[ad_1]

NATURAL GAS, NG – Outlook:

- Natural gas prices jumped to a ten-week high last week.

- The recent price action raises the odds that base building may have started.

- What is the outlook on natural gas and what are the key levels to watch?

Recommended by Manish Jaradi

Traits of Successful Traders

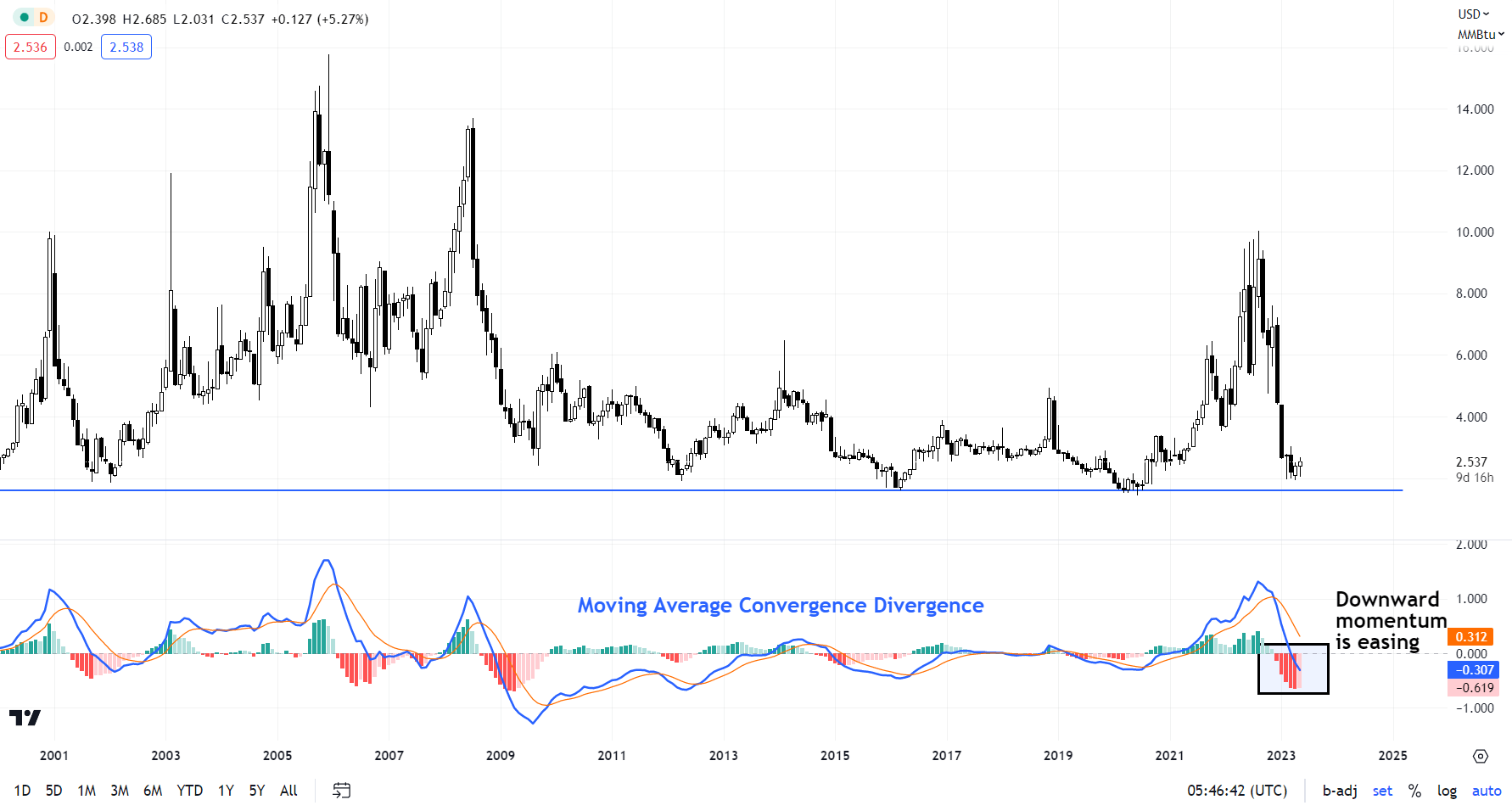

The surge in momentum last week could be an early sign that natural gas may have started to form a base after a prolonged period of weakness.

However, the pace and the extent of the fall from last year imply that any recovery could be ‘two-steps-forward-one-step-back’, rather than a unidirectional rise. Reduced gas exports from Canada due to wildfires in Alberta and other western provinces appear to be the most recent catalyst aiding natural gas. Lower wind power last week leading to higher gas usage to produce electricity also aided prices.

In addition, declining drilling activity on oversupply conditions and tighter credit conditions mean the bar for a further substantial decline in natural gas prices is high. Indeed, in its recent Short-term Energy Outlook, the US Energy Information Administration expects the U.S. natural gas spot price to rise toward 3.71 by December.

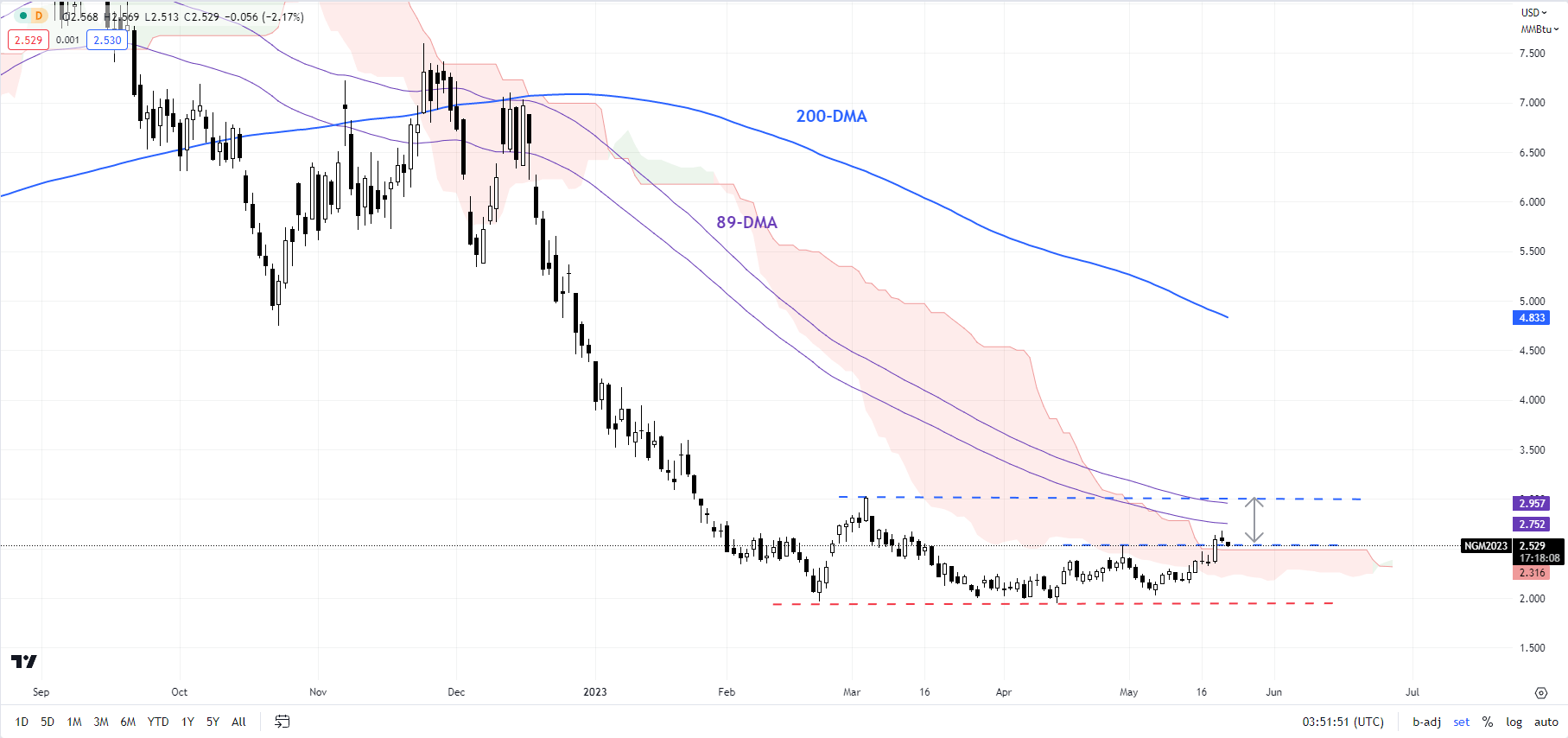

Natural Gas Daily Chart

Chart Created by Manish Jaradi Using TradingView

On technical charts, natural gas is attempting to rise above a crucial barrier at the April high of 2.52, roughly coinciding with the upper edge of the Ichimoku channel on the daily charts. A break above could open the upside toward the March high of 3.03, which could be tough to crack, at least on the first attempt.

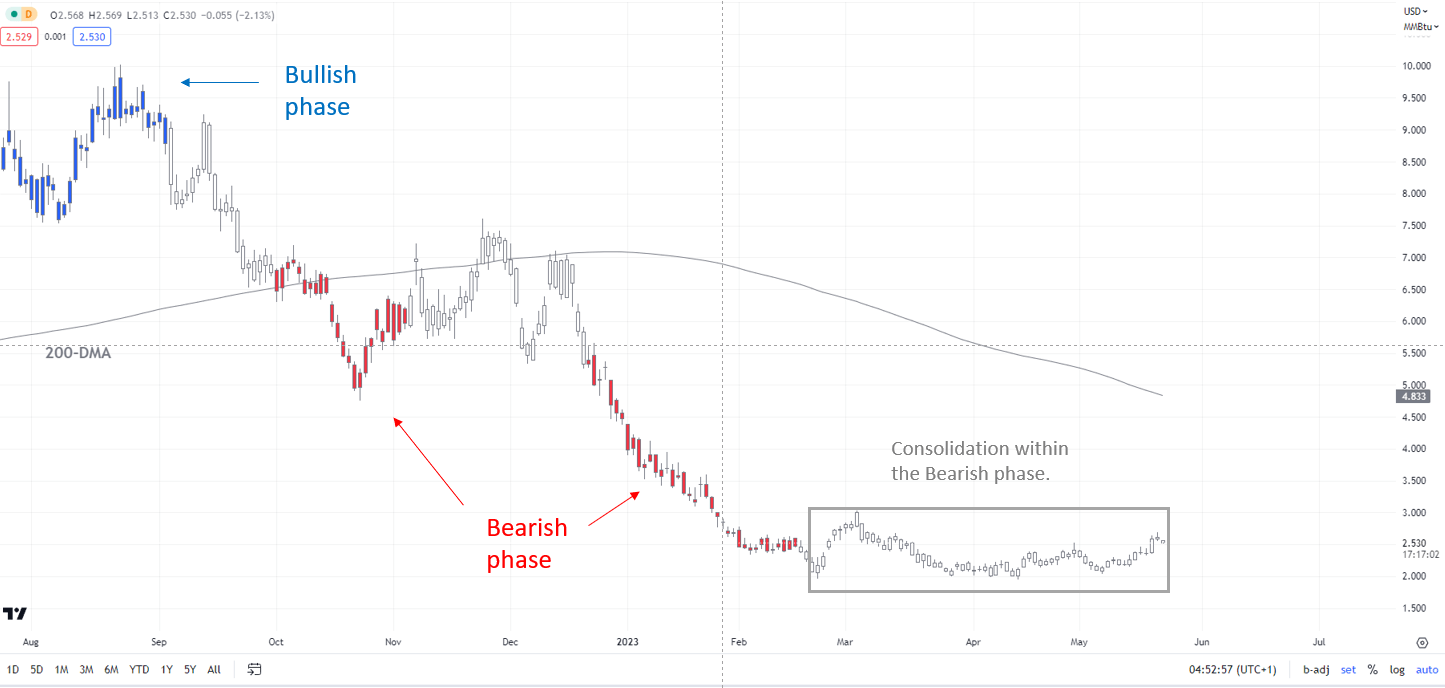

Natural Gas Daily Chart

Chart Created by Manish Jaradi Using TradingView; Notes at the bottom of the page.

Overall, though, the downward pressure in natural gas appears to be fading – see colour-coded candlestick charts based on trending/momentum indicators. Moreover, market diversity had been running at extremely low levels. See “Natural Gas Price Setup: Downward Pressure is Abating”, published April 11, and “Natural Gas Price Rebound Could Extend; What’s Next for Crude Oil?” published May 18.

Natural Gas Monthly Chart

Chart Created by Manish Jaradi Using TradingView

On the downside, natural gas needs to stay above the early-May low of 2.03 for the short-term upward pressure to remain intact. A fall below the support would raise the risk of a renewed leg lower.

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, or around a support/resistance and/or in sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

Source link