[ad_1]

Feeling a little seasick? It’s not just you. Besides turning in a historically ugly performance over the first four months of 2022, stocks have been uncommonly choppy.

“This has become a classic trader’s market as spikes in volatility and increasingly bearish headlines reverberate,” said Quincy Krosby, chief equity strategist for LPL Financial.

Take a look at the tape: Through Friday, the S&P 500

SPX,

had finished with a daily gain or loss of more than 2% 12 times so far in 2022 — 6 up and 6 down. That’s compared with just 7 up or down moves of that magnitude in all of 2021, according to Dow Jones Market Data.

With the exception of 2020, when pandemic-induced volatility produced 44 such days, the S&P 500 has already topped or is on track to exceed totals for 2%-or-greater moves for every year stretching back to 2011.

The swings have felt even more pronounced lately, with three of those 2%-plus sessions coming in the final six trading days of April. That includes a 2.5% Thursday bounce that turned the index positive on the week before a 3.6% Friday plunge that pushed the large-cap benchmark back into a market correction and left it at its lowest close since May 19.

So what gives?

Earnings season certainly isn’t serving to smooth the waters.

“As one typically sees in the late stages of a market cycle, you get a lot of dispersion in earnings forecasts and announcements,” said Garret DeSimone, head of quantitative research at OptionMetrics, in a phone interview.

Look no further than the market reactions to results this past week from Facebook parent Meta Platforms Inc.

FB,

and Amazon.com Inc.

AMZN,

Stocks jumped Thursday, with the rally attributed in part to investors cheering better-than-expected user numbers from Meta as the potential harbinger of a bottom for tech stocks. On Friday, stocks slumped, with Amazon shares plunging more than 14% for their biggest one-day drop since July 26, 2006, after the e-commerce and tech giant reported its first quarterly loss in seven years.

It underlines the late-cycle pattern, in which volatility rises and individual stock performance is less correlated, DeSimone explained.

And then, of course, there’s the Federal Reserve and its plans to rein in inflation running at its hottest in more than four decades.

The Fed, which delivered a quarter percentage point interest rate increase in March, is expected to deliver a rare half-point hike to the fed-funds rate when policy makers conclude a two-day meeting on Wednesday. And investors have penciled in the possibility of more outsize rate increases to come, along with expectations for an aggressive wind-down of the central bank’s balance sheet.

See: A half-point Fed rate hike seen already baked in the cake

The end of the Fed’s bond-buying program means the market has lost a “volatiity anchor,” wrote analysts at Bank of America, in their weekly Flow Show report on Friday, a development they dubbed the “biggest story of ’22.”

Disorderly rates and currency moves are also part of the backdrop, they said, noting that market panics are “often associated with diverent central bank policy objectives.”

That was on display over the past week as the the Japanese yen

USDJPY,

collapsed to a 20-year low versus the dollar and the euro

EURUSD,

edged closer to parity with the greenback. The Bank of Japan surprised investors by not budging from its ultra-easy monetary policy, in contrast to a Fed set to deliver its most aggressive tightening cycle in decades.

Meanwhile, inflation-wary investors have dumped long-dated Treasurys, sending yields higher, while shorter-dated yields have risen in anticipation of Fed rate increases. A flattening of the yield curve, which briefly saw the 2-year rate above the 10-year rate in late March and early April, highlights jitters over the potential for the Fed’s efforts to tip the economy into recession.

Real, or inflation-adjusted, Treasury yields are on the rise. That could offer yield-hungry investors an alternative to stocks that’s long been lacking.

Read: Farewell TINA? Why stock-market investors can’t afford to ignore rising real yields.

The Russia-Ukraine war, which has sent prices of oil and other commodities jumping, feeds volatility through the elevated inflation channel, which also feeds Treasury volatility, DeSimone said.

The Cboe Volatility Index

VIX,

a measure of expected 30-day S&P 500 volatiity, rose 18% over the past week to 33.40 on Friday, above its long-run average below 20. It edged up further to around 34 on Monday.

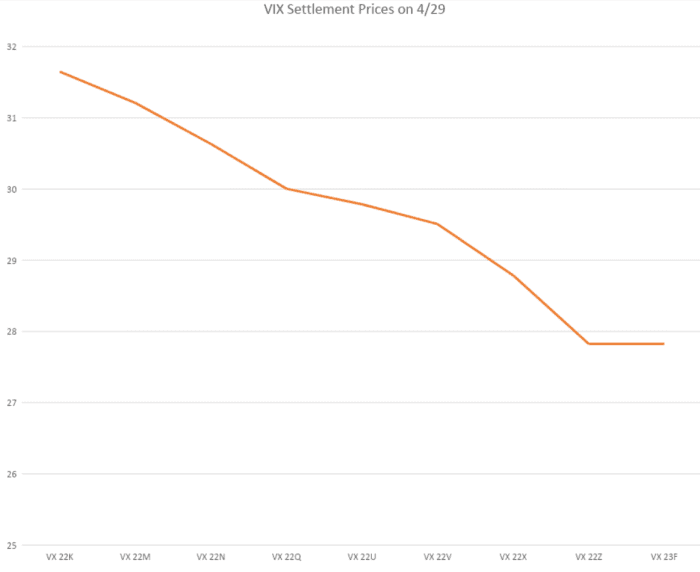

The VIX futures curve, which typically slopes upward, is is instead in a state known as backwardation, with longer-dated contracts trading below near-term VIX futures.

OptionMetrics

But the very front end of the curve remains elevated, dipping below 30 only with the August contract. That indicates that investors expect market to remain volatile at least into the early summer without a reversion to the mean, DeSimone said — a move that likely reflects uncertainty around the size and scope of Fed rate hikes. Related volatility in Treasurys, where a selloff has sent yields soaring, has spilled over to equities, he said.

The Fed has generally tried to offer some clarity rather than to feed volatility, so investors may be looking for the Fed to smooth the waters when it concludes its two-day policy meeting on Wednesday, DeSimone said.

Stocks, meanwhile, were back under pressure Monday afternoon, with the Dow Jones Industrial Average

DJIA,

down around 230 points, or 0.7%, while the S&P 500 lost 0.9%. The Nasdaq Composite

COMP,

fell 0.5% after posting its lowest finish since Nov. 30, 2020, on Friday.

[ad_2]

Source link