[ad_1]

A massive energy shock following Russia’s invasion of Ukraine in 2022 added to inflation pressures that ravaged eurozone economies following the onset of the COVID pandemic. Switzerland, meanwhile, stood apart.

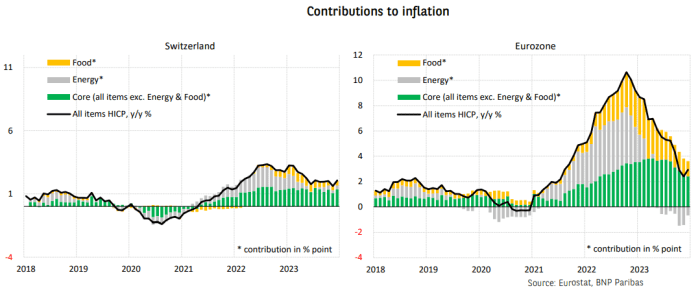

Eurozone inflation peaked at 10.6% in October 2022. Swiss inflation never exceeded 3.3%, topping out in July-August 2022. (The U.S. consumer price index peaked at 9.1% year over year in June 2022.)

See: Global population decline will drive up inflation long-term, ECB’s Isabel Schnabel says

Two factors worked in Switzerland’s favor, said Lucie Barette, economist at BNP Paribas, in a Wednesday note.

First, fossil fuels make up only 2% of Switzerland’s energy mix versus 38% for the eurozone. Second, standing outside the euro, a strong Swiss franc also kept prices in check (see charts below).

BNP Paribas

Barette broke down how Switzerland’s energy mix helped insulate the economy from surging oil and gas prices.

“The weight from hydropower energy (68%), nuclear energy (19%) and photovoltaic and wind energy (11%) has enabled the Swiss economy to be moderately impacted by the increase in gas prices from Russia and the surge in oil prices,” Barette said.

Energy price inflation in Switzerland hit 29% year-over-year at its highest between 2021 and 2022 versus 44% in the euro area over the same period. Russia accounted for just 41% of Swiss gas imports, or just 4% of the country’s total energy mix.

The economist noted that energy also accounts for a lower share of Swiss household consumer spending. That means the weight assigned to its contribution when calculating inflation is automatically lower than in the eurozone (5.5% compared to 10.2%, respectively).

As a result, the energy component only contributed 38% to Switzerland’s headline inflation on average, compared with 54% in the euro area.

The first-round effects of this shock have then spread to the other components of the eurozone’s price index. However, as the rise in energy prices has generally been contained in Switzerland, no significant increases have been seen in the food and core components either, Barette wrote.

And then there’s the Swiss franc

USDCHF,

It’s appreciation also helped to contain inflation by reducing the cost of imported goods and services and helped the country get an even firmer grip on prices of imported oil and gas, which are largely traded in the euro and dollar, she said.

The limited rise in prices, meanwhile, allowed the Swiss National Bank to become of of the last central banks to emerge from period of negative interest rates, Barette said, noting the SNB has hiked rates just five times, or 250 basis points in total, since mid-2022. It’s nominal interest rate stands at 1.75%, leaving its real, or inflation-adjusted, rate in negative territory with inflation standing at around 2% year-over-year at the end of 2023.

[ad_2]

Source link