[ad_1]

Bond yields hovered near four-month lows Thursday amid concerns of a weakening U.S. economy.

What’s happening

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.088%

slipped by 2.6 basis points to 4.072%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.388%

retreated 1 basis point to 3.368%. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.552%

fell 1 basis point to 3.533%.

What’s driving markets

Benchmark Treasury yields were hovering near four-month lows as fears mount the U.S. is sliding into recession.

Weak retail sales and industrial production data released on Wednesday added to the gloom, leaving the 10-year Treasury yield down more than 40 basis points so far this year.

U.S. economic updates set for release on Thursday include weekly initial jobless claims, building permits and housing starts for December, and the Philadelphia Fed manufacturing index, all due at 8:30 a.m. Eastern.

Worries about the U.S. economy build as the Federal Reserve is expected to continue raising interest rates as it perseveres in trying to push inflation — currently 6.5% — back to its 2% target.

Markets are pricing in a 94.3% probability that the Fed will raise interest rates by another 25 basis points to a range of 4.50% to 4.75% after its meeting on February 1st, according to the CME FedWatch tool. The central bank is expected to take its Fed funds rate target to 4.85% by June 2023, according to 30-day Fed Funds futures.

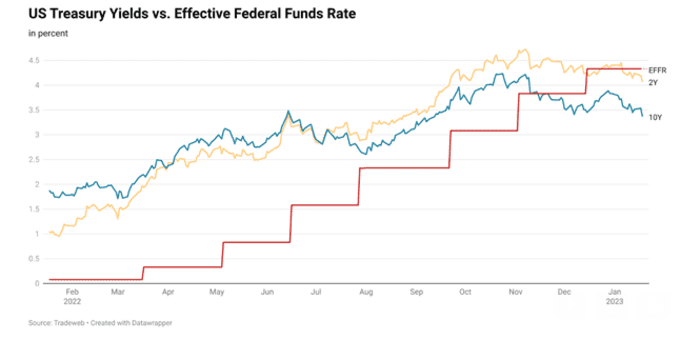

Fears about weakening economy alongside a hawkish Fed has pushed both 10-year and 2-year Treasury yields below the Fed Funds rate.

Source: Tradeweb

Fedspeak for Thursday includes Boston Fed President Susan Collins at 9 a.m., Fed Vice Chair Lael Brainard at 1:15 p.m. and New York Fed President John Williams at 6:35 p.m..

What are analysts saying

“Weak U.S. retail sales suggested consumers’ resilience may have been pushed beyond breaking point…This undermined the hypothesis of a ‘soft landing’ for the US economy with inflation easing before rates have inflicted too much pain. News that Microsoft is planning to cut 10,000 jobs…also didn’t help the market’s mood,” said Russ Mould, AJ Bell investment director.

Stephen Innes, managing partner at SPI Asset Management, said: “Despite rising incomes and surplus savings, U.S. consumers are tightening their belts in the face of still-high inflation, rising credit costs, and shrinking wealth. The feeble December retail sales report and recent better inflation numbers should keep the Fed on course to slow the pace of hikes to 25bp on Feb 1.”

[ad_2]

Source link