[ad_1]

JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

- The Yen appears Vulnerable to Further Selling Pressure Following Comments from BoJ Governor Ueda. No More Pivot Hopes?

- RSI Approaching Overbought Territory for All Three JPY Pairs and Thus a Retracement Cannot be Ruled Out.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Read More: GBP/USD Price Forecast: Markets Appear Cautious as 50-Day MA and 1.2400 Support Level Hold Firm

JAPANESE YEN BACKDROP

The Japanese Yen had seen its sustained weakness of late as markets digest comments from the BoJ Governor, inflation data and more recently improving wage data as well. Inflation data came in extremely hot on Friday but unlike many Central Banks isn’t really guiding policy at this stage.

Comments in the aftermath of the release from Governor Ueda have further weighed on the safe have Yen. The Governor stated that he sees inflation at the Central Banks 2% target in the middle of the current fiscal year while ruling out monetary policy tightening. Ueda said that any further tightening in response to the inflation print would only hurt the economy.

The weakness in the Yen is likely to continue with other major Central Banks like the ECB and BoE still planning at least one more rate hike while Fed Policymakers have been striking a rather hawkish tone. This is in complete contrast to Fed Chair Jerome Powell who on Friday struck a dovish note in his comments.

Recommended by Zain Vawda

The Fundamentals of Trend Trading

PRICE ACTION AND POTENTIAL SETUPS

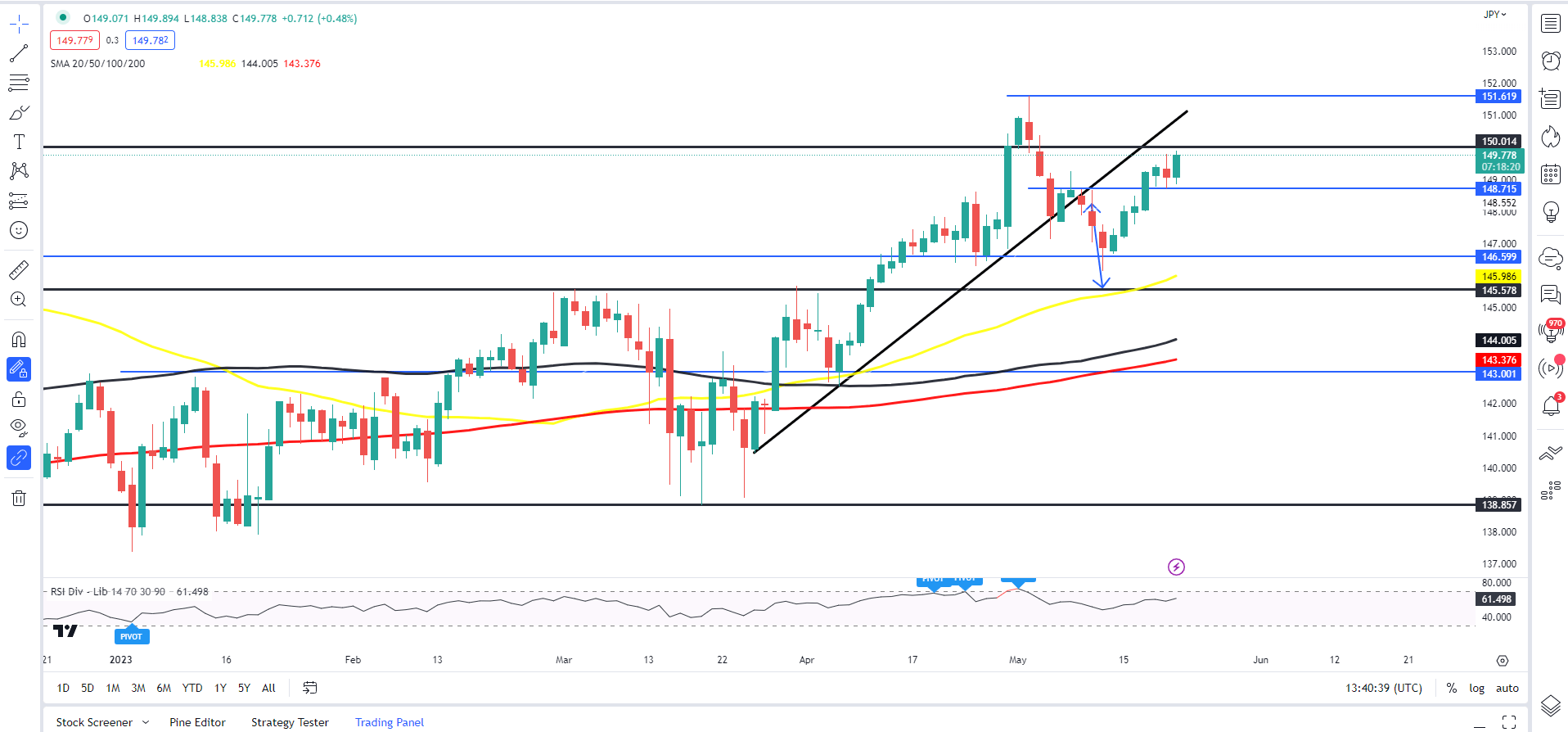

EURJPY

EUR/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

EURJPY continued its upside rally today following Friday’s brief pause and consolidation. We have pushed higher today within a whisker of the 150.00 psychological level.

It will be interesting to see what reaction we get of the psychological level here if any, with acceptance above leading toward a retest of recent highs around the 151.600. I do not see any reason here to fight the overall bullish trend and would look at any pullbacks as potential for longs. The RSI is nearing overbought condition on the D and could be worth monitoring but I do expect upside continuation for now.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

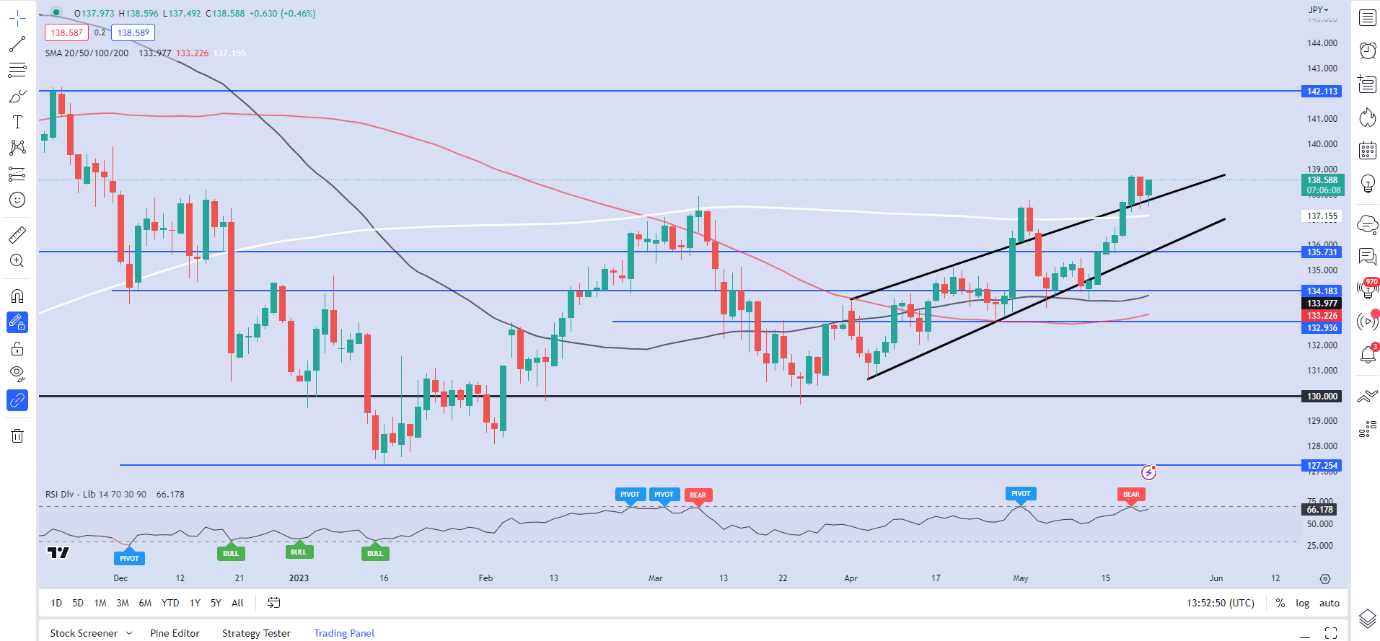

USDJPY

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, the daily chart for USD/JPY looks eerily similar to EUR/JPY. This is a theme across Yen pairs given last week’s rally as you will no doubt see shortly when taking a look at GBP/JPY. The RSI on USD/JPY is a little closer to the overbought region then EUR/JPY and could be monitored for a potential top in the current rally.

Right now, we remain firmly in bullish territory with Friday’s pullback bringing us within a whisker of support provided by the 200-day MA at 137.15. Today’s daily candle is on course to print a bullish engulfing candlestick pattern which would hint at some upside continuation. The 140.00 psychological level being the first area of attention before the November 22 swing high around 142.00 becomes an area of focus.

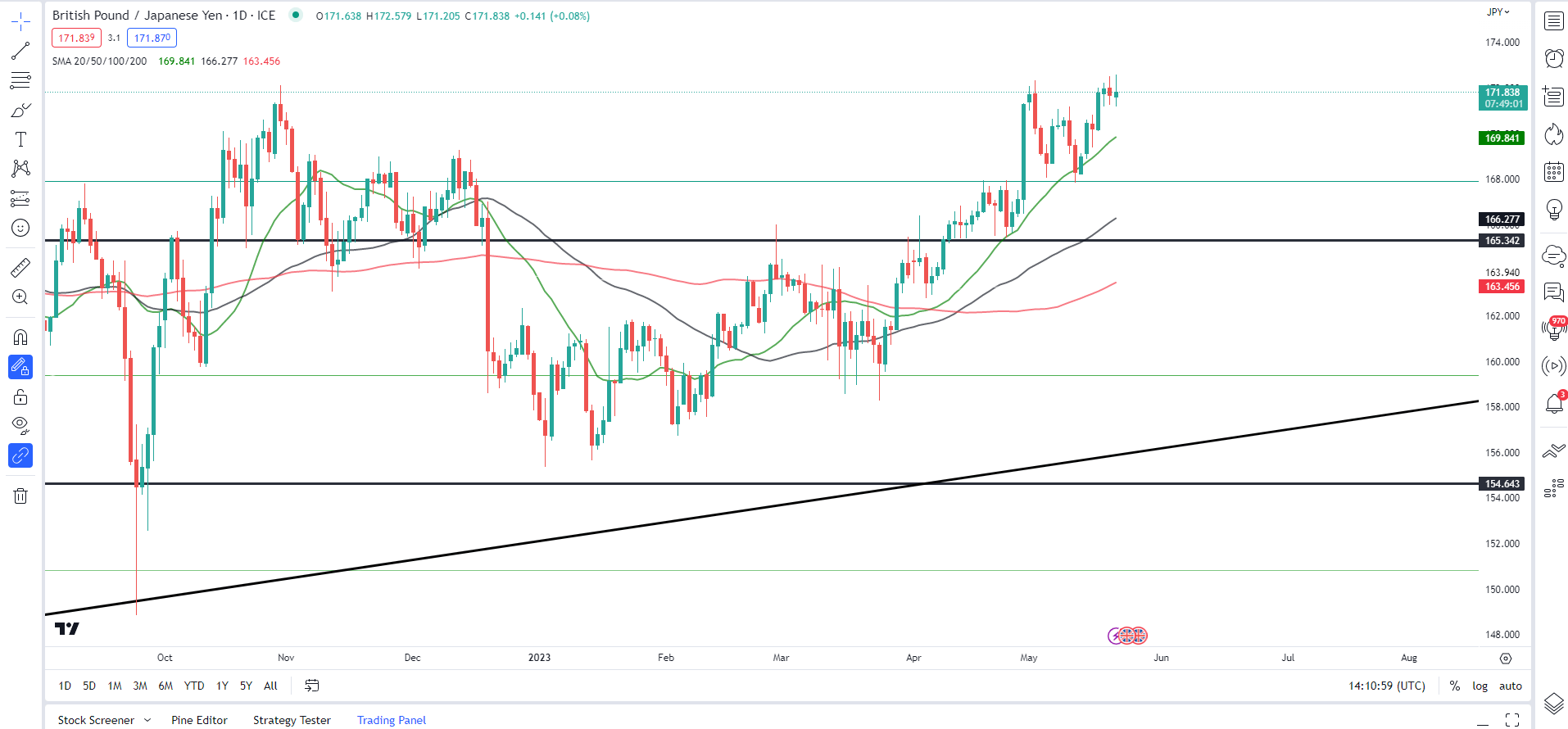

GBPJPY

GBP/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

The GBP/JPY chart is still very bullish on the higher timeframes with a golden cross on the weekly as well further highlighting the momentum. We are getting some UK data this week in the form of UK inflation which could add some volatility.

Much like USD/JPY and EUR/JPY we are seeing near identical price action over the last 5 days or so. The Uptrend remains strong, and it would require a brave soul to go against it at present. Overall technicals and fundamentals both look to be supporting an upside narrative.

We are starting to see some signs that we could be in for a retracement on GBP/JPY with a pullback to the 170.00 before upside continuation not out of the question with the 50-day MA at 169.80 likely to come into play.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link