[ad_1]

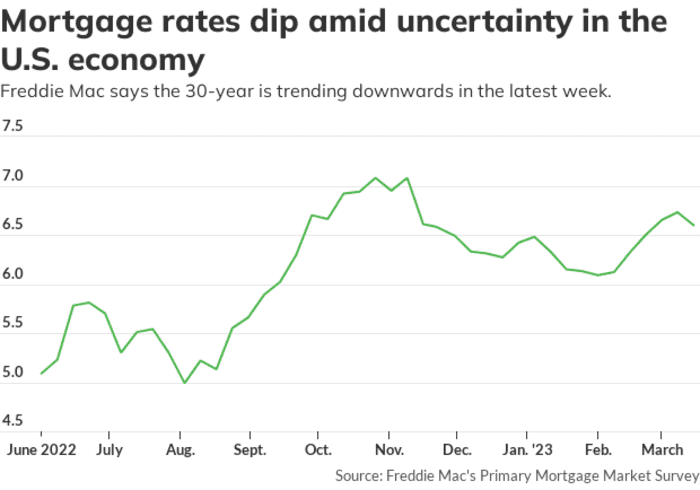

The numbers: Mortgage rates are down for the first time in six weeks, as the U.S. economy deals with bank collapses and an uncertain road ahead.

The 30-year fixed-rate mortgage averaged 6.60% as of March 16, according to data released by Freddie Mac

FMCC,

on Thursday.

That’s down 13 basis points from the previous week — one basis point is equal to one hundredth of a percentage point.

Last week, the 30-year was at 6.73%. Last year, the 30-year was averaging at 4.16%

The average rate on the 15-year mortgage fell to 5.9%, from 5.95% the previous week. The 15-year was at 3.39% a year ago.

Freddie Mac’s weekly report on mortgage rates is based on thousands of applications received from lenders across the country that are submitted to Freddie Mac when a borrower applies for a mortgage.

Separate data by Mortgage News Daily said that the 30-year fixed-rate mortgage was averaging at 6.55% as of Thursday morning.

What Freddie Mac said: “Turbulence in the financial markets is putting significant downward pressure on rates, which should benefit borrowers in the short-term,” Sam Khater, chief economist at Freddie Mac, said in a statement.

Khater urged buyers to shop around for additional rate quotes and not stick with one lender, given the present volatility in mortgage rates.

“Our research concludes that homebuyers can potentially save $600 to $1,200 [per year] annually by taking the time to shop among multiple lenders,” Khater said.

What they’re saying: A drop in rates is boosting mortgage demand, Bob Broeksmit, president and CEO of the Mortgage Bankers Association, said in a statement.

“Anticipated further rate declines may spur additional application gains as the spring home buying season begins,” he added.

Market reaction: The yield on the 10-year Treasury note

TMUBMUSD10Y,

was trading below 3.5% during the afternoon trading session on Thursday.

[ad_2]

Source link