[ad_1]

The Federal Reserve System (the Fed) was founded in 1913 by the United States Congress. The Fed’s actions and policies have a major impact on currency value, affecting many trades involving the US Dollar. Find out about the history of the Fed, its influence on USD and how to trade Fed monetary policy decisions.

What is the Federal Reserve?

The Federal Reserve is the central bank of the United States. It was founded to create a stable, flexible monetary and financial system for the nation. Its general duties are to set monetary policy and oversee effective economic operation, ultimately serving the public interest.

To meet these top-level directives, the Fed performs five general functions:

- Promote maximum employment, stable pricing and moderate interest rates long term

- Reduce risk where possible to create a stable financial system

- Develop safety within financial institutions

- Champion safety within payment and settlement systems

- Advocate consumer protection through a supervisory stance.

To execute day-to-day operations, the nation is divided up into 12 Federal Reserve Districts, each of which is served by a separately incorporated Reserve Bank. These districts and member banks operate independently while being supervised by the Federal Reserve Board of Governors.

Who owns the Fed?

The Fed is both a private and public institution. The Board of Governors is a government agency, while the banks themselves are structured like private corporations – member banks hold stock and earn dividends.

Who is the Federal Reserve chairman?

As of August 2019, the chairman of the Federal Reserve is Jerome Powell, who has served in this office since February 5, 2018. He is the 16th person to have held the position and will serve a four-year term. Before his appointment, Mr Powell served as a member of the Board of Governors from May 25, 2012. He also currently serves as Chairman of the Federal Open Market Committee, which looks after monetary policy.

Which banks make up the Fed?

The 12 Federal Reserve Districts, each with their own Reserve Bank, are:

- Boston

- New York

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas

- Dallas

- San Francisco

How is the Fed held accountable to its functions?

The Fed is accountable to the public, as well as to the US Congress. The Chair and Federal Reserve officials testify in front of Congress, while the system of setting monetary policy is designed to be clear and transparent. In the interests of accountability, the Federal Open Market Committee (FOMC) will publish statements following all annual meetings. All financial statements are audited independently once a year to ensure financial accountability as well.

Key Economic Mandates of the Federal Reserve System

US monetary policy is the core mandate of the Federal Reserve bank. The statutory objectives of this monetary policy are outlined by the Congress and are:

- Maximum employment: The monetary policy set out by theFOMC should ensure unemployment remains low, working to boost the economy where needed so that businesses thrive, make a profit and hire more staff to grow

- Price stability: The Fed defines price stability as an inflation rate of 2% in the long term

- Moderate long-term interest rates: This works alongside price stability – when an economy is stable, long-term interest rates remain at a moderate level

The Fed aims to achieve its monetary policy through its influence over interest rates and the general financial climate. This can lead to volatility of the US Dollar, ahead of Fed announcements and changes to policies.

Federal Open Market Committee

Monetary policy is set by the Federal Open Market Committee (FOMC), which oversees the open market operations of the Federal Reserve System. They set a target for the federal funds rate at FOMC meetings; this is the interest rate that they want banks to offer to each other for overnight loans. While the FOMC doesn’t control the rate, it can influence it in three main ways:

- Open market operations. This means the buying and selling of government bonds on the open market – selling bonds decreases monetary supply with the aim of increasing interest rates. Buying bonds puts money back into the economy, with the aim of decreasing interest rates

- Discount rate. This is the rate that banks pay to borrow money from the Fed. When this rate is lower, then it is also more likely the federal funds rate will be lower too

- Reserve requirements. Banks need to hold a certain percentage of customers’ deposits to cover withdrawals – this is the reserve requirement. When these are raised, banks can’t loan as much money and must ask for higher interest rates. When lowered, banks can loan more money and ask for lower interest rates.

Recommended by Laura Wagg

Consult our USD forecast for Fed target rate expectations

How Does the Federal Funds Rate Affect the US Dollar?

The Fed’s interest rate, also known as the Fed funds rate, is set by the Board of Governors of the Federal Reserve System. The current interest rate and the expectations of future interest rate changes can both affect the value of the US Dollar. If traders anticipate a change in interest rates based on announcements from the Board of Governors, this can cause the Dollar to appreciate or depreciate in value against other currencies.

This table sets out the way in which market expectations and rate changes can affect the value of the dollar:

| Market expectations | Actual Results | Resulting FX Impact |

|---|---|---|

| Rate Hike | Rate Hold | Depreciation of currency |

| Rate Cut | Rate Hold | Appreciation of currency |

| Rate Hold | Rate Hike | Appreciation of currency |

| Rate Hold | Rate Cut | Depreciation of currency |

Find out more about the impact of interest rates on the foreign exchange market.

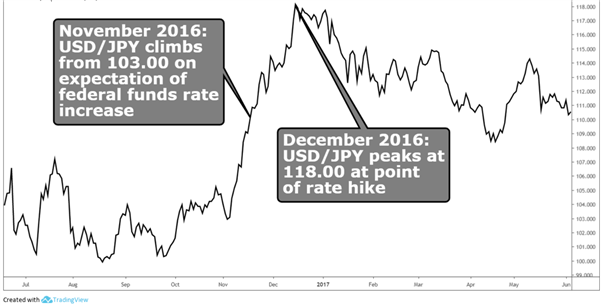

As you can see in the chart below, the Dollar strengthened against the Yen in the leadup to the Fed’s interest rate announcement in December 2016 because it was widely expected that the fed funds rate would increase. The pair peaked at around 118.371 on the day of the announcement, December 14, 2016.

USD/JPY chart before and after Fed hikes in 2016

Find out more on how interest rates affect the forex market.

How to Trade the Fed Monetary Policy Decisions

In order to prepare for Fed rate change decisions, traders should follow these two key steps:

- Keep up with news from the Fed. The FOMC holds eight regular meetings a year, where policies and interest rates are discussed and agreed upon. Keeping up with news ahead of these meetings is the best way to make predictions about interest rates, and whether to buy or sell the US dollar

- Keep with news from the markets. Rest assured that it won’t just be you speculating on interest rates – ahead of Federal Reserve meetings and announcements, many forex traders will be watching what happens very closely. Keep an eye out for others’ predictions and forecasts, and stay well informed enough that you can have your own opinions and add your own logic to that of others

No method of predicting interest rate decisions can ever be completely accurate and surprises do occur. It’s always important to protect yourself when trading forex, so make sure you place stops in advance to ensure you keep your losses to a minimum should the markets move against you.

Remember to stick to your trading plan and never place a trade where you wouldn’t be able to afford the losses. Trades can go both ways. No matter how sure you feel that they will work in your favour, there’s always the chance that they might not.

Top Takeaways on the Fed and Forex Trading

[ad_2]

Source link