report to see why daily/weekly changes affect the USD/JPY price outlook

| Change in | Longs | Shorts | OI |

| Daily | 0% | -5% | -4% |

| Weekly | 1% | -1% | -1% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link