[ad_1]

Funds that follow managed futures strategies have been outperforming benchmark indexes by a wide margin this year.

They tend to have different approaches and can be risky. But for a typical investor with a majority of assets invested in the stock market, having a modest portion allocated to managed futures can lower overall portfolio risk, according to Mike Loewengart, managing director of investment strategy for E-Trade from Morgan Stanley.

A managed futures strategy is one through which a money manager will move in or out of various asset classes, including commodities, currencies, bonds and stocks across geographies, employing long and short positions to take advantage of market trends.

There’s no crystal ball — managers don’t predict events, but they will jump on or away from a pricing trend, hopefully at an early stage. That can lead to performance that runs counter to that of the broader stock market.

During an interview, Loewengart said: “There is no doubt that in recent months we have seen more interest in managed futures funds, and more specifically the commodities space in general.”

Managed futures is a type of “liquid alternative” strategy that wasn’t available to most investors until about 10 years ago, when mutual funds began to employ the strategy, Loewengart explained.

“Before that, you had to seek a private vehicle,” he said, which meant being able to meet the high account minimum for a hedge fund.

“After years and years of seeing diversified portfolios lag, because nothing kept up with large-cap equites, it is encouraging to see these strategies providing value to investors,” he added.

Four managed futures funds

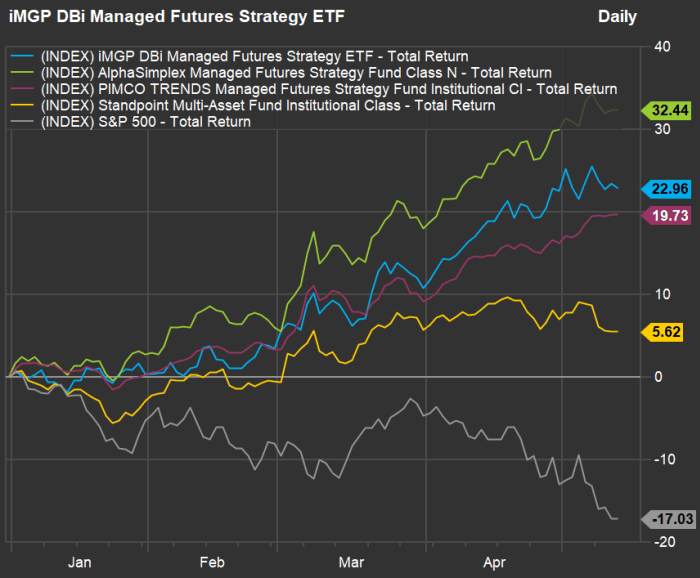

First, look at this year’s performance for four funds that employ managed futures strategies compared with the benchmark S&P 500 Index

SPX,

through May 12:

FactSet

All four of the managed futures funds have produced gains this year as the S&P 500 has dropped 17% (with dividends reinvested). The best performer is up 32%.

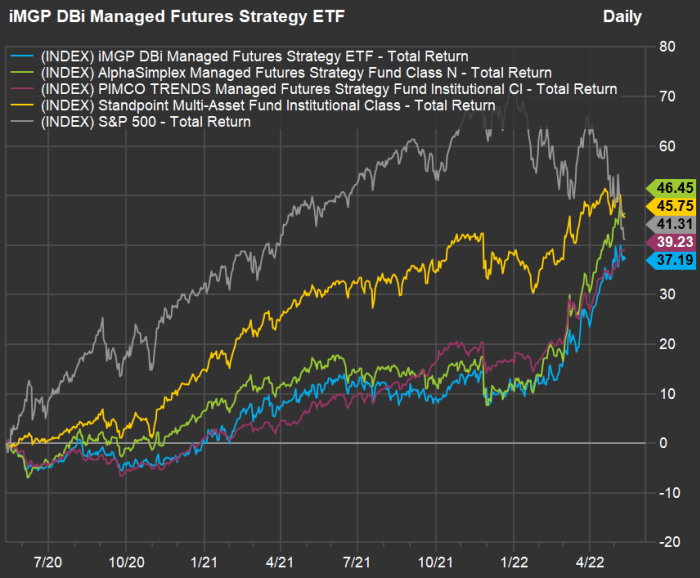

It’s important to review longer time periods. This is two-year performance:

FactSet

Now you can see that through a longer period, all five approaches have been viable, with the S&P 500 soaring to the greatest heights before falling to the middle of the pack.

Here’s a breakdown of the four funds:

-

The iMGP DBi Managed Futures Strategy ETF

DBMF,

+1.30%

is the only exchange traded fund on the list. It is actively managed and seeks to give access to hedge-fund-like strategies to seek long-term capital growth for relatively low fees. See this ETF Wrap column for Christine Idzelis’ interview with Andrew Beer of Dynamic Beta investments (DBi). -

The AlphaSimplex Managed Futures Strategy Fund

AMFNX,

+0.53%

follows what it calls an “absolute return strategy,” using various asset models to take long and short positions across asset types, globally. It is included on the E-Trade from Morgan Stanley All-Star Mutual Funds list. -

The Pimco Trends Managed Futures Strategy Fund

PQTIX,

-0.29%

also follows a strategy designed to take advantage of price momentum across asset types, to provide positive returns “particularly during equity market downturns.” -

The Standpoint Multi-Asset Fund

BLNDX,

+1.68%

follows a hybrid approach — it is about 50% invested in long equity and bond positions (mostly stocks) through a group of ETFs, with the rest invested per a managed futures strategy, long and short, across asset types. Its performance on the two-year chart, above, bears out the strategy. You can read more about the fund here. Eric Crittenden, co-manager of the Standpoint Multi-Asset Fund, wrote in an email that he has increased short exposure to bonds this year, while increasing long exposure to the dollar against other currencies. He has also reduced what he called “significant” long exposure to commodities while increasing “modest” long exposure to energy markets. “The theme here is stagflation, and it is not expected to be smooth or fun. It is by far the toughest market environment to navigate as an investor,” he wrote. - The three mutual funds listed above (that is, excluding DBMF) have multiple share classes. The charts show the institutional share classes, which have the lowest expenses and the highest account minimums. But some brokers are able to offer the institutional shares to their customers with lower account minimums.

Loewengart said the Class A (or Investor Class) shares for the funds are available without sales charges at E-Trade and most other large brokers, even though the prospectuses might list sales charges.

The Class A tickers for the mutual funds are:

-

AlphaSimplex Managed Futures Strategy Fund

AMFAX,

+0.54% . -

Pimco Trends Managed Futures Strategy Fund

PQTAX,

-0.30% . -

AlphaSimplex Managed Futures Strategy Fund

REMIX,

+1.69% .

Avoid ‘performance-chasing’

“My concern is about performance-chasing. Investors may go in, looking at recent results, not being entirely cognizant” of the risks, Loewengart said.

Chasing performance is a phenomenon that also affects investors within equity strategies. They might move money into “last year’s best-performing stock fund,” without considering that they might be buying high and underperform the following year.

Loewengart stressed that “commodities have done well during this period of volatility, once inflation sunk in.”

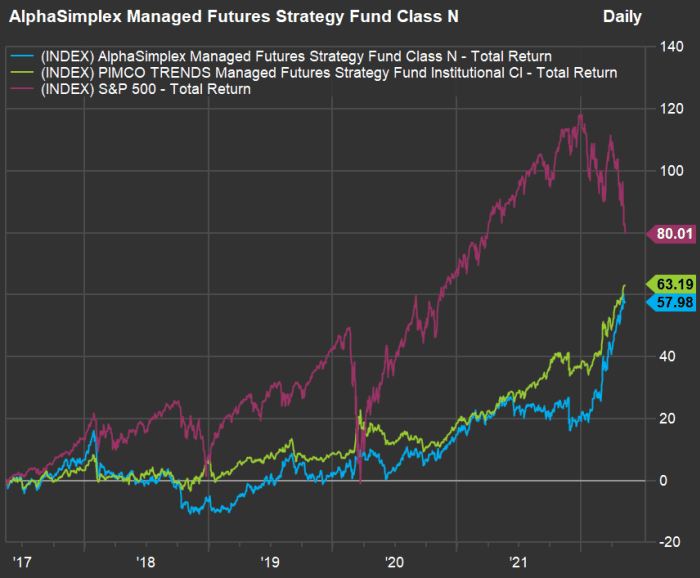

So this is a special time for commodities and of managed futures funds. Now take a look at a five-year chart for the AlphaSimplex Managed Futures Strategy Fund, the Pimco Trends Managed Futures Strategy Fund and the S&P 500. (The two other funds are less than five years old):

FactSet

This shows the risk of the managed futures strategies. They are “having their moment,” Loewengart said, outperforming during this difficult period of high inflation and rising interest rates. But they missed a portion of the bull market that preceded the downturn.

“By themselves, managed futures strategies may not be appropriate for many investors. But when you include them within a well-diversified portfolio, you can reduce the risk of the portfolio over time,” Loewengart said.

Don’t miss: Here’s the case for buying Netflix’s stock now

[ad_2]

Source link