[ad_1]

For all the supposed anxiety about various types of economic landings, stubborn inflation amid a renewed surge in oil prices, Federal Reserve hawkishness and weak China growth, the S&P 500

SPX

will still start Friday less than 2% shy of its 2023 peak.

That’s impressively stoic. Sure, a well-received bumper IPO, like ARM Holdings’

ARM,

this week was always going to juice sentiment, yet the latest rally has come despite benchmark bond yields

BX:TMUBMUSD10Y,

of late the market’s kryptonite, hovering near 16-year peaks.

A clue to why those cycle-high implied borrowing costs are not having the same debilitating impact on sentiment can be seen in the ICE BofAML MOVE index , which tracks expected volatility in Treasurys.

The MOVE this week dropped below 100, its lowest in 18 months and half the level to which it spiked during the regional bank crisis in March.

The more relaxed bond market is reflected in equities, where the CBOE VIX

VIX,

a gauge of expected S&P 500 volatility, is below 13 and near its lowest since January 2020.

Source: Google Finance

Force of habit requires it to be written that such calmness can be deemed complacency, and as such often proves to be a handy contrarian indicator.

But there are perhaps four important reasons why bulls should hold their ground.

First, the technical. The S&P 500 has just moved back above its 50-day moving average, which is supportive, while even after the decent run it’s 14-day relative strength index, a momentum gauge, is trending up but at 56 sits well below overbought territory.

Next, and alluding to easing angst in the fixed income arena, Fundstrat’s Tom Lee notes that the equity rally, which followed the European Central Bank’s decision to deliver a ‘dovish hike,’ bodes well for when the Fed also signals it is done tightening.

The ECB’s move “and the market’s reaction is a harbinger of the 1982 moment ahead for the S&P 500…the key takeaway is equities went to an all-time high 17 trading days after Volcker publicly considered ‘ending the inflation war’,” says Lee.

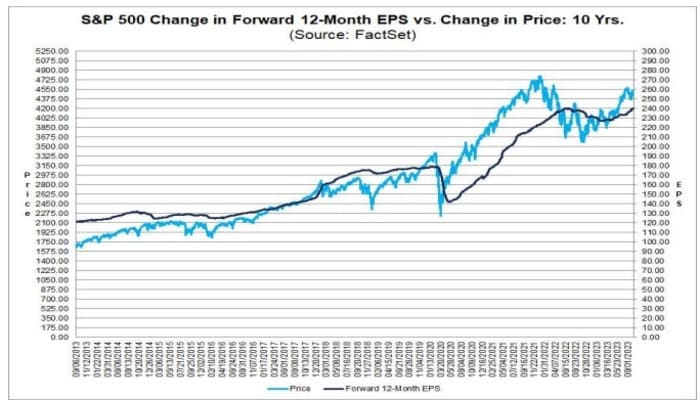

There’s another fundamental microeconomic reason encouraging bulls: company profits. As John Butters, senior earnings analyst at FactSet notes, earnings forecasts have been improving over recent months and now the S&P 500’s aggregate third quarter earnings per share are expected to rise 0.5%.

Source: Factset

“If 0.5% is the actual growth rate for the quarter, it will mark the first quarter of (year-over-year) earnings growth reported by the index since Q3 2022,” says Butters in his latest note.

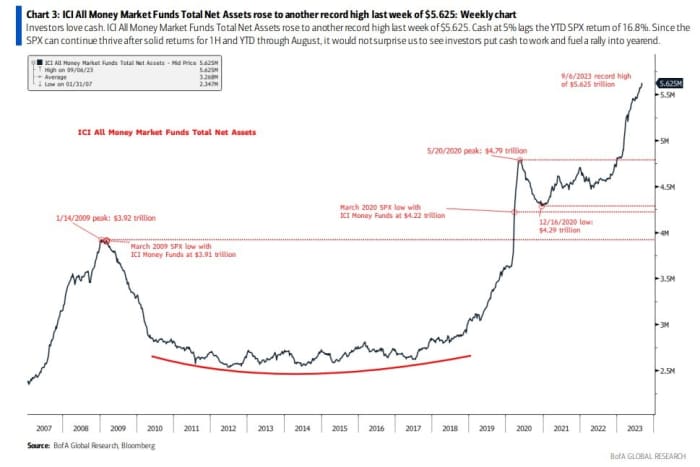

Finally, among the most important prerequisites for a sustained bull run is firepower. It can mean that when new highs are made there’s still sufficient cash to support the trend.

So, consider the chart below from Stephen Suttmeier, technical research strategist at Bank of America. It shows the amount held in money market funds has hit a fresh record of $5.625 trillion .

Source: Bank of America

“Investors love cash,” he says, but at 5% cash lags the year-to-date return for the S&P 500 of about 17%. “Since the SPX can continue thrive after solid returns for 1H and YTD through August, it would not surprise us to see investors put cash to work and fuel a rally into year end,” Suttmeier concludes.

Markets

U.S. stock-indices

SPX

COMP

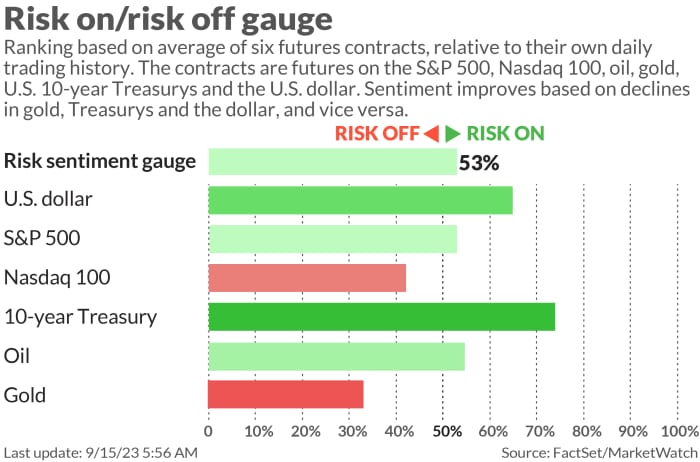

are expected to open slightly higher as benchmark Treasury yields

BX:TMUBMUSD10Y

nudge up. The dollar

DXY

is lower, while oil prices slip and gold gains.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Some $4 trillion of derivatives linked to stocks, index options and futures will mature on Friday. The so-called ‘triple witching’ event coincides with a re-balancing of indices such as the S&P 500

SPX.

The United Auto Workers union has gone on strike against Ford Motor

F,

General Motors

GM,

and Stellantis

STLA,

as it seeks more money for its members across the sector.

Shares of Arm Holdings

ARM,

are up another 7% in premarket action after popping 25% following its IPO on Thursday.

Instacart has raised its IPO price target to $28 to $30 a share from $26 to $28 previously. The move comes after Arm Holding’s successful IPO on Thursday.

Adobe shares

ADBE,

are down 2% even after the software company forecast revenue in line with Wall Street estimates and steady margins.

U.S. economic data on Friday include August import prices and the Empire State manufacturing survey for September, both due at 8:30 a.m. Eastern. Industrial production and capacity utilization reports for August will be released at 9:15 a.m., followed at 10 a.m. by the preliminary reading of August consumer sentiment.

Asia stock markets

JP:NIK

HK:HSI

were chipper after data showed China’s industrial production and retail sales improving in August.

Best of the web

Inside Exxon’s strategy to downplay climate change.

A golf company with $90,000 of sales that reached a $500 million market value.

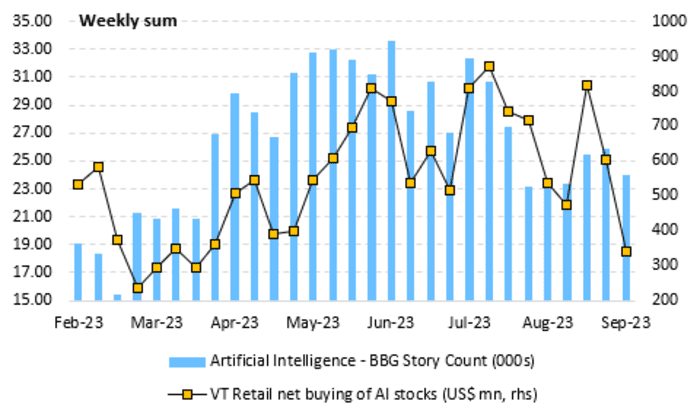

The chart

“The allure of AI stocks is steadily waning, with retail investors showing a decline in their net purchases of AI-related stocks,” says Vanda Research. “This diminishing interest is further evidenced by a notable reduction in the frequency of Bloomberg stories covering the AI sector.”

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

ARM, |

Arm |

|

AMC, |

AMC Entertainment |

|

NKLA, |

Nikola |

|

MULN, |

Mullen Automotive |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

AMZN, |

Amazon.com |

Random reads

French supermarket’s ‘shrink-shame’ brands.

The rise and fall of TV’s golden age.

Lady Di’s $1 billion sheep-themed jumper.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton

[ad_2]

Source link