[ad_1]

I’ve been studying money, investing and personal finance for more than 18 years. During that time I’ve learned a lot of lessons about what actually builds wealth. Some of those lessons were learned by reading and connecting with successful people. Other lessons were learned through my own trial and error.

A question I often ask myself is: “what do I wish I could teach my younger self about money, personal finance and investing?”

Here are 11 critical money lessons I wish I’d known back then:

1. Know your numbers

You can’t make decisions without good information. This is why the first step to building wealth is to track your income, expenses and net worth.

It doesn’t really matter how you get these numbers. Some people use software like Mint, Personal Capital or YNAB; others like to do it manually in Google Sheets or Microsoft Excel.

Once you have this information, you can start to examine your life and ask yourself wealth-building questions such as:

- What is our current financial situation?

- What are our biggest expenses?

- Are we overspending in some categories?

- Does our spending align with our values?

- Are we on track to achieve our financial goals?

2. Pay off debt

Carrying debt doesn’t seem like a big deal when things are going well, but debt can become a huge burden when life takes a turn for the worse (and it eventually will). The future is unpredictable, and carrying debt adds financial stress to your life like nothing else.

If you have debt, make it a priority to pay it off.

3. In the beginning, focus on increasing your savings rate

I used to believe that maximizing my investing returns was all that mattered. I’ve since learned that what really matters is how much money you save and invest.

Consider this simple math: a 20% gain on $1,000 is $200, but a 5% gain on $10,000 is $500. Which side of the equation has a bigger impact on your total net worth? Your portfolio balance.

When you are just starting out, it’s far more impactful to increase your contributions than it is to increase your return. That’s why new investors should focus their energy on increasing their income.

4. Investing isn’t just for the ‘rich’

I used to believe that investing was only for the well-to-do. That may have been true a few decades ago, but it’s no longer true. Investment costs have fallen to the point that anyone can start their journey even if they only have $50 a month.

5. Your biggest advantage is patience—don’t waste it

The only way to invest successfully is to invest for the long haul. Anything can (and will) happen to the stock market

SPX,

in the short term. You must develop the patience to hold stocks when they are falling. If you let your emotions get the best of you and sell in a panic, you’ll do poorly.

6. There will never be a ‘perfect’ time to invest

The news is always filled with negative headlines that might make you believe that right now isn’t a good time to start investing. The truth is that there’s never a “perfect” time to invest. Do it anyway.

7. Penny stocks are priced that way for a reason, and it’s usually not a good one

I was drawn to penny stocks when I first started investing. Thankfully, I had a really bad experience with them and lost what felt like a lot of money. That turned out to be the best tuition I’ve ever paid. I’ve since learned to avoid penny stocks. They are priced that way for a reason.

8. Time in the market is more important than timing the market

The single biggest factor that will determine how well you do as an investor is how long you stay invested. Don’t try to outsmart the stock market

DJIA,

by timing the tops and bottoms. Just invest on a regular schedule for a few decades and you’ll be very happy that you did.

Read: How to turn $30,000 into millions: the power of time beats a lucky stock pick

9. You don’t need to pick your own stocks

I’m an investing fanatic. I love to research companies, value them and buy them. I love the challenge of investing. For that reason, the bulk of my family’s net worth is invested in individual stocks. However, few people share my affinity for the stock market

COMP,

The idea of stock-market research bores them to tears. That’s perfectly fine! There’s no need to buy individual stocks if you don’t have the time or interest to learn how. Just buy index funds and call it a day.

Choose Fi Media, Inc.

10. Invest, don’t trade

It can be very tempting to buy and sell stocks rapidly to earn small gains. If you think you beat Wall Street at its own game, you should know that professional traders have faster computers and better information than you’ll ever have.

11. Get started now

There’s an old Chinese proverb that says “The best time to plant a tree was 20 years ago. The second-best time is now.” This is especially true of investing. A common regret I hear older investors make is, “I wish I had started sooner.” I feel the same way, and I was lucky enough to become interested in investing when I was 22. Get your wealth snowball rolling as soon as possible. Your future self will thank you.

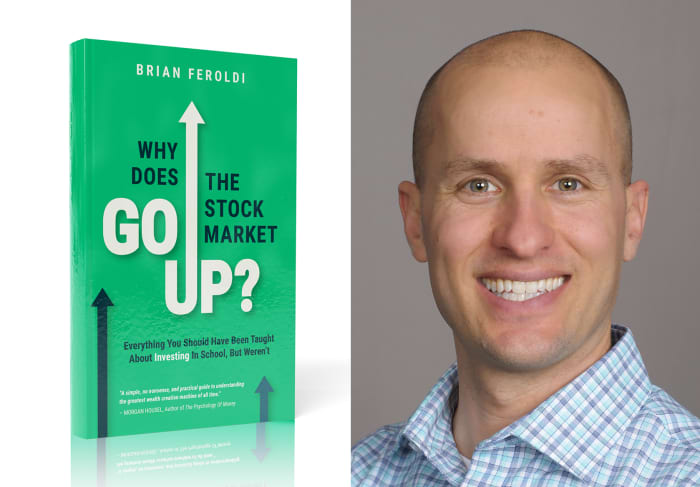

Brian Feroldi is the author of “Why Does the Stock Market Go Up? Everything you should have been taught about investing in school, but weren’t”.

[ad_2]

Source link